Canada’s Equalization Policy in Comparative Perspective

- La péréquation, un programme essentiel du fédéralisme canadien, utilise des revenus du gouvernement fédéral afin d’atténuer les conséquences des inégalités fiscales entre les provinces.

- Les pressions fiscales changent en fonction des circonstances, une situation qui crée souvent des tensions politiques importantes entre les gouvernements pour ce qui est des droits de péréquation.

- En s’inspirant de la Commonwealth Grants Commission australienne, la création d’une agence autonome recommandant le niveau des paiements de péréquation pourrait favoriser une dépolitisation de ce processus.

In mid-March 2016, just before the unveiling of the federal budget, Saskatchewan Premier Brad Wall requested that the Trudeau government send back the money his province had contributed to equalization in order to help Saskatchewan through an enduring downturn in the oil industry. As he stated, “I understand the equalization formula is not likely to change anytime soon…But the federal government could recognize that the formula is flawed by providing Saskatchewan with new economic stimulus funding at least equal to the amount they are taking in equalization.”1 Made during the 2016 Saskatchewan electoral campaign, Premier Wall’s remarks point to long-standing frustrations about the functioning of the federal equalization program in wealthier provinces such as Alberta that do not receive equalization payments.

In 2008, then Ontario Premier Dalton McGuinty expressed his own frustration at a time when that province was experiencing a severe economic crisis but not yet receiving equalization payments (due to the lag in the formula). “Were we to become a recipient, we would rescue ourselves with our own money. That’s how perverse and nonsensical this financial arrangement is,” McGuinty said.2 The remarks by Wall and McGuinty, however, misrepresent the workings of equalization. The program is not a direct province-to-province transfer, as McGuinty’s comments seem to imply; rather, it is financed from the general revenues of the federal government — and, therefore, by all Canadian taxpayers — which means Ottawa does not “take” equalization money from the provinces, as Wall suggested.

Statements such as Wall’s and McGuinty’s can resonate fairly strongly with the public, as happened when, in December 2004, then Newfoundland and Labrador Premier Danny Williams took on the federal government over what he felt was the unfair treatment of his province through equalization. This high level of resonance might be related to the public’s limited knowledge about equalization, a lack that is especially relevant now, as Ottawa and the provinces discuss the possibility of a new health accord that could significantly affect fiscal federalism.

Equalization policy is a key component of modern Canadian fiscal federalism: federal government revenues are used to mitigate the consequences of fiscal disparities among provinces. Understanding the nature of that policy would allow Canadians to grasp what is unique about the equalization system, what choices Canada made in setting up the system in 1957 and how it differs from the Australian model, elements of which some have suggested might be adopted in this country.

Fiscal Federalism and Equalization Policy

The basis of fiscal federalism more generally, as Ronald Watts notes, is the “redistribution of revenue” between central and constituent unit governments. In most federal systems, the central government is allocated substantial taxation powers as a way to mitigate fiscal competition among the constituent units and to draw on “the administrative advantages of centralizing certain kinds of revenue levying and tax collection.” [italics in the original]3 As a result, Atkinson et al. explain, “[i]n all federations, there is an imbalance between the revenues and expenditures of central [federal] governments and constituent units, and every central government transfers funds to the constituent units. Through such transfers, central governments exercise their spending power to achieve various goals, including national standards and objectives.”4

