An Imbalanced Federation: The Unequal Distribution of Budget Constraints in Canada

The costs of programs under provincial responsibility are likely to grow faster in the years ahead than those administered by the federal government. Not only are provincial programs more costly, but they are also more popular and visible to Canadians, making it harder for provincial governments to cut spending. Provinces could alleviate these cost pressures by increasing revenues, but they also face more severe revenue constraints than the federal government. The unequal distribution of cost pressures, retrenchment capacities and revenue constraints mean that the federal government has more fiscal room to manoeuvre. This disparity may reshape Canadian federalism in durable ways by exacerbating inequality among provinces or by centralizing the federation without any formal constitutional change or consultation with Canadians.

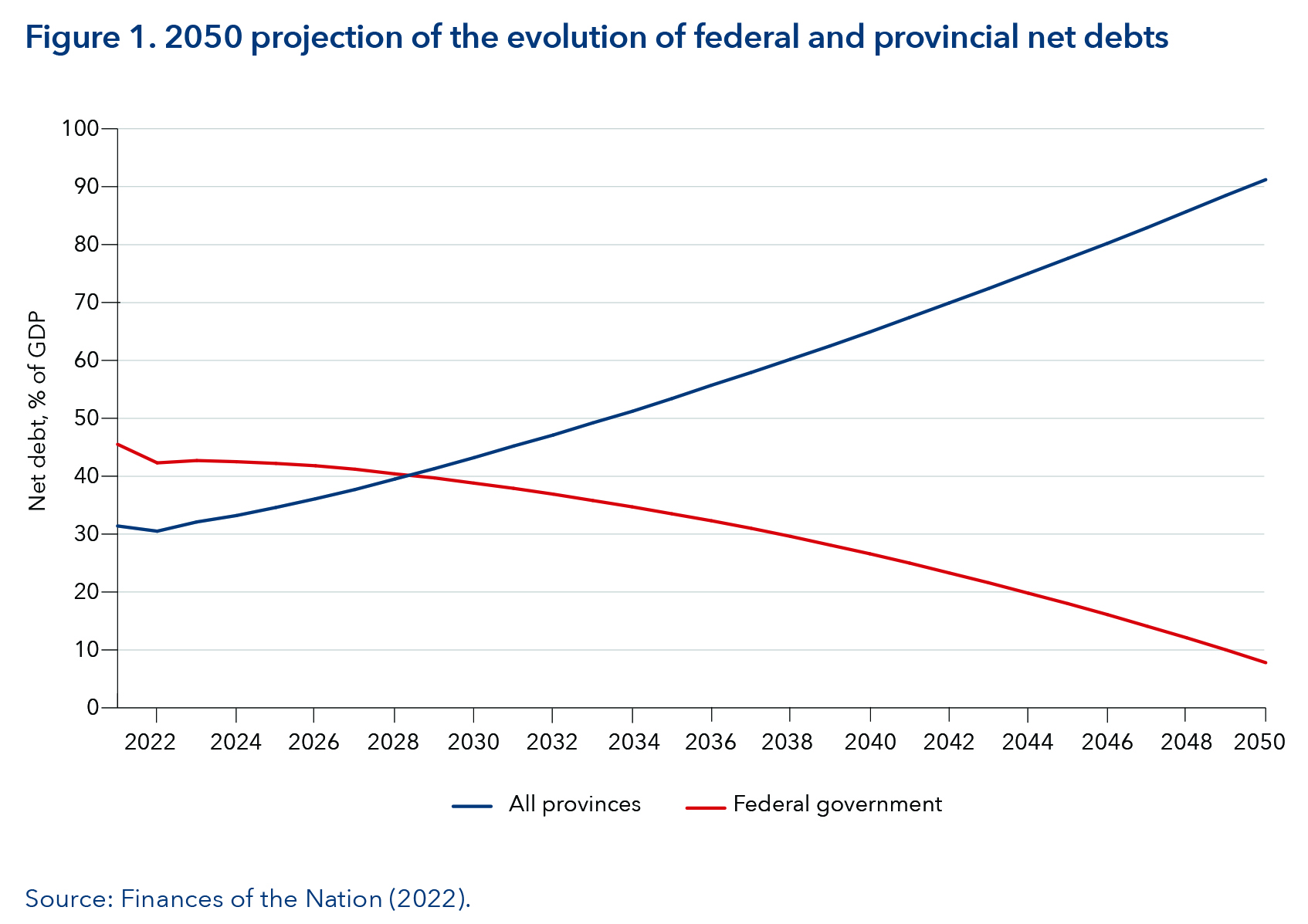

The federal government’s net debt is trending downward while the average debt of the provinces is on a path to double in less than 30 years, reaching more than 90 per cent of GDP in 2050. This trend gives the federal government much more fiscal room to manoeuvre than the provinces and is due, in large part, to the unequal distribution of three factors: program cost pressures, retrenchment capacities and revenue constraints.

Cost pressures: The costs of programs under provincial responsibility are likely to grow more quickly than those administered by the federal government. For instance, the cost of provincial health care tends to increase faster than the growth in the economy, while the costs of federal programs are largely under control.

Retrenchment capacities: Provincial programs are more costly, but they are also more popular and visible. This makes it more difficult for provincial governments to curtail program spending than their federal counterpart because reducing federal transfers to provinces and means-tested benefits to individuals is easier than cutting universal programs like health care and education for which the provinces are responsible.

Revenue constraints: While the provinces could alleviate cost pressures by increasing revenues rather than reducing expenditures, they also face more severe revenue constraints than the federal government. Among subnational jurisdictions within OECD countries, Canadian provinces rely most heavily on corporate taxes. This makes provinces vulnerable to tax competition and to economic recessions. While all federal revenues are derived from own-source revenues, provinces are dependent on intergovernmental transfers from the federal government to bridge the gap between their revenues and expenditures. However, intergovernmental transfers remain relatively low, with little political incentive to move away from this equilibrium and reform fiscal arrangements.

The study shows how the combination of these three factors could have important consequences for Canadian federalism:

First, the differences in policy choices between left-leaning and right-leaning governments are likely to be more significant at the federal level given its larger fiscal room and we should observe convergence of budgetary policies between left and right provincial governments given how constrained they are in their policy choices.

Second, this could lead to more centralization in the federation when the Liberal party is in power in Ottawa and uses the federal spending power in provinces’ jurisdictions. If the Conservatives are in power and prefer to reduce federal taxes, this could lead to more inequalities between provinces that recuperate the fiscal room left by federal tax cuts and those that do not.

The overarching consequence is the potential reshaping of Canadian federalism and party politics at the provincial level in a durable way without any formal constitutional change or consultation with Canadians.

Introduction

The sustainability of provincial public debt is a great concern for the future of the Canadian federation. Figure 1 visualizes Trevor Tombe’s (2020) projections of the provincial and federal fiscal balances, assuming programs budgeted in 2023 are maintained over time. Whereas the federal government’s net debt is trending downward, provincial debt is on a path to double in less than 30 years, reaching more than 90 per cent of GDP in 2050, up from only 30.5 per cent in 2022. This long-term trend reflects an imbalance between the revenue-raising and revenue-spending capacities of the provincial and federal governments; similar trends have been highlighted by the Parliamentary Budget Officer (2022). Provincial governments (Ministère des Finances, 2021; CoF, 2021) have therefore expressed concern that the fiscal pressure generated by rising public debt may prevent them from providing the services needed by their citizens, unless the federal government increases intergovernmental transfers significantly to balance the situation.

The imbalance in public debt between provincial and federal governments depicted in figure 1 can be attributed to three different factors: first, the difference in the projected growth of program costs between the provinces and the federal government is a well-known cause of unequal public debt. The cost of provincial health care tends to increase faster than the growth of the economy, while the costs of federal programs are under control (Hartmann, 2017; Tombe, 2020; Tremblay, 2012). Second, the current analysis shows that not only does the nature of provincial and federal social programs result in divergent cost pressures, but they also lead to significantly different retrenchment capacities. Fiscal consolidation has been more substantial at the federal level because reducing transfers to provinces and means-tested benefits to individuals is easier than retrenching universal programs administered by the provinces, like health care and education.

While the political left may celebrate the difficulty provincial governments have in implementing austerity measures, its proposed solution — that is, raising revenue — to pay for rising social policy costs is also more likely to be constrained at the provincial level. Third, we argue that another factor contributing to imbalanced public debt is that provinces face more stringent constraints on revenue than the federal government does. Provincial tax revenues are more restricted by tax competition and political incentives lead to relatively low intergovernmental transfers from the federal government.