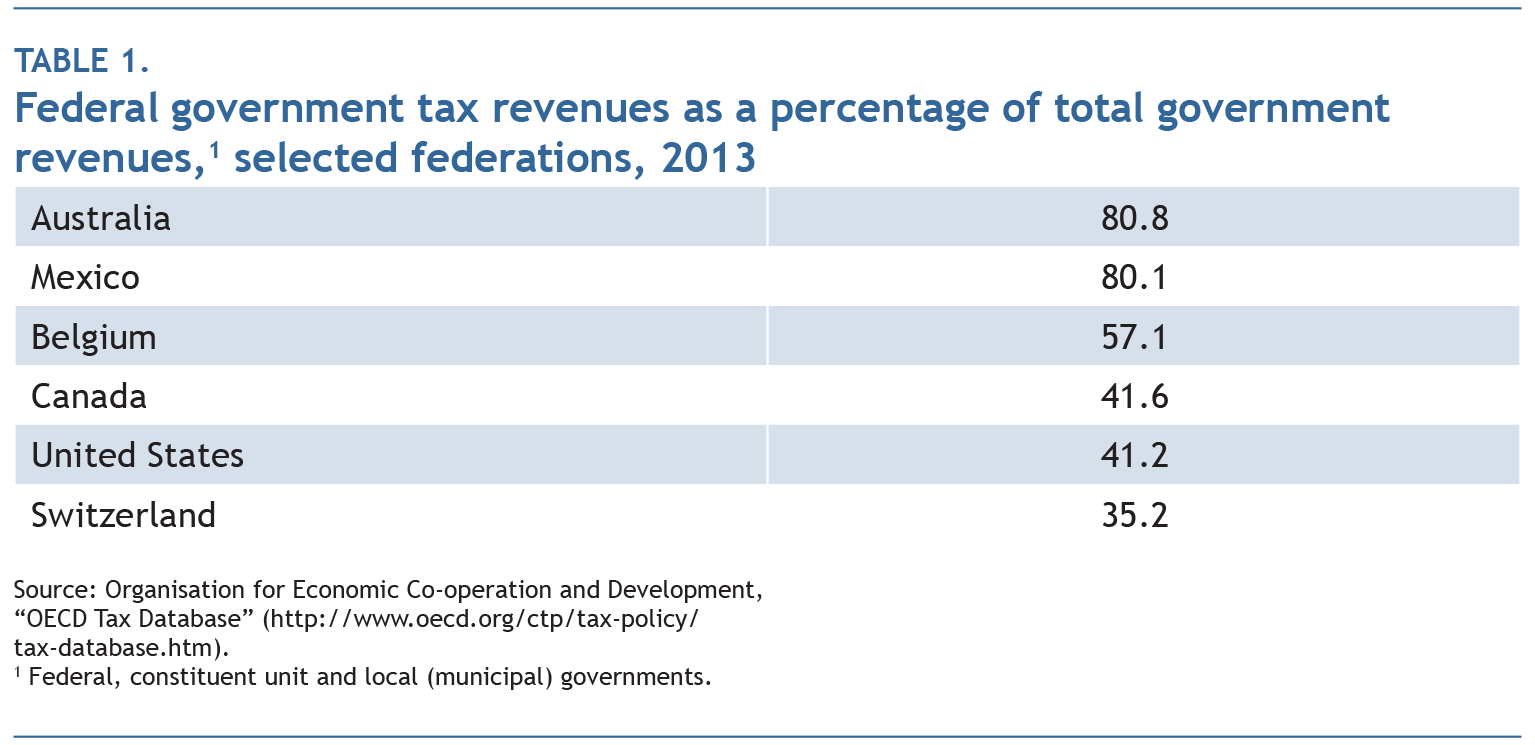

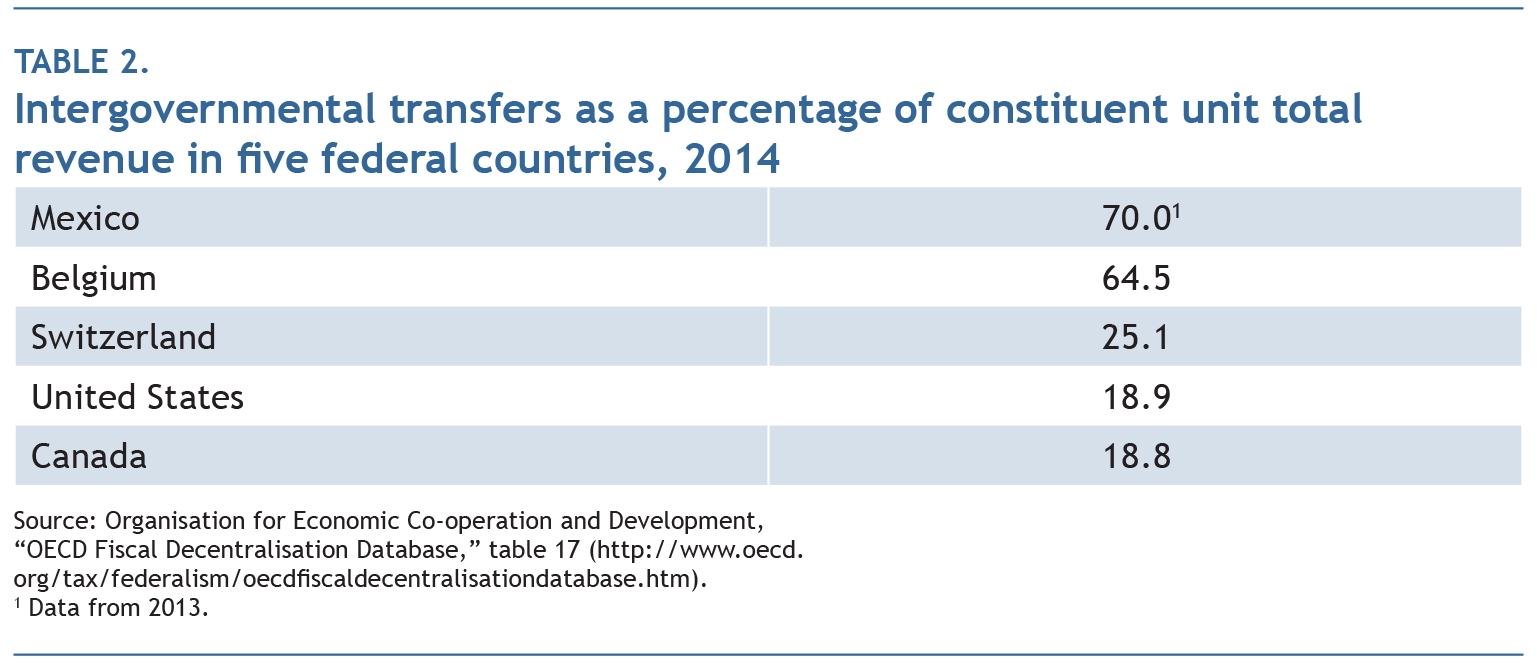

The constitutional division of taxation powers between the federal and constituent unit governments varies greatly across federal systems. Federal government revenues as a percentage of total government revenues before intergovernmental transfers provide a perspective on fiscal centralization in federal systems (table 1). This indicator suggests that Canada is, from a fiscal perspective, one of the most fiscally decentralized federations in the world, with the federal government collecting just over 40 percent of total government revenues. Other centralization indicators suggest a similar conclusion. The provincial governments have few restrictions on their own-source revenues, and their borrowing autonomy is unconstrained. As well, the provinces have access to major revenue sources such as income tax and sales tax, and they are much less reliant on federal transfers than are constituent units in other federal systems (table 2).