The dynamic outlined above — unequal constraints faced by provincial and federal governments — has important political consequences. Building on Paul Pierson’s New Politics of the Welfare State (2001), we suggest a theory that should be tested in future research: since the provinces’ fiscal room to manoeuvre is more constrained than the federal government’s, the differences in policy choices between left- and right-wing provincial governments should be smaller than those between Liberal and Conservative federal governments. Liberal federal governments have used, and may continue to use, their spending power, which allows them to spend in areas of provincial jurisdiction to respond to public demands for policy expansion that provincial governments cannot provide. This ultimately leads to the centralization of the federation. In fact, the federal government’s fiscal room to manoeuvre allows the current Liberal federal government to pay for significant social policy expansions by increasing public debt rather than by balancing the books through tax increases.[1] In contrast, Conservative federal governments also have the room to manoeuvre in order to substantially reduce taxes, thereby increasing inequalities between provinces while preserving the decentralized nature of the federation.

Unequal Growth of Programs under Provincial and Federal Responsibility

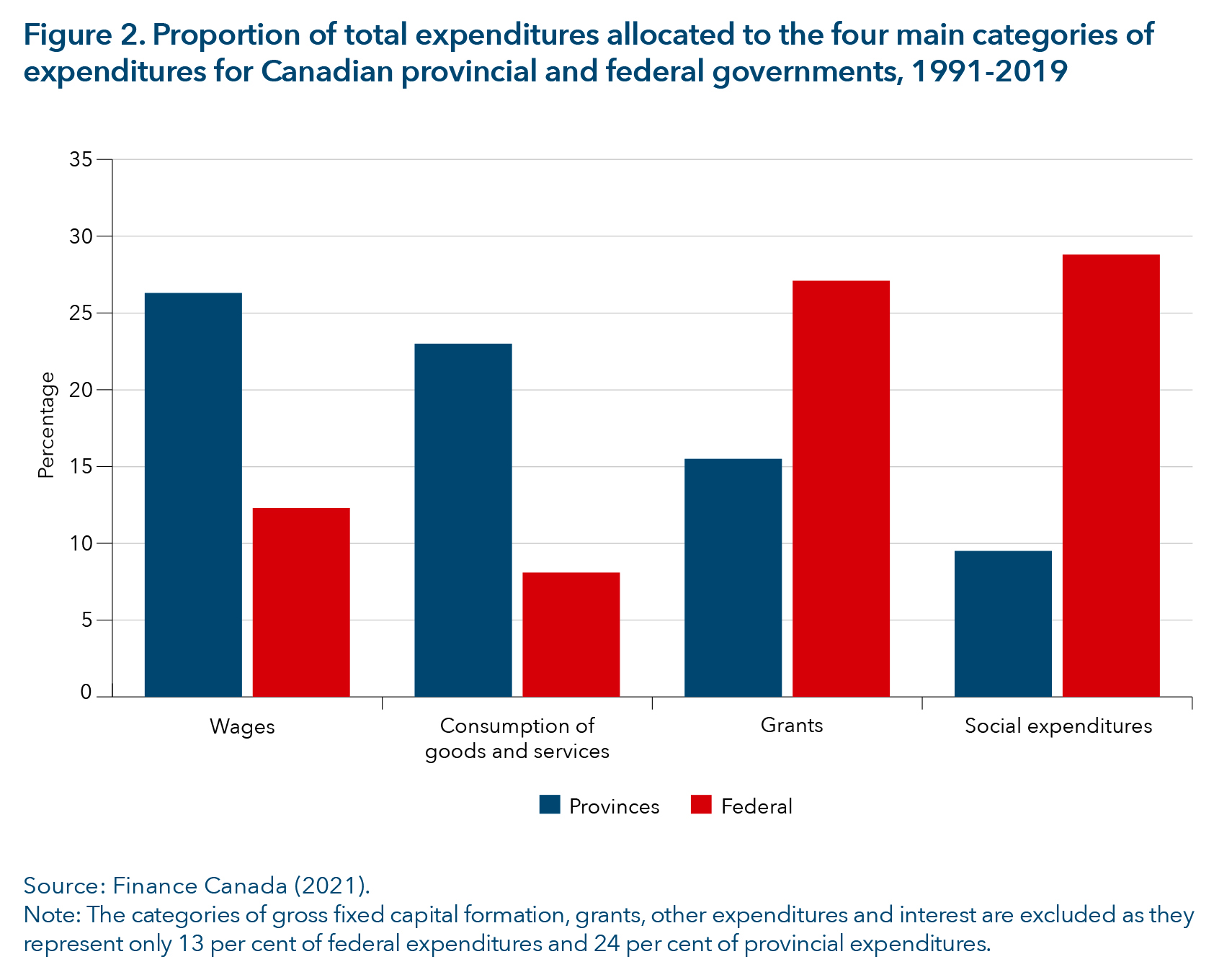

The programs administered by provincial and federal governments differ significantly in terms of how they contribute to increasingly unequal cost pressures. Figure 2 compares the types of programs provided by the provinces and by the federal government. Almost 50 per cent of total provincial expenditures are composed of wages (26.3 per cent) and of the consumption of goods and services (23 per cent). However, wages and the consumption of goods and services represent only 20.4 per cent of federal expenditures. In contrast, more than 27 per cent of total federal expenditures are allocated to grants (including transfers to other levels of governments) while grants represent only 15.5 per cent of provincial expenditures. Almost 29 per cent of federal expenditures are allocated to social expenditures, mostly in the form of transfers to individuals rather than services.

The Financial Reference Tables also reveal that, in 2019-2020, transfers to other levels of government represented 22.7 per cent of total federal program expenditures; transfers to individuals represented 30.7 per cent (of which 52.6 per cent were for old age security, 22.7 per cent for family benefits and 20.3 per cent for employment insurance); and transfers to direct programs represented 43.6 per cent. However, a third of these direct programs are composed of other transfer payments and of carbon tax benefits. Hence, transfer payments represent 71 per cent of federal expenditures, in comparison to an estimated 30 per cent of provincial expenditures (Noël, 2022). In fact, more than 80 per cent of provincial expenditures are allocated to “open-ended” programs, whose costs are determined by the number of beneficiaries. Similar programs represent only about 30 per cent of federal expenditures (Hartmann, 2017).