Another indicator of the level of fiscal centralization in federations is the conditionality of transfers. In Canada, the two main vertical transfers, the Canada Health Transfer (CHT) and the Canada Social Transfer (CST), come with conditions that are not overly constraining. To receive the CST, provinces cannot impose a minimum residency requirement for residents to receive social assistance. As for the CHT, the federal government has the right to reduce by a discretionary amount transfers to provinces it judges are not respecting the five principles of the 1984 Canada Health Act — portability, accessibility, universality, comprehensiveness and public administration. Overall, though, the provinces enjoy strong fiscal autonomy; as a consequence, they can pursue their own policy objectives within their areas of jurisdiction.5

Canadian provinces have one of the highest degrees of policy autonomy among constituent units of federations. They have sole or predominant jurisdiction in a number of key policy fields (education, health care, employment relations, civil law, natural resources and policing), and play a significant role in several others (social policy, transportation, agriculture, immigration, language, culture, financial regulation and the environment). Indeed, the federal government is preponderant only in the areas of criminal justice, international relations, currency, defence and citizenship.

Despite Canada’s high level of fiscal decentralization and provincial autonomy, political and policy debates about fiscal federalism feature two types of “fiscal imbalance”: vertical and horizontal. Vertical fiscal imbalance typically refers to the claim that “the federal government’s tax sources are much greater than its expenditure responsibilities whereas, in the provinces, precisely the opposite is the case.”6 Politically, provincial leaders have used this claim to seek greater fiscal transfers from Ottawa — Quebec, in particular, has long articulated a strong discourse denouncing vertical fiscal imbalance. As for horizontal imbalance, this refers to “the differential capacities of the provinces to raise revenues.”7

A vigorous debate on “fiscal imbalance” emerged in the mid-1990s, when deficit elimination became a major priority of the Liberal federal government after the 1993 election. A crucial tool for reaching a balanced budget was a sharp reduction in fiscal transfers to provincial governments. In the 1960s and most of the 1970s, these transfers took the form of shared-cost programs: the federal government would split the costs of health care, higher education and social assistance with the provinces. In 1977, transfers for health care and higher education were changed to a block grant formula, thus detaching the federal government’s commitment to help finance those fields from provincial spending. Left intact, however, was the Canada Assistance Plan (CAP), which, since 1966, had been reimbursing the provinces for about half the costs incurred for social assistance and welfare. With CAP still in place, the federal government did not have full control over how much it was required to transfer to the provinces.

The federal government finally ended CAP in 1996 as it consolidated its major vertical transfers into the Canada Health and Social Transfer (CHST), an -omnibus block grant based on a formula independent of actual provincial spending on health care, education and social assistance. The Quebec government, then formed by the Parti Québécois (PQ), harshly criticized the changes, as did governments in other provinces. In the aftermath of the 1995 sovereignty referendum, the PQ denounced Ottawa for balancing its budget “on the backs of Quebecers.” It argued that the needy and the sick in the province were being cared for by a Quebec government that did not have the necessary resources to provide the best services possible, while the federal government’s financial resources exceeded the needs associated with its constitutional responsibilities. The PQ labelled this situation “fiscal imbalance,” and the other Quebec provincial parties agreed. The Quebec government commission created to study the issue advocated giving provinces a greater share of the “fiscal space” (primarily the sales tax) so they could augment their fiscal resources without raising income tax.8

In 2003, the Quebec Liberal Party, now forming the provincial government, kept up the pressure on the federal Liberals to address the issue of fiscal imbalance. The Quebec Liberals did not have to work hard to convince most other provincial governments that there was indeed a fiscal imbalance in the Canadian federation. Sensitive to the electoral implications of denying the notion of fiscal imbalance, all federal opposition parties acknowledged fiscal imbalance and promised to address it, if and when they took power. The 2004 health accord between Ottawa and the provinces occurred in the context of such discussions over vertical fiscal imbalance.9

The Conservative government led by Stephen Harper, formed after the 2006 federal election, produced a budget that gave considerable importance to the theme of fiscal imbalance. The new government favoured a different approach to federalism (labelled “open federalism”) that respected provincial jurisdictions and therefore refrained from creating new national programs, including those that would address the fiscal imbalance. Although the Harper government followed none of the key recommendations of Quebec’s fiscal imbalance commission, it declared that it had addressed the imbalance adequately through the decision in the 2007 budget to increase the CST, commit to 6 percent annual growth in the CHT and implement many of the recommendations of the Expert Panel on Equalization and Territorial Formula Financing.10 Quebec and most of the other provinces did not accept this verdict (although it did give Quebec the opportunity to cut certain taxes). Fiscal imbalance as a burning political issue nevertheless disappeared from the federal policy agenda, perhaps in part because federal surpluses also disappeared as a result of the post-2008 recession.

Horizontal fiscal imbalance points to enduring fiscal inequalities between constituent units, which reflect broader economic and territorial disparities. In Canada, one main reason for these disparities is the provincial ownership of natural resources. All provinces have natural resources of some type: oil, gas, hydro-electricity, forestry, fisheries and minerals. But not only are these resources unevenly spread out across the country, their value is also quite uneven and can change dramatically — particularly in the case of oil. According to the Constitution, resource revenues go directly to the provincial government on whose territory the resource lies. After the Pierre Trudeau government embarked on oil price regulation in the early 1980s, provincial governments insisted that a “resource amendment” be included in the Constitution Act, 1982. As a result, article 92A states that “in each province, the legislature may exclusively make laws in relation to: (a) exploration for non-renewable natural resources in the province; (b) development, conservation and management of non-renewable natural resources and forestry resources in the province.” This amendment enhanced the legislative powers of the provinces.11

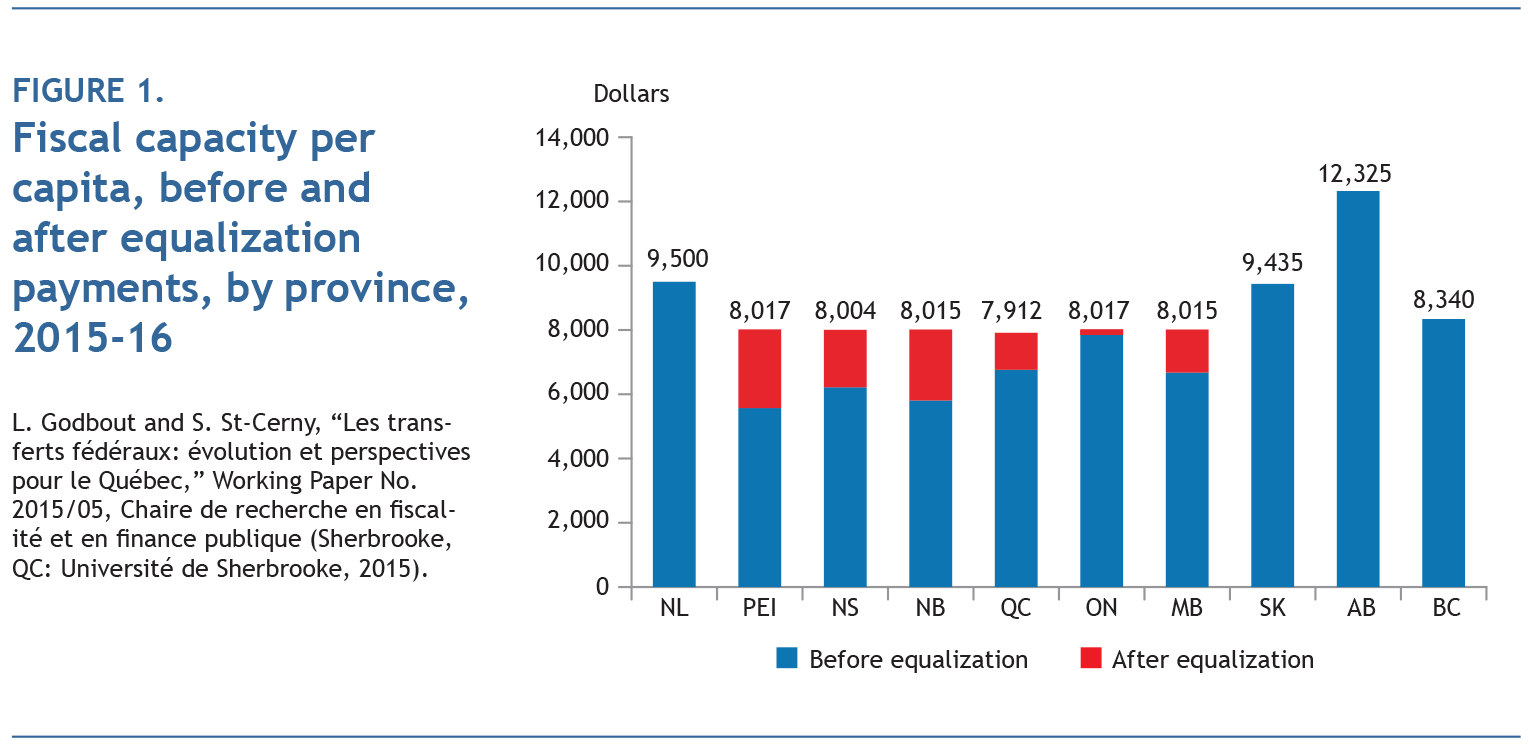

The fact that provincial governments receive revenues stemming from resource exploitation taking place on their territory greatly affects their fiscal capacity, or the ability “to raise revenue from their own sources.”12 Fiscal revenues vary across jurisdictions and fluctuate over time, especially during resource revenue booms, which can put a strain on equalization. In 2012, for example, Newfoundland and Labrador’s real own-source revenue — at $13,966 per capita the highest in the country — was more than double that of Nova Scotia ($6,452 per capita). From both a public policy and a normative standpoint, these differences are problematic because they can compromise the ability of poorer provinces to deliver services of comparable quality to those provided by their wealthier counterparts without imposing an undue fiscal burden on their residents. This is why the equalization program transfers federal money to provinces that fall below a standard in terms of fiscal capacity (see figure 1).