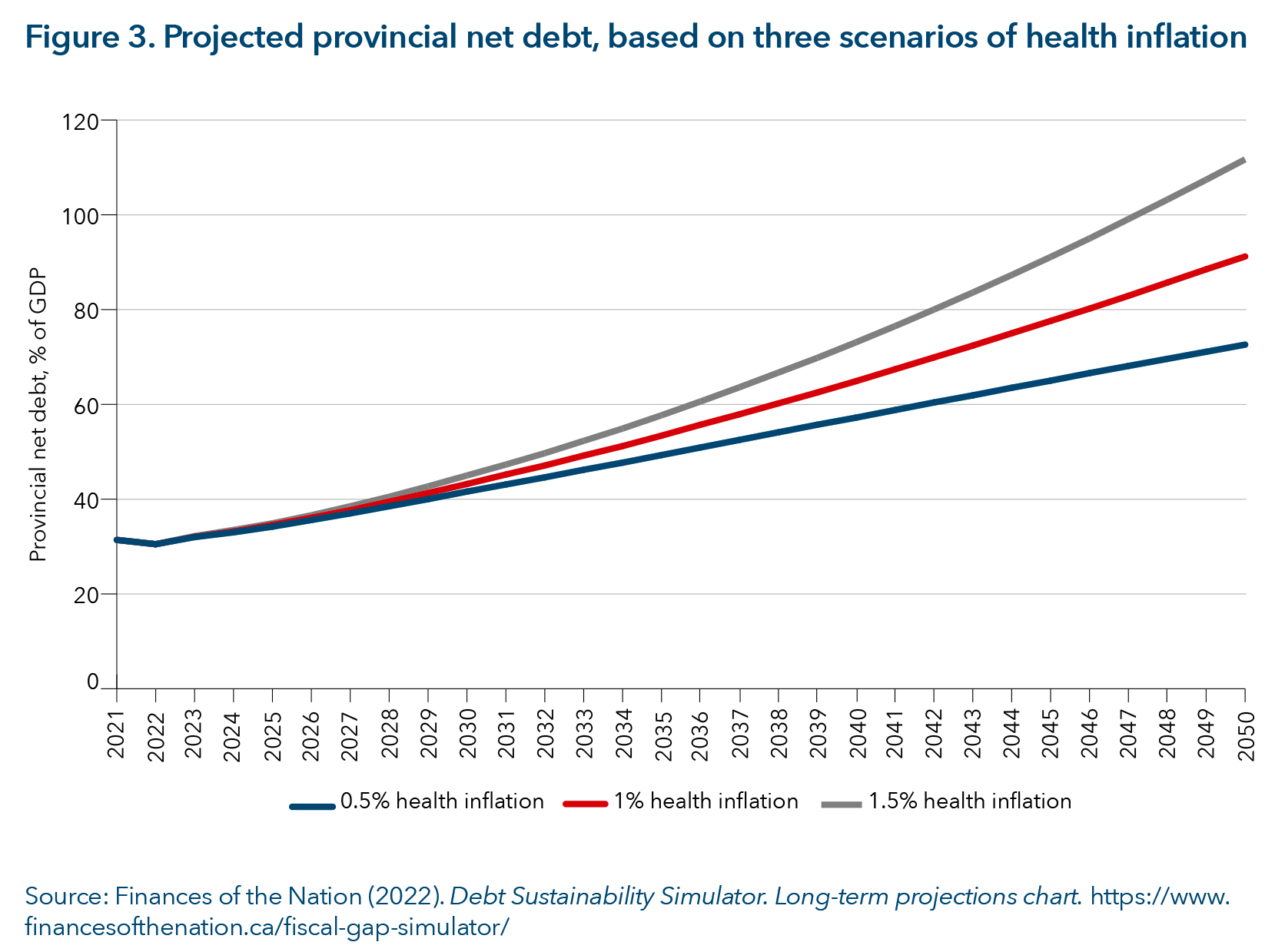

Health care already represented an average of 42 per cent of provincial program expenditures in 2019-2020 and up to 47.5 per cent of those in Quebec and British Columbia (Kneebone & Wilkins, 2016). Because of population aging and costly technological innovations, health-care costs are projected to continue to grow. Health inflation — defined as health-care cost growth beyond annual inflation and above those incurred by aging — represents a substantial cause of the projected imbalance between federal and provincial net debts. Figure 3, based on Tombe’s projections (2020), reveals that health inflation has a significant impact on provincial net debt, which varies from 72.6 per cent in 2050, when health-care inflation is constrained to 0.5 per cent per year, to 111.7 per cent if health inflation reaches 1.5 per cent per year. Following the cutbacks in the health-care sector during the austerity period of the mid-1990s, average provincial health-care cost inflation was 1.3 per cent per year from 1998 to 2018.

In contrast, according to the Parliamentary Budget Office’s Fiscal Sustainability Report (2022), the costs of federal programs are projected to remain stable during the first half of the 21st century. The costs of pensions, a federal responsibility in Canada, are low and under control from a comparative standpoint. The first tier of the Canadian pension system is composed of basic universal flat rate benefits, called Old Age Security (OAS), and of the Guaranteed Income Supplement (GIS), a means-tested benefit for poor seniors. These two federal programs currently cost 2.4 per cent of GDP, which is projected to increase to 3.1 per cent in 2032 but will decline afterward and remain stable (PBO, 2022). The second tier of the pension system, the Canada Pension Plan (CPP), is a federal contributory public plan available in all provinces, except Quebec. The CPP is not particularly costly, as replacement rates offered by the public system remain low for incomes at and above the average (Myles, 2000). Under the current structure of the CPP, projected contributions and benefits are sufficient to ensure that, over the long term, the net asset-to-GDP position remains close to its initial value (PBO, 2022).

The costs of the other most expensive federal programs are also under control. Child benefits’ costs are projected to decline as children are expected to represent a smaller proportion of the population in the next decade (PBO, 2022). Employment insurance (EI) costs are related to the business cycle, and as discussed in the following section, the government has had no difficulty reducing the amount of the benefit when the cost to maintain the program did not match the contributions to it. Finally, the two most expensive transfers to provinces (Canada Health Transfer (CHT) and equalization payments) have been capped to the growth of the economy. The federal provincial agreement on health-care transfers signed in the winter of 2023 increases federal funding without making significant changes to the federal government’s long-term sustainability. The Canada Social Transfer, on the other hand, is not tied to the growth of the economy, but is legislated to increase at 3 per cent per year, which is sustainable. In fact, more than 60 per cent of federal expenditures are either fully funded (like the CPP or EI) or discretionary (Hartmann, 2017). Hence, Ottawa could decide to implement new programs that may endanger its long-term fiscal sustainability, but the costs of current programs are not projected to grow (PBO, 2022).

Unequal Retrenchment Capacities

Welfare state retrenchment is the main tool available to governments to control cost pressures. We contend that it is easier to achieve at the federal level because provincial social policies are considerably more popular and visible, and are supported by larger and more influential beneficiary groups.

The federal government’s focus on transfers also makes it easier to achieve retrenchment of federal programs. Transfers only involve extracting funds and allocating them, while services involve transforming money into an output, generally provided by well-organized groups that control the production process and have a vested interest in continuing the existing system (Jensen, 2011). The influence of these provider groups may prevent the retrenchment of provincial services (Starke, 2021). Moreover, these services are composed of the wages of permanent, unionized public sector employees, which tend to be easier to freeze than to cut (Forni & Novta, 2014; Tepe, 2009). In short, the cost of transfers to other levels of government is less likely to grow over time than that of provincial services and these transfers are relatively easy to compress.

The largest cuts in all the expenditure categories presented in table 1 happened in 1996 and 1997, when the federal government reduced transfers to the provinces by 20 per cent (in current dollars) (Finance Canada, 2021). Politicians can avoid blame for cutbacks to intergovernmental transfers — even if these transfers fund popular programs like health care — because the public does not know who is responsible for what in complex intergovernmental fiscal relations (Cutler, 2008). There is plenty of opportunity to avoid blame when federal versus provincial responsibility for programs is separated and one government funds programs in the jurisdiction of the other (Jordan, 2009). Governments can also easily avoid blame by delaying cutbacks, such as when the Harper government reduced the future growth of the CHT as part of its fiscal consolidation exercise in the early 2010s.

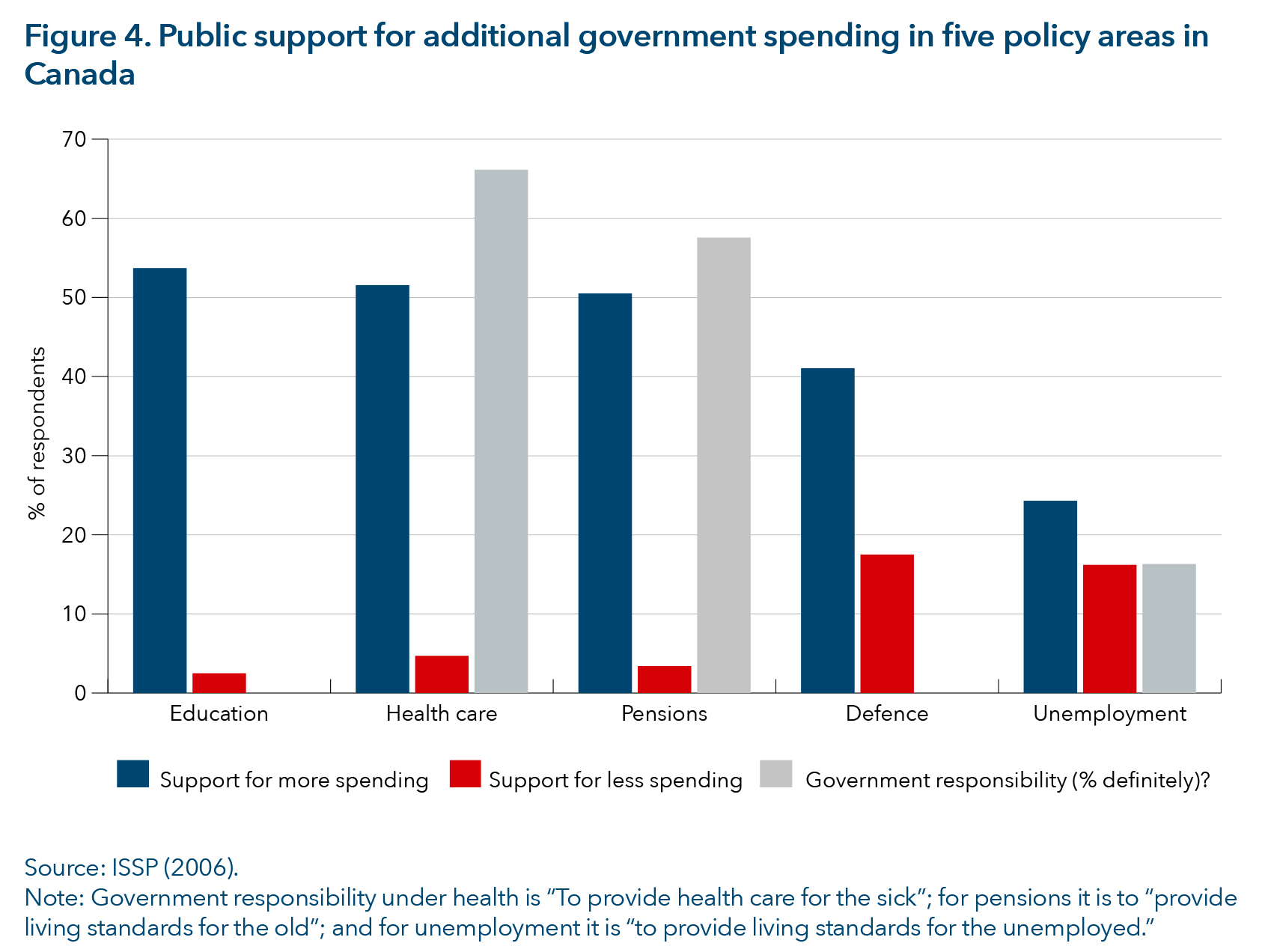

Moreover, programs at the federal and provincial level do not have the same degree of popularity. International evidence suggests that education, health care and pensions are the most popular social policies (Busemeyer & Garritzmann, 2017). This is because they cover life cycle risks that all citizens face: everyone ages, becomes sick and goes to school at some point in their life (Jensen, 2012). Hence, the potential pool of beneficiaries is large and the perceived deservingness of the recipients is particularly high (Jensen & Petersen, 2017). In contrast, labour market risks tend to be correlated with income; the programs covering these risks, like the federal EI benefit, are popular mostly among those facing labour market risks (Jensen, 2012). Between 66 per cent and 75 per cent of provincial expenditures are allocated to health care and education, whereas a considerably smaller proportion of federal expenditure is allocated to pensions, the only life cycle risk covered by Ottawa. Moreover, health care and education are universal programs in Canada, which tend to be considerably more popular among the middle class than means-tested programs for the poor (Brady & Bostic, 2015; Larsen, 2008).

Canadian-specific data on public opinion and the popularity of different programs are scarce, but what little there is seems to confirm the popularity of provincial programs relative to federal ones. Figure 4 compares the popularity of provincial and federal programs, using the International Social Survey Programme (ISSP) on the Role of Government in 2006, the last year during which Canada participated to the survey. Support for additional spending for the unemployed is considerably less popular (24.3 per cent) than for health care, education and pensions, which are supported by more than half the respondents. Moreover, only 16.3 per cent of respondents believe that it is a government’s responsibility to provide basic living standards for the unemployed, whereas 66 per cent believe it is a government’s responsibility to provide health care for the sick.

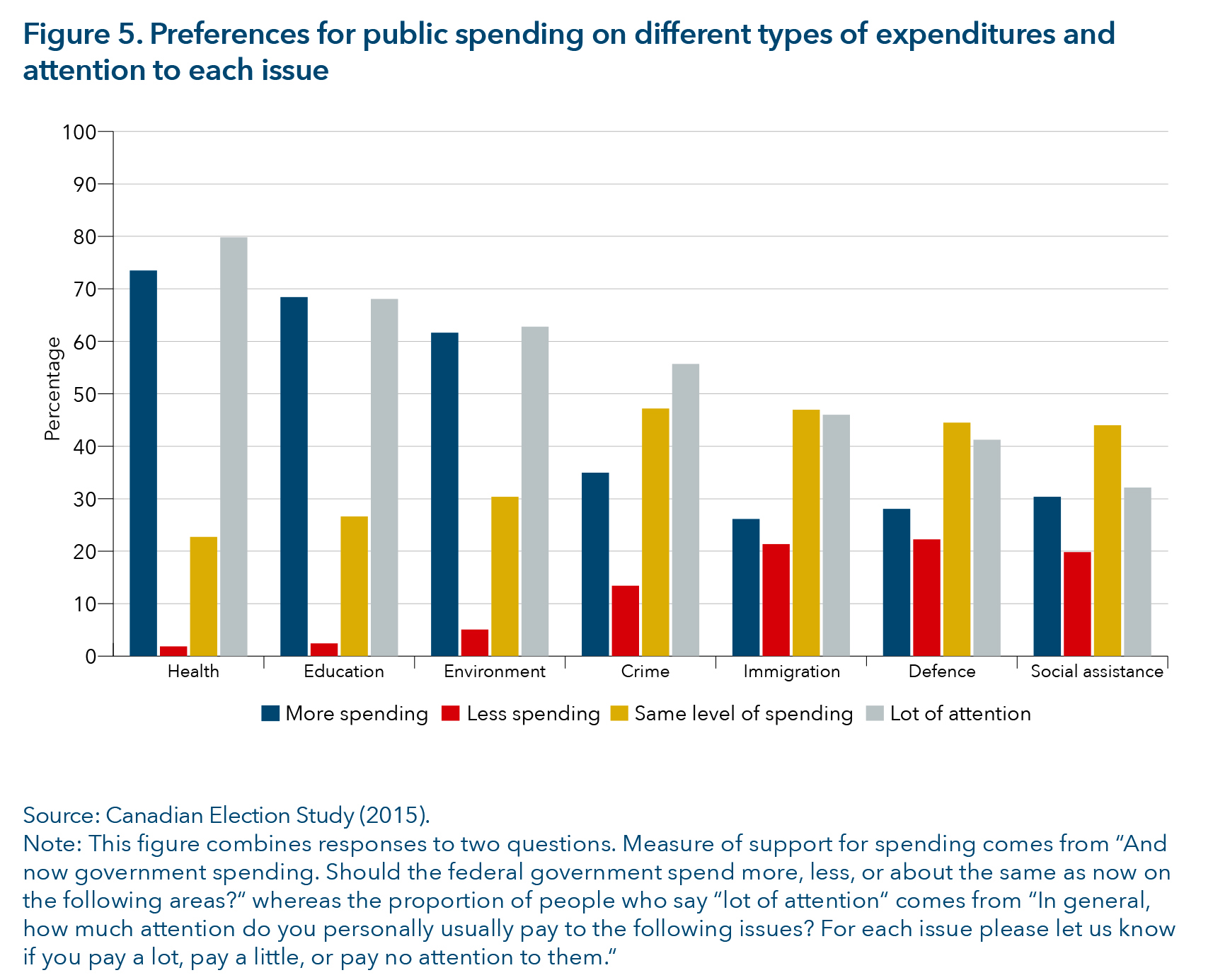

Figure 5 provides additional evidence based on the Canadian Election Study of 2015.[2] It shows that support for additional spending and public attention remains low for programs of federal responsibility (like defence and crime) and of shared responsibility (like welfare and immigration), but very high for programs of provincial responsibility (like education and health care).