From a pure public policy standpoint, important discrepancies in provincial fiscal capacity could lead to out-migration from poorer provinces, while wealthier provinces would experience net in-migration. Arguably, the traditionally poorer provinces — Newfoundland and Labrador, Prince Edward Island, New Brunswick, Nova Scotia, Manitoba and Saskatchewan — would have lost even more people in the absence of equalization, compounding their economic difficulties. In turn, the institutional basis of the federation could have been destabilized insofar as important provincial population losses and gains would have called into question the delicate balance of provincial representation in the House of Commons.

From a normative perspective, important differences in the fiscal capacity of provinces challenge the meaning of Canadian citizenship, solidarity and even nationhood. The development of the welfare state has compensated for socio-economic inequalities among individuals or social classes, but, since the provinces have an important role to play in social and education policy, there are limits on the federal government’s ability to give substance to the idea of Canadian social citizenship. Varying means among provincial governments to offer their residents social protection can present a serious challenge to the notion of solidarity. Indeed, chronic and unmitigated territorial discrepancies provide material for politicians to generate, build or sustain feelings of resentment to, and alienation from, the central state. In turn, those sentiments can strengthen existing territorial identities and even compromise nationhood.

Most advanced industrialized federations operate a stand-alone equalization program. One significant exception is the United States.13 Only between 1972 and 1986 did the US government run a “revenue-sharing” program that featured equalization components, but the program focused primarily on addressing the vertical fiscal imbalance between Washington and both states and municipalities.14 The absence of a stand-alone equalization program in the United States is the product of three distinct factors: the lack of a direct threat to national unity; a limited emphasis on equal access to services associated with the notion of social citizenship and a particular conception of the role of government in society; and the nature of US political institutions, particularly the power of the upper chamber (the Senate), which would make the adoption of an equalization program unlikely even if some constituencies supported the idea.15

Equalization programs can take many different forms. Designing and reforming such a program involves making choices about at least six different features. The first is the source of financing for the program. In Canada, equalization is financed from the general revenues of the federal government. Other federations have made different choices. For instance, in Australia, equalization payments to the six states and two territories come from the goods and services tax (GST) levied by the Commonwealth government since 2000. Similarly, in Germany, part of the value-added tax (VAT) is allocated to the 16 states (Länder). In Brazil, equalization to states and municipalities comes from the sharing of revenues “from three main federal taxes: personal income taxes, corporate income taxes, and the elective VAT.”16 These examples illustrate the diversity of equalization financing across federal countries.

The second choice concerns the degree of equalization to be achieved. In Canada, the operative words are “reasonably comparable” levels of public services, as per article 36(2) of the Constitution Act, 1982. In contrast, in Australia, the Commonwealth Grants Commission (CGC) — the arm’s-length commission that makes recommendations on equalization payments — has suggested: “State governments should receive funding from the Commonwealth such that, if each made the same effort to raise revenue from its own sources and operated at the same level of efficiency, each would have the capacity to provide services at the same standard.”17 In Germany, a 1999 judgment by the Federal Constitutional Court following a challenge of the federal equalization law by some of the “donor” Länder stated that the purpose of equalization was to “diminish but not level” territorial disparities.18

The third choice is the territorial organization of the transfers. In Canada, as in most other federations, equalization payments are made by the federal government. In Germany, however, they take the form of “direct horizontal transfers from the rich to the poor Länder,” although the federal government provides “a final topping up through vertical supplementary transfers.”19 Interestingly, in Canadian political and media discourse, equalization is sometimes depicted as if the program entailed a direct flow of money from wealthier to poorer provinces, but this has never been the case in reality.20 Indeed, moving toward such a system could prove extremely controversial, especially in resource-rich provinces such as Alberta.

The fourth choice involved in the design or reform of an equalization program is whether to equalize strictly on fiscal capacity or to also consider needs — that is, the cost of providing public services for specific constituent units of a federation. In fact, constituent units with the same fiscal capacity might face greater costs in providing exactly the same public service because of particular challenges they face. For example, a province with many elderly or with a highly dispersed population will find it especially expensive to provide needed services. There is often some tension between those who prefer the simpler approach of a strictly equalizing fiscal capacity and those who feel that a needs-based approach is more equitable, if more complex.

The fifth choice concerns the governance structure for equalization. The primary issue here is who will have decision-making power over the equalization formula used to calculate payments. In other words, what public authority will decide which constituent units receive equalization money and how much. The broad parameters of equalization — for example, are needs as well as fiscal capacity to be considered? — can also be influenced by the source of authority behind the program. In Canada, the federal government is the only decision-maker for the program; provinces can be consulted, and sometimes are, but there is no obligation on Ottawa’s part to consider their position. In Australia, the CGC makes an annual recommendation for the “relativities” to be paid to the states. These “relativities” determine the share of the GST that goes to each state, inclusive of an equalization component. The Commonwealth government is under no obligation to follow the recommendation of the CGC, but the commission has a reputation for technocratic expertise and neutrality that gives it great credibility.