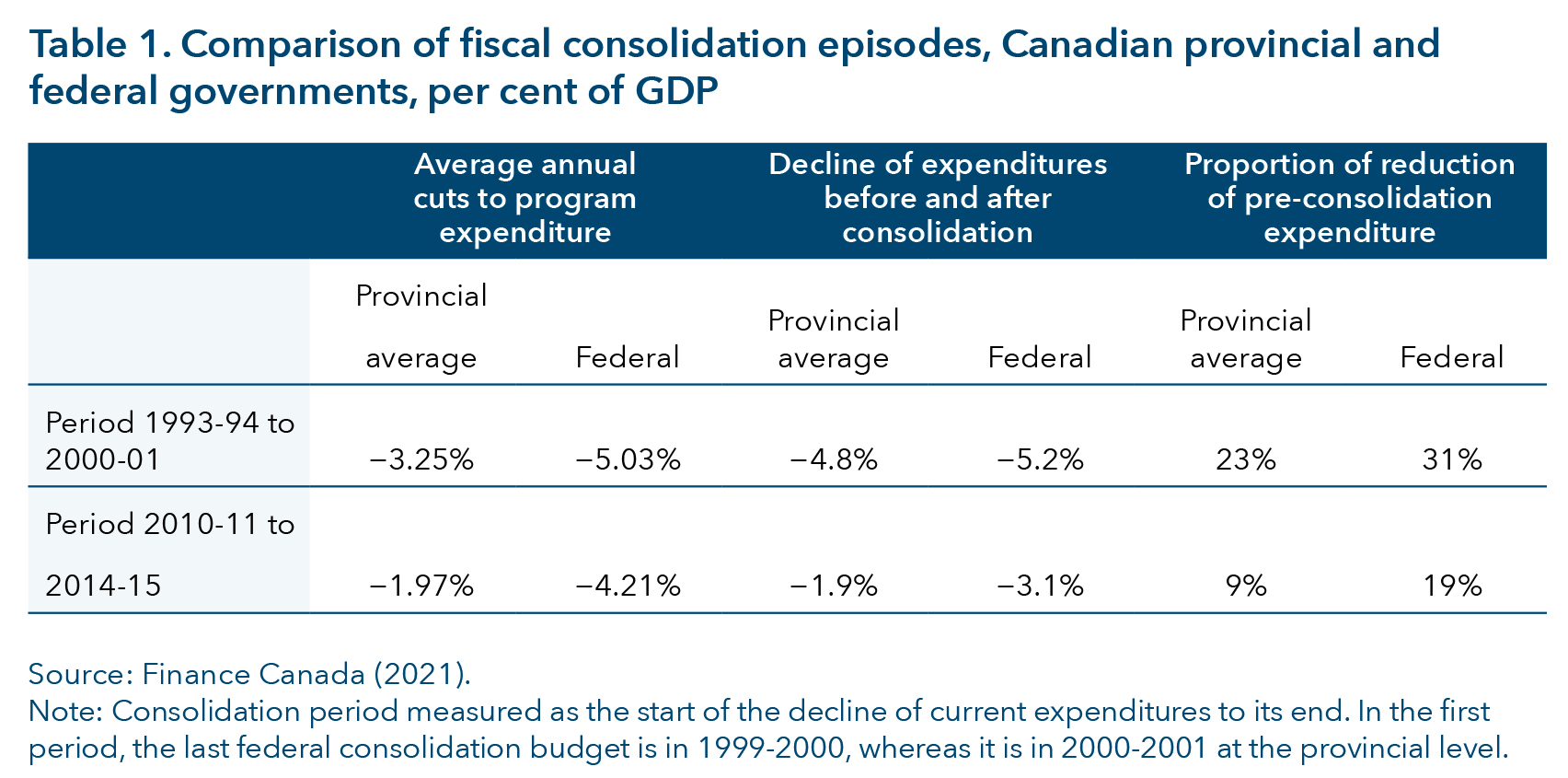

Popularity matters because governments choose the path of least resistance when they implement retrenchment measures: they cut back less popular programs and tend to preserve the popular ones (Jacques, 2021, 2020). Since provincial programs are considerably more popular than federal programs, analyzing previous episodes of consolidation episodes should reveal that the federal government has been able to implement more stringent retrenchment measures than provincial governments have. Table 1 compares the size (expressed as a proportion of GDP) of federal and provincial fiscal consolidations since 1990, the first year for which provincial data are available in the Fiscal Reference Tables (Finance Canada, 2021). Two main consolidation episodes occurred at both levels of government, first in the mid-1990s and then in the early 2010s, each following major recessions (Alesina et al., 2019; Finance Canada, 2021). Table 1 summarizes changes to current program expenditures from the start of the consolidation period to its end.

This reveals that the federal government’s consolidation exercises resulted is a greater decrease of expenditures than those implemented by the provinces in absolute and relative terms. From 1993 to 2001, public expenditures were reduced by more than 5 per cent per year at the federal level, leading to a 31 per cent total reduction relative to pre-consolidation expenditure levels. This is greater than the provincial average of a 3.3 per cent per year reduction of expenditures, which led to a 23 per cent overall reduction. Federal cuts reached 4.2 per cent per year from 2010 to 2015 (19 per cent reduction of pre-consolidation expenditures), in contrast to only 1.97 per cent per year at the provincial level (9 per cent reduction of pre-consolidation expenditures). Hence, provinces can consolidate and have been able to do so, but significantly less effectively than the federal government.

What else could explain this difference? Government partisanship cannot explain federal-provincial differences in the size of fiscal consolidations: during the consolidation of the 1990s, provinces were evenly split between right, left and centre governments, whereas the federal government was led by the Liberals. During the second consolidation, the Conservatives were in power federally and the provinces were also right-leaning: the right governed in half of provinces during the period, while the left governed in only 25 per cent of provinces at the same time. In fact, comparative studies suggest that government partisanship has little effect on the scale of reduction during consolidation episodes, which are rather driven by electoral demands, economic declines and the size of the deficit (Hübscher, 2016).

We recognize that the fiscal situation was worse at the federal level than at the provincial level in the years preceding the two fiscal consolidation episodes, which helps to explain why cutbacks were larger at the federal level than in provinces. However, we contend that this situation is not sufficient to explain federal-provincial differences in the size of consolidations. Had the provinces been in the worse financial situation, many factors suggest that consolidations would still not have been as large as what the federal government was able to achieve. It is difficult to reduce total provincial government expenditures without facing significant popular backlash, particularly as baseline costs for health care generally grow at a faster rate annually than inflation. Provinces can constrain the rate of growth, but the federal government can more easily cut expenditures. If provincial governments implemented cutbacks to health care and education, their popularity would decline, as was the case after the austerity measures implemented by the Couillard government in Quebec (2014-2018). At the time, the deficit was projected to increase to 7.9 per cent of total government expenditures (Tellier, 2018), leading the Quebec Liberal Party (QLP) government to implement significant budget consolidation measures in the first two years of its mandate — this generated surpluses as early as 2016. It is worth noting that the government could only constrain the rate of health-care cost growth to 1.4 per cent in 2014 and 1.1 per cent in 2015, which was well below cost inflation, but it could not implement cuts in absolute terms (Béland et al., 2023). This consolidation has been identified as one of the decisive factors explaining the defeat of the Couillard government: public disapproval jumped from 51 per cent in fall 2014 to 65 per cent in October 2017, while only a third of citizens approved of austerity (Bélanger & Chassé, 2021).

The popularity of the federal governing party, in contrast, increased as it implemented consolidations during both austerity periods presented in table 1 — exceptional considering austerity generally reduces a government’s popularity (Jacques and Bélanger 2022). Ottawa was able to manage one of the largest fiscal consolidations of any OECD country in the 1990s (Haffert 2019) in large part because its main expenditures are for programs that are not particularly visible or popular. For example, in 1996 and during the tenure of Prime Minister Harper, the federal government significantly retrenched EI benefits, a means-tested and somewhat unpopular program (Béland and Myles 2012), or it reduced transfers to the provinces.

Unequal Revenue Constraints

Since retrenchment is more difficult to implement at the provincial level, provinces could ensure their fiscal sustainability by increasing revenues. However, revenue constraints are also more severe at the provincial level. Among OECD countries, the Canadian provinces are the form of subnational jurisdiction with public budgets that relies most heavily on corporate taxes. This overreliance makes provinces vulnerable to tax competition and to economic recessions (Tremblay, 2012). Indeed, fiscal federalism literature has established that subnational taxes on mobile factors, such as capital or highly skilled individuals, are subject to strong competition within a federation (Musgrave, 1971; Oates, 1968). Mintz and Smart (2004) find that corporate taxes are very elastic at the provincial level because firms can easily shift income to lower-tax locations within the same country. Similarly, Milligan and Smart (2016) argue that reported individual income is also very elastic: they estimate that a 10 per cent tax increase on the top 1 per cent of earners leads to a 6.6 per cent decrease in their taxable income, while the elasticity is much less for lower-income individuals. Of the income that has been shifted, 75 per cent is due to taxpayers moving their income to lower-tax provinces (Milligan & Smart, 2019). As such, increases of top marginal tax rates on the highest percentile do not generate substantial revenues at the provincial level (Milligan & Smart, 2016).

Models of fiscal federalism assume that capital and labour mobility is considerably lower across national borders than between subnational jurisdictions (Oates, 1999). While tax competition also poses constraints on capital taxes for the government of Canada, the federal government’s corporate tax rates apply to all corporations in Canada, reducing their capacity to pit provinces against each other to reduce tax rates. Hence, increasing the tax on high incomes, corporations and capital to alleviate the pressures of permanent austerity generates significantly fewer revenues at the provincial than at the federal level. These taxes have rarely represented a significant proportion of the revenues of mature welfare states, but they can provide a useful marginal gain of income for cash-strapped governments.

Moreover, taxes on high-income individuals and corporations are considerably more popular than taxes on the middle class. Workhorse models of political economy assume that voters want to reduce their own tax burden while maximizing the size of the public benefits they receive (Meltzer & Richard, 1981). This means that most citizens prefer to shift the tax burden toward high-income individuals and corporations, since few individuals consider themselves to be rich (Cansunar, 2021) and because the incidence of corporate tax is complex to understand for the average voter. Citizens tend to consider taxes on the middle class to be too high (Barnes, 2015; Jacques, 2023a). Indeed, political parties are more likely to lose votes if they increase broad taxes than if they raise taxes on the rich (Tillman & Park, 2009) and survey experiments have shown that taxes on top incomes increase public support for tax reforms whereas taxes on middle incomes decrease it (Bremer & Bürgisser, 2022), while governments can increase corporate taxes without losing popularity (Bansak et al., 2021). Increasing taxes on the rich is not necessarily easy to implement and can lead to “rich people’s movements” that are often successful in blocking tax increases (Martin, 2013), but these tax increases remain more popular than increases of taxes paid for by all taxpayers. Hence, these relatively popular taxes do not generate sufficient levels of revenues for provinces.

A Low-Transfer Equilibrium

While all the revenues of the federal government are derived from own-source revenues (OSR), provinces are dependent on intergovernmental transfers to bridge the gap between their revenues and expenditures. However, the Canadian federation rests on a low-transfer equilibrium structured by political incentives (for an extended discussion on this issue, see Jacques, 2023b). If Ottawa increases costly transfers, provincial governments will benefit electorally from presumably better public services. But to increase transfers to provinces, the federal government must raise taxes, increase deficits or cut its own programs, which could hurt the party in office in the next election. Voters do not know enough about fiscal federalism to reward the federal government for an invisible increase in transfers to the provinces. Instead, they are likely to punish the federal government for the visible costs of financing these transfers. Support for additional health-care transfers is overwhelmingly high, but it drops considerably when the costs of transfers are revealed in terms of higher taxes or deficits (Borwein et al., 2023).

Moreover, the current transfer system gives the federal government little opportunity to monitor how the additional funds are spent by provinces; it must trust the provinces to use the transfers wisely. Additionally, Canadian party systems are not integrated between the federal and provincial levels: parties may share the same name, but they are not the same organization and do not hesitate to blame each other — in contrast with, for example, the Republicans and Democrats at the state and federal levels in the United States. In integrated party systems, electoral credits go to provincial and federal leaders for improved collective goods but politicians can also be disciplined since they must face the electoral consequences of their policy decisions in other jurisdictions. In contrast, in Canada’s non-integrated system, the party in power in Ottawa has very little incentive to increase transfers to help their provincial party members. Intergovernmental co-operation in which benefits at one level (province or federal) are sacrificed to yield gains at another is unlikely, thereby increasing the difficulty of reforming the arrangements of fiscal federalism (Rodden, 2006).

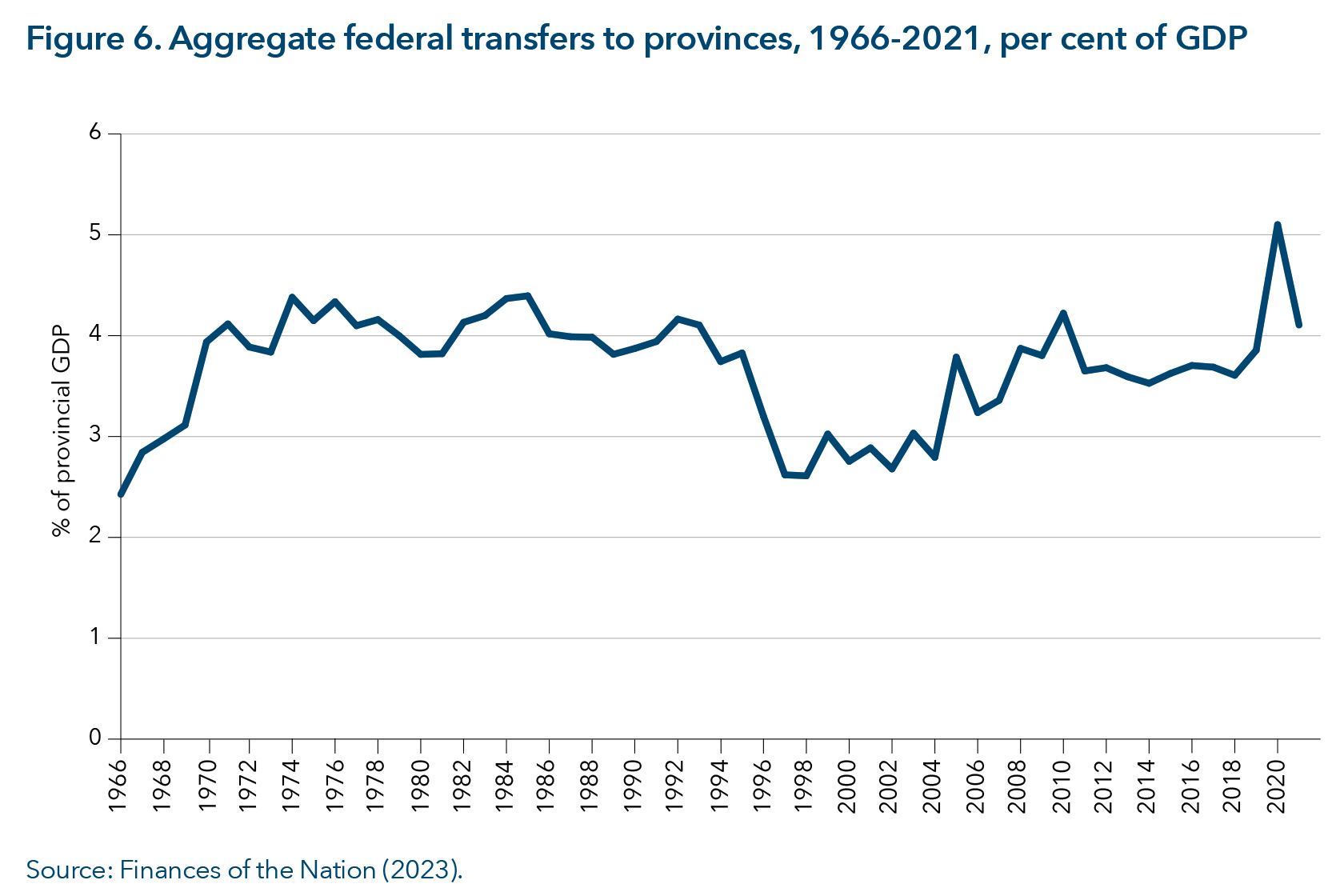

Figure 6 suggests that these political incentives constrain the transfers from the federal government to the provinces as they have remained largely constant since 1976. The substantial increase of transfers from 1966 to 1976 corresponds to the implementation of the Medical Care Act, which created shared-cost universal health care. In 1977, the federal government shifted to block funding, which reduced the cost of transfers. Whereas shared-cost programs force each level of government to match the expenditures made by the other, block grants can be determined in a discretionary manner by the federal government. Transfers were further reduced during the consolidation period of the 1990s and have remained relatively low ever since, except for a significant increase implemented by the Martin government in 2004. Federal transfers went up significantly during the COVID-19 crisis, but these were temporary measures. In short, a low-transfer equilibrium contributes to limiting a provincial government’s revenues, namely because these transfers are low relative to the main expenditure of health care, the cost of which has grown from about 4.5 per cent of provincial GDP in 1970 to 8.7 per cent in 2021.

Conclusion: Political Consequences of the Unequal Distribution of Budget Constraints

In New Politics of the Welfare State, Pierson (2001) argues that acute fiscal pressures caused by a combination of growing program costs, and difficulties raising taxes and retrenching popular welfare state commitments reduce the impact of government partisanship on policy outcomes. The left cannot expand public expenditures significantly, whereas the welfare state’s popularity prevents the right from cutting back programs in order to reduce taxes. Confirming Pierson’s insight, previous studies of the Canadian provinces and OECD countries have shown that the effect of government partisanship on policy choice is larger when fiscal and economic pressures are lower (Jacques, 2020; Lipsmeyer, 2011). Intuitively, when a government’s fiscal room to manoeuvre is reduced, the budgetary differences between the left and the right are smaller.