The sixth choice to make when designing or reforming an equalization program is its legal foundation. Canada constitutionalized the federal government’s commitment to make equalization payments. In Germany, the Basic Law refers to the “reasonable equalization of the disparate financial capacities of the Länder.” In Australia, in contrast, equalization is not constitutionalized.

From Australia to Canada

In Canada, the creation of a stand-alone equalization program in 1957 -represented a milestone in this country’s political development. Not only did it establish mechanisms to reduce the consequences of territorial disparities, but it also embedded equalization in broader notions of Canadian citizenship, solidarity and nationhood. Provinces that are typically equalization recipients consider equalization payments an expression of national unity. Although conflict around equalization erupts from time to time, even traditional nonrecipient provinces view equalization largely as a positive contributor to the Canadian political community. Alberta is a partial exception.

To gain greater insight into the development of equalization in Canada, it is useful to have a comparative perspective. For this purpose we turn to Australia, another federation frequently compared to Canada.21 Beyond the key historical and institutional similarities between these two Commonwealth countries, stemming in part from their colonial past, it is appropriate to turn to Australia because it created the first system of equalization in the 1930s. Also, the Australian model served as a reference point for Canadian policy specialists in the late 1930s and early 1940s, when the idea of equalization first entered federal policy debates.22

The story of the development of equalization in Australia validates some of the points already made about the impulse behind the establishment of the Canadian program. Australia, like Canada, is a large federation with a stand-alone equalization system created partly to mitigate territorial tensions. In both countries, therefore, a case could easily be made that disparities threatened the capacity of some constituent units to offer quality public services. Also, the creation of the CGC in 1933 was prompted in part by a secessionist movement in Western Australia whose grievances were primarily of an economic nature (the state even held a referendum in which a majority chose independence), just as national unity concerns linked to Quebec favoured the creation of a Canadian equalization program.23

When the time came to design and implement an equalization system in 1957, Canadian decision-makers made some different policy choices from their Australian counterparts. Most important, Canada chose to base its equalization formula strictly on fiscal capacity (the revenue side), rather than also considering needs (the cost side); and it favoured federal executive discretion in the management of the program, rather than using an arm’s-length agency.

Why did Canadian federal and provincial officials not favour incorporating a needs component into the equalization formula, as Australia did? To answer this requires a broad understanding of federalism in the two countries. Australian federalism has had a clear centralizing trajectory.24 Today, the Commonwealth government is incontestably the most important government in the eyes of Australians, and its strong presence in a multiplicity of policy fields is not only tolerated but desired. In Canada, the historical trajectory of federalism has been quite different. Created as a centralized federation, the evolution has been toward a gradual empowerment of the provinces, which are genuine political communities with strong identities. The provinces strongly value their autonomy, are usually ready to defend it and can count on their residents for support. The consequence of these differences in the two countries’ federal dynamics is that in Australia the assessment of expenditure needs is widely accepted as legitimate, whereas in Canada it is considered an outright intrusion into provincial affairs. In fact, in Canada, in the rare instances when this option was raised, provincial autonomy moved to the forefront of the debate and became a direct obstacle to its adoption.25 Thus, federal officials have seldom promoted this controversial policy option.26

Canada’s decision not to create an arm’s-length body similar to Australia’s CGC can also be linked to the distinct natures of Australian and Canadian federalism. Canada’s provinces see themselves as equal partners with the federal government in the management of the federation, and therefore have been loath to endorse an arm’s-length agency that potentially would limit provincial agency in shaping decision-making on equalization. Of course, the provincial governments play no formal role in the management of equalization, and the federal government does not even have a formal obligation to consult them, even on important decisions. However, the existence of dense networks of intergovernmental relations means that the provinces potentially can exercise some leverage on the federal government when it comes to equalization.

Current Pressures on the Equalization System and Potential Reforms

Canada’s current equalization arrangements will remain in effect until 2019, meaning there is plenty of time to consider some alternatives for reform, two of which are inspired by the Australian model.

One reform option is to take into account provinces’ particular needs when determining equalization payments. There has been much talk in recent years that adding an expenditure needs dimension to equalization would make it fairer. Many have argued that the current “fiscal capacity only” system is particularly unfair to Ontario.27 For example, the high cost of doctors’ and teachers’ salaries in that province means that its equalization payment does not go as far as, for example, that of Prince Edward Island. Other provinces face other types of challenges with the cost of providing public services — for example, the Atlantic provinces, British Columbia and Quebec have particularly fast-aging populations, placing an additional burden on their provincial governments. This problem was compounded by the Harper government’s decision to remove the equalization component of the CHT and move to equal per capita transfers starting in fiscal year 2014-15. In this context, adjusting equalization payments to needs would seem to make sense.

One problem with the needs-based option is that it would introduce greater subjectivity into the equalization system. We can easily imagine every single province pleading its expenditure needs case. In the Australian context, this type of dynamic does not lead to significant intergovernmental quarrelling because of the arm’s-length nature of the CGC. In Canada, the federal government, which alone decides on equalization payments, would have to arbitrate the needs claims of the provinces, and provincial governments would bring all of their mobilization resources to bear to secure the best possible consideration of what they see as their needs. Hence, adding a needs dimension likely would contribute to a further politicization of equalization, an outcome we consider detrimental to the cohesion of the federation.

A second reform option is to raise the equalization ceiling. In 2009, the federal government placed a ceiling on the overall equalization pool, limiting increases to the level of annual GDP growth. The ceiling raises important questions about the extent to which the equalization program now works in a way that respects its spirit.28 Indeed, the total equalization pool should be expected to rise when territorial fiscal disparities increase (often as a result of higher oil prices), simply because this situation requires more money to bring recipient provinces up to the equalization standard. This is not happening currently.

Although desirable in principle, lifting the equalization ceiling would not be fiscally realistic. As long as Ontario remains a recipient province, its population size would require a much higher equalization pool if there were no ceiling. Even if Ontario ceased to be a recipient, pressures to revise the program would continue, given that most provincial governments are expected to continue to face significant deficits and growing fiscal pressures.29 The federal government is unlikely to favour a massive enlargement of the equalization pool, as this would increase the already sizable federal deficit or require expenditure cuts. Still, raising the ceiling on equalization would allow the program to be more responsive to the fiscal disparities provincial governments face and would better honour the principles behind this fundamental instrument of Canadian solidarity.

A third reform option is to draw on Australia’s experience and create an expert independent commission to recommend the level of equalization payments. However, as indicated above, most provincial governments likely would oppose this type of institutional reconfiguration because it would reduce their capacity to pressure the federal government directly, something they have done regularly since the creation of the equalization program in 1957.30 Although the federal government could modify equalization’s governance structure on its own, such an important change would be difficult to implement in the face of strong provincial opposition. Yet, for provincial governments, there should be some attraction to operating in an equalization environment that resembles political neutrality. In addition, such a commission likely would lead to greater predictability and diminish the extent to which the program is — or appears to be — constantly up for revision. In Australia, from time to time, the Commonwealth issues “terms of reference” that include a request to review the CGC’s methodology for determining payments to the states, but calls for amendments to the formula are less frequent than in Canada. From this perspective, some provincial support for an arm’s-length agency might be generated since provinces tend to favour stability and predictability in the program.

An arm’s-length agency, however, might not lead to the same level of depoliticization experienced in Australia. For example, it could prove difficult, at least at first, to convince Canadians of the neutrality of commissioners. In Australia, the CGC’s members — often former state civil servants or prominent academics — are appointed by the Commonwealth after consultation with the states.31 Sometimes, commissioners have worked previously in more than one state, which diminishes the likelihood of their being associated with a particular state. In Canada, commissioners might readily be identified with their province of origin and suspected of catering to that province. That said, over time they might acquire a veneer of neutrality and legitimacy that comes close to that of the CGC commissioners — much the way Supreme Court of Canada judges are largely viewed as being above provincial loyalties. Considering that an arm’s-length agency could improve the fairness of the equalization program and the broader workings of the federation, such a body, in our view, would be a worthwhile innovation.

Conclusion

Before even thinking about reforming the equalization system, Canadians need greater knowledge about its nature and the policy choices made in the past. Equalization has been a fixture of Canadian federalism since 1957, and the fundamental choices made at that time — for example, looking strictly at the revenue side and having the federal government be the sole decision-maker on equalization payments — are still at the heart of the system. Yet, other important provisions have changed multiple times since — for example, the number of provinces used to calculate the equalization standard and the treatment of natural resource revenues — with these changes often triggering dissatisfaction on the part of some provinces. To a certain extent, such dissatisfaction simply reflects that every decision made concerning the program creates winners and losers among the provinces.

At a deeper level, however, provincial protests that follow reforms to the equalization program or simply equalization payments announcements are the result of the system’s potential for politicization. In publicly expressing opposition to some aspect of equalization, provincial governments look to apply political pressure on the federal government, most often to obtain “compensation” for a situation or decision that affects them negatively.

Equalization is part of Canadian politics. From the point of view of democracy and representation, there is value in having the country’s elected officials engage in debates on equalization. At the same time, the politicization of equalization sometimes produces intergovernmental conflict, which places strain on the workings of the federation. Factoring expenditure needs into the formula, we argue, could increase such politicization because of their more subjective aspects compared to the revenue side (fiscal capacity).

In this context, we conclude that the creation of a new governance structure centred on an arm’s-length agency (drawing on Australia’s experience with its Commonwealth Grants Commission) would help mitigate episodic tensions over the formula and the level of payments. We recognize, however, that, given the politics of Canadian federalism, an arm’s-length agency to administer equalization might not work as well in this country as it does in Australia. For example, provincial premiers probably would want to see their province represented among the agency’s senior officials. Even so, they might not consider the body to be neutral, at least initially. In fact, depoliticizing equalization completely is virtually impossible in a federation where the provinces have strong identities and are not reluctant to challenge federal policies openly. Still, there is room to achieve some depoliticization of equalization in Canada, and the establishment of an arm’s-length agency would be a crucial step in this process.

A new federal government that has signalled its willingness to innovate and to develop a new type of relationship with the provinces might provide an opportunity to restructure how equalization is administered. The first step in such a process would be to think about the governance of the program, an issue that has been given only cursory attention by policy-makers and analysts. Now that intergovernmental relations around equalization are quiet, this would be a good time to consider reform options that could help avoid the type of bickering that occurred during the Martin and early Harper years.