In a near future, provinces may be spending 75 per cent of their budget on the two core functions of health and education, leaving few resources for other policy fields and therefore limiting the capacity to provide public spending that responds to citizen demand. Hence, we should observe some form of convergence of budgetary policies between left and right governments in Canadian provinces. Provinces facing harsher fiscal constraints should witness even more convergence between their parties and large-scale cuts to public spending or taxes may become less frequent. In contrast, the federal government has more fiscal room to manoeuvre and we should observe larger differences between left and right governments. It is beyond the scope of this essay to demonstrate these political consequences empirically, but we hope to open a new research agenda.

The consequences of the trends described in this article are that Conservative governments will have substantial fiscal room to reduce federal taxes. The first Harper government (2006-2008) reduced federal sales taxes from 7 per cent to 5 per cent, thereby achieving several results desired by the Conservative Party: constrain the size of the federal government, reduce vertical fiscal imbalance and increase policy competition between provinces (Harmes, 2007). However, only Quebec and Nova Scotia responded by increasing their provincial sales taxes by two percentage points between 2010 and 2012, whereas other provinces either waited until 2016 to do so (N.B., P.E.I. and N.L.) or didn’t increase their sales taxes in response to Harper’s tax cut (Ontario and the Western provinces). Indeed, provincial governments have electoral incentives to pass on the tax cuts to their constituents rather than to solve their long-term fiscal problems. The main consequence of reducing federal taxes is inequality: it reduces the federal government’s redistributive capacity and generates an imbalance between the provinces that recuperate the fiscal room left by federal tax cuts and those that do not. Hence, federal tax cuts have tended to preserve decentralized governance at the expense of provincial equality.

A government led by the Liberal Party of Canada will have the fiscal room to expand the role of the federal government without having to pay the political price of equivalent tax increases, because the government’s fiscal room allows for some degree of deficit-financing. If cash-strapped provinces cannot respond to public demands, the federal government might use its spending power to implement policies in areas of provincial jurisdiction. In fact, the federal government has the capacity to significantly expand the federal welfare state: examples include the recent creation of a national dental-care plan and child-care strategy, as well as an increase of child benefits.[3] Likewise, cash-strapped provinces may be more likely to accept federal conditions imposed on health and social policy intergovernmental transfers. This may take the form of shared-cost programs that allow provinces to fund social policy expansions in strategic areas, but it also requires that provinces accept federal encroachment in their policy jurisdictions. Politically, conditional transfers are popular among left-wing voters outside of Quebec and are generally supported by the left wing of the Liberal Party of Canada and by New Democratic Party voters (Borwein et al., 2023).

Since the degree of centralization of the Canadian federation evolves along with the balance of power between the constitutive units rather than by constitutional means (Banting, 2005; Lecours, 2019), it is conceivable that this unequal fiscal room to manoeuvre could push the federation toward more centralization, especially if the Liberals are in office in Ottawa. Indeed, there are very few safeguards in Canada against federal encroachment on provincial authority. In her classic study on Robust Federation, Jenna Bednar (2008) highlights four safeguards against encroachment, none of which exist in Canada. The provinces are not incorporated in the federal decision-making process; the courts have allowed the federal government to use its spending power; the party system is not integrated and the popular safeguard does not exist outside a few provinces such as Quebec; and citizens do not share a strong federal culture that would constrain the federal encroachment of provinces’ power (Fafard et al., 2010). Hence, this unequal fiscal room between provinces and the federal government may shape Canadian federalism in a durable way, either by increasing inequalities between provinces or by centraling the federation, without any formal constitutional change or consultation of Canadians’ opinion on the matter.

[1] Pre-pandemic projections suggested that the federal government’s net debt would reach zero by 2050. The comparison with the situation depicted in 2023 in figure 1 suggests that the federal government has spent a large proportion of its future room to manoeuvre by implementing new programs.

[2] The 2019 survey has fewer question on social policies and the 2021 survey is not yet available.

[3] For a recent review of the use of the spending power by the federal government under the Liberals, see Graefe and Fiorillo (2023).

Alesina, A., Favero, C., & Giavazzi, F. (2019). Austerity: When it works and when it doesn’t. Princeton University Press.

Bansak, K., Bechtel, M. M., & Margalit, Y. (2021). Why austerity? The mass politics of a contested policy. American Political Science Review, 115(2), 486-505.

https://doi.org/10.1017/S0003055420001136

Banting, K. (2005). Canada: Nation building in a federal welfare state. In H. Obinger, S. Leibfried, & F. G. Castles (Eds.), Federalism and the welfare state (pp. 89-137). Cambridge University Press.

Barnes, L. (2015). The size and shape of government: Preferences over redistributive tax policy. Socio-Economic Review, 13(1), 55-78. https://doi.org/10.1093/ser/mwu007

Bednar, J. (2008). The robust federation: Principles of design. Cambridge University Press.

Béland, D., Dinan, S., Jacques, O., & Marier, P. (2023). The “right” and the welfare state: The case of the Coalition Avenir Quebec government. Canadian Journal of Political Science/Revue canadienne de science politique, Forthcoming.

Béland, D., & Myles, J. (2012). Varieties of federalism, institutional legacies, and social policy: Comparing old-age and unemployment insurance reform in Canada. International Journal of Social Welfare, 21(s1), S75-S87. https://doi.org/10.1111/j.1468-2397.2011.00838.x

Bélanger, É., & Chassé, P. (2021). The 2018 provincial election in Quebec. Canadian Political Science Review, 15(1), 34-43. https://ojs.unbc.ca/index.php/cpsr/article/view/1839/1391

Borwein, S., Jacques, O., Béland, D., & Lecours, A. (2023). National standards or territorial autonomy? Public opinion and the politics of fiscal federalism for healthcare in Canada. Territory, Politics, Governance. https://doi.org/10.1080/21622671.2023.2196303

Brady, D., & Bostic, A. (2015). Paradoxes of social policy: Welfare transfers, relative poverty, and redistribution preferences. American Sociological Review, 80(2), 268-298.

https://doi.org/10.1177/0003122415573049

Bremer, B., & Bürgisser, R. (2022). Do citizens care about government debt? Evidence from survey experiments on budgetary priorities. European Journal of Political Research, 62(1), 239-263. https://doi.org/10.1111/1475-6765.12505

Busemeyer, M. R., & Garritzmann, J. L.. (2017). Public opinion on policy and budgetary trade-offs in European welfare states: Evidence from a new comparative survey. Journal of European Public Policy, 24(6), 871-889. https://doi.org/10.1080/13501763.2017.1298658

Canadian Election Study. (2015). https://ces-eec.arts.ubc.ca/english-section/surveys/

Cansunar, A. (2021). Who is high income, anyway? Social comparison, subjective group identification, and preferences over progressive taxation. The Journal of Politics, 83(4), 1292-1306. https://doi.org/10.1086/711627

Council of the Federation (CoF). (2021). Increasing The Canada Health Transfer Will Help Make Provinces and Territories More Financially Sustainable over the Long Term. https://www.canadaspremiers.ca/wp-content/uploads/2021/03/PT_Finance_Report.pdf.

Cutler, F. (2008). Whodunnit? Voters and responsibility in Canadian federalism. Canadian Journal of Political Science/Revue canadienne de science politique, 41(3), 627-654.

https://doi.org/60.1017/S0008423908080761

Fafard, P., Rocher, F., & Côté, C. (2010). The presence (or lack thereof) of a federal culture in Canada: The views of Canadians. Regional and Federal Studies, 20(1), 19-43.

https://doi.org/10.1080/13597560903174873

Finance Canada. (2021, December). Financial Reference Tables. Government of Canada.

https://www.canada.ca/en/department-finance/services/publications/fiscal-reference-tables/2021.html

Finances of the Nation. (2022). Debt sustainability simulator. Long-term projections chart. https://www.financesofthenation.ca/fiscal-gap-simulator/

Finances of the Nation. (2023). Aggregate Federal Transfers, https://financesofthenation.ca/historical-federal-transfers/

Forni, L., & Novta, N. (2014). Public employment and compensation reform during times of fiscal consolidation. International Monetary Fund.

Graefe, P., & Forillo, N. (2023). The federal spending power in the Trudeau era: Back to the future? IRPP Study 91. Institute for Research on Public Policy.

https://centre.irpp.org/research-studies/the-federal-spending-power-in-the-trudeau-era/

Haffert, L. (2019). Permanent budget surpluses as a fiscal regime. Socio-Economic Review, 17(4), 1043-1063. https://doi.org/10.1093/ser/mwx050

Harmes, A. (2007). The political economy of open federalism. Canadian Journal of Political Science/Revue canadienne de science politique, 40(2), 417-437.

https://doi.org/40.1017/S0008423907070114

Hartmann, E. (2017). Balance of risks: Vertical fiscal imbalance and fiscal risk in Canada. Mowat Centre for Policy Innovation.

Hübscher, E. (2016). The politics of fiscal consolidation revisited. Journal of Public Policy, 36(4), 573-601. https://doi.org/10.1017/S0143814X15000057

International Social Survey Programme, 2006. Role of Governement IV, GESIS,

https://www.gesis.org/en/issp/modules/issp-modules-by-topic/role-of-government/2006

Jacques, O. (2020). Partisan priorities under fiscal constraints in Canadian provinces. Canadian Public Policy, 46(4), 458-473. https://doi.org/10.3138/cpp.2020-007

Jacques, O. (2021). Austerity and the path of least resistance: How fiscal consolidations crowd out long-term investments. Journal of European Public Policy, 28(4), 551-570.

https://doi.org/10.1080/13501763.2020.1737957

Jacques, O. (2023a). Explaining willingness to pay taxes: The role of income, education, ideology. Journal of European Social Policy, forthcoming.

Jacques, O. (2023b). Les contraintes politiques et institutionnelles au règlement du déséquilibre fiscal. Politique et Sociétés, forthcoming.

Jacques, O., & Bélanger, E. (2022). Deficit or austerity bias? The changing nature of Canadians’ opinion of fiscal policies. Canadian Journal of Political Science/Revue canadienne de science politique, 55(2), 404-417. https://doi.org/10.1017/S0008423922000038

Jensen, C. (2011). The forgotten half: Analysing the politics of welfare services. International Journal of Social Welfare, 20(4), 404-412. https://doi.org/10.1111/j.1468-2397.2010.00745.x

Jensen, C. (2012). Labour market- versus life course-related social policies: Understanding cross-programme differences. Journal of European Public Policy, 19(2), 275-291.

https://doi.org/10.1080/13501763.2011.599991

Jensen, C., & Petersen, M.B. (2017). The deservingness heuristic and the politics of health care. American Journal of Political Science, 61(1): 68-83. https://doi.org/10.1111/ajps.12251

Jordan, J. (2009). Federalism and health care cost containment in comparative perspective. Publius: The Journal of Federalism, 39(1), 164-186. https://doi.org/10.1093/publius/pjn022

Kneebone, R. & Wilkins, M. (2016). Canadian provincial government budget data, 1980/81 to 2013/14. Canadian Public Policy, 42(1), 1-19. https://doi.org/10.3138/cpp.2015-046

Larsen, C. A. (2008). The institutional logic of welfare attitudes: How welfare regimes influence public support. Comparative Political Studies, 41(2), 145-168.

https://doi.org/10.1177/0010414006295234

Lecours, A. (2019). Dynamic de/centralization in Canada, 1867–2010. Publius: The Journal of Federalism, 49(1), 57-83. https://doi.org/10.1093/publius/pjx046

Lipsmeyer, C. S. (2011). Booms and busts: How parliamentary governments and economic context influence welfare policy. International Studies Quarterly, 55(4), 959-980.

https://doi.org/10.1111/j.1468-2478.2011.00685.x

Martin, I. (2013). Rich people’s movements: Grassroots campaigns to untax the one percent. Oxford University Press.

Meltzer, A. H., & Richard, S. F. (1981). A rational theory of the size of government. Journal of Political Economy, 89(5), 914-27. https://doi.org/10.1086/261013

Milligan, K., & Smart, M. (2016). Provincial taxation of high incomes: The effects on progressivity and tax revenue. In D. A. Green, C. Riddell, & F. St-Hilaire (Eds.), Income inequality. The Canadian story (pp. 479-507). Institute for Research on Public Policy. https://irpp.org/research-studies/provincial-taxation-of-high-incomes/

Milligan, K., & Smart, M. (2019). An estimable model of income redistribution in a federation: Musgrave meets Oates. American Economic Journal: Economic Policy, 11(1 ), 406-434. https://doi.org/10.1257/pol.20160600

Ministère des finances. (2021). Pour un financement accru du fédéral en santé: augmenter le transfert Canadien en matière de santé. Government of Quebec.

https://www.budget.finances.gouv.qc.ca/budget/2021-2022/fr/documents/Budget2122_FinancementFedSante.pdf

Mintz, J., & Smart, M. (2004). Income shifting, investment, and tax competition: Theory and evidence from provincial taxation in Canada. Journal of Public Economics, 88(6), 1149-1168. https://www.sciencedirect.com/science/article/abs/pii/S0047272703000604?via%3Dihub

Musgrave, R. A. (1971). Economics of fiscal federalism. Nebraska Journal of Economics and Business, 10(4), 3-13. https://www.jstor.org/stable/40472398

Myles, J. (2000). The maturation of Canada’s retirement income system: Income levels, income inequality and low income among older persons. Canadian Journal on Aging/La Revue Canadienne du Vieillissement, 19(3), 287-316. https://doi.org/10.1017/S0714980800015014

Noël, A. (2022, July 29). Quand les gouvernements trébuchent. Policy Options Politiques. https://policyoptions.irpp.org/magazines/july-2022/quand-les-gouvernements-trebuchent/

Oates, W. E. (1968). The theory of public finance in a federal system. The Canadian Journal of Economics/Revue canadienne d’Economique, 1(1), 37-54.

Oates, W. E. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37(3), 1120-1149. https://doi.org/10.1257/jel.37.3.1120

Parliamentary Budget Officer (PBO). (2022, July 28). Fiscal sustainability report. https://www.pbo-dpb.ca/en/publications/RP-2223-012-S–fiscal-sustainability-report-2022–rapport-viabilite-financiere-2022

Pierson, P. (2001). Coping with permanent austerity: Welfare state retrenchment in affluent democracies. In P. Pierson (Ed.),The new politics of the welfare state (pp. 410-56). Oxford University Press.

Rodden, J. (2006). Hamilton’s paradox:The promise and peril of fiscal federalism. Cambridge University Press Cambridge.

Starke, P. (2021). The politics of retrenchment. In B. Greve (Ed.), Handbook on austerity, populism and the welfare state (pp. 38-52). Edward Elgar.

Tepe, M. S. (2009). Public administration employment in 17 OECD nations from 1995 to 2005. REC-WP Working Papers on the Reconciliation of Work and Welfare in Europe, 12/2009. https://dx.doi.org/10.2139/ssrn.1489958

Tillman, E. R., & Park., B. (2009). Do voters reward and punish governments for changes in income taxes?. Journal of Elections, Public Opinion and Parties, 19(3), 313-331.

https://www.tandfonline.com/doi/full/10.1080/17457280903074169

Tombe, T. (2020). Finances of the nation: Provincial debt sustainability in Canada: Demographics, federal transfers, and COVID-19. Canadian Tax Journal/Revue fiscale canadienne, 68(4), 1083-1122. https://doi.org/10.32721/ctj.2020.68.4.fon

Tremblay, J.-F. (2012). Fiscal problems, taxation solutions: Options for reforming Canada’s tax and transfer system. Mowat Centre for Policy Innovation.

ABOUT THIS PAPER

This study was published as part of the research of the Centre of Excellence on the Canadian Federation, under the direction of Charles Breton and assisted by Ji Yoon Han. The manuscript was copy-edited by Claire Lubell, proofreading was by Zofia Laubitz, editorial co-ordination was by Étienne Tremblay, production was by Chantal Létourneau and art direction was by Anne Tremblay.

A French translation of this text is available under the title Une fédération déséquilibrée: la répartition inégale des contraintes budgétaires au Canada.

Olivier Jacques is an assistant professor in the Department of Health Policy Management and Evaluation at the School of Public Health of the Université de Montréal, researcher at CIRANO and member of the Centre d’analyse politique-constitution et fédéralisme and of the Center for the Study of Democratic Citizenship. His research concerns the political economy of public finance, social and health policy in Canada and Europe, with a particular focus on public opinion.

To cite this document:

Jacques, O. (2023). An Imbalanced Federation: The Unequal Distribution of Budget Constraints in Canada. IRPP Insight 48. Institute for Research on Public Policy.

The opinions expressed in this paper are those of the author and do not necessarily reflect the views of the IRPP or its Board of Directors.

IRPP Insight is a refereed series that is published irregularly throughout the year. It provides commentary on timely topics in public policy by experts in the field. Each publication is subject to rigorous internal and external peer review for academic soundness and policy relevance.

If you have questions about our publications, please contact irpp@irpp.org. If you would like to subscribe to our newsletter, IRPP News, please go to our website, at irpp.org.

Cover photo: Shutterstock.com

ISSN 2291-7748 (Online)