The Canadian public is in dire need of a better understanding of equalization. Comparative analysis can shed light on the nature and consequences of the choices Canada has made, and will make, when it comes to equalization policy. Knowing what these choices are and why they differ from what other countries, notably Australia, have done is an excellent start toward improving the quality of the policy debate about equalization in Canada. A better understanding is the best protection against politically motivated and often explosive statements that weaken support for a crucial component of Canadian fiscal federalism.

This IRPP Insight is based on material from the manuscript Equalization Policy and Fiscal Federalism, which is currently under contract with the University of Toronto Press. The authors thank Greg Marchildon, Haizhen Mou and Rose Olfert for their feedback and their collaboration on the book project. They also thank Rachel Hatcher, France St-Hilaire, Leslie Seidle and David Péloquin for their suggestions. Finally, they acknowledge support from the Social Sciences and Humanities Research Council and, in the case of Daniel Béland, the Canada Research Chairs Program.

- “Saskatchewan Premier Wants $570M from Ottawa in Federal Budget,” CBC News, March 16, 2016.

- R. Benzie and R. Ferguson, “Ontario Demands New Deal,” Toronto Star, May 1, 2008.

- R.L. Watts, Comparing Federal Systems, 3rd ed. (Kingston, ON: Queen’s University, Institute of Intergovernmental Relations, 2008), 95.

- M. Atkinson, D. Béland, G.P. Marchildon, K. McNutt, P.W.B. Phillips, and K. Rasmussen, Governance and Public Policy in Canada: A View from the Provinces (Toronto: University of Toronto Press, 2013), 10. For a discussion of the concept of spending power in comparative perspective, see R.L. Watts, The Spending Power in Federal Systems: A Comparative Study (Kingston, ON: Queen’s University, Institute of Intergovernmental Relations, 1999).

- See Atkinson et al., Governance and Public Policy.

- Atkinson et al., Governance and Public Policy, 62.

- Atkinson et al., Governance and Public Policy, 62.

- Commission on Fiscal Imbalance, A New Division of Canada’s Financial Resources (Quebec City: Government of Quebec, 2002); A. Lecours and D. Béland, “Federalism and Fiscal Policy: The Politics of Equalization in Canada,” Publius: The Journal of Federalism 40, no. 4 (2010): 569-96.

- The 2004 health care accord specified that the CHT would grow by 6 percent annually until 2014. In 2011, the federal government announced the extension of this arrangement to fiscal year 2016-17. Starting in 2017-18 the CHT will grow in line with a three-year moving average of nominal gross domestic product (GDP) growth, with funding guaranteed to increase by at least 3 percent a year.

- Expert Panel on Equalization and Territorial Formula Financing, Achieving a National Purpose: Putting Equalization Back on Track (Ottawa: Expert Panel on Equalization and Territorial Formula Financing, 2006).

- W.D. Moull, “Natural Resources and Canadian Federalism: Reflections on a Turbulent Decade,” Osgoode Hall Law Journal 25, no. 2 (1987): 413.

- S.M. Barro, Macroeconomic versus RTS Measures of Fiscal Capacity: Theoretical Foundations and Implication for Canada (Kingston, ON: Queen’s University, Institute of Intergovernmental Relations, 2002), 1.

- In comparative policy and social science research, it has long been common to compare Canada with the United States; see, for example, C. Leman, “Patterns of Policy Development: Social Security in the United States and Canada,” Public Policy 25 (1977): 261-91; S.M. Lipset, Continental Divide: The Values and Institutions of the United States and Canada (New York: Routledge, 1990); A. Maioni, Parting at the Crossroads: The Emergence of Health Insurance in the United States and Canada (Princeton, NJ: Princeton University Press, 1998); D. Zuberi, Differences That Matter: Social Policy and the Working Poor in the United States and Canada (Ithaca, NY: Cornell University Press, 2006). This is particularly the case in the field of federalism studies, where this comparison is both common and fruitful; see, for example, G. Bousheya and A. Luedtkeb, “Fiscal Federalism and the Politics of Immigration: Centralized and Decentralized Immigration Policies in Canada and the United States,” Journal of Comparative Policy Analysis 8, no. 3 (2006): 207-24; R. Simeon, “Canada and the United States: Lessons from the North American Experience,” in Rethinking Federalism: Citizens, Markets, and Governments in a Changing World, ed. K. Knop, S. Ostry, R. Simeon, and K. Swinton (Vancouver: UBC Press, 1995), 250-72; B. Théret, “Regionalism and Federalism: A Comparative Analysis of the Regulation of Economic Tensions between Regions by Canadian and American Federal Intergovernmental Transfer Programmes,” International Journal of Urban and Regional Research 23, no. 3 (1999): 479-512; R.L. Watts, “The American Constitution in Comparative Perspective: A Comparison of Federalism in the United States and Canada,” Journal of American History 74, no. 3 (1987): 769-92. The absence of an equalization program in the United States obviously reduces the value of the comparative perspective with that country on the management of horizontal fiscal imbalance.

- B.A. Wallin, From Revenue Sharing to Deficit Sharing: General Revenue Sharing and Cities (Washington, DC: Georgetown University Press, 1998).

- See D. Béland and A. Lecours, “Fiscal Federalism and American Exceptionalism: Why Is There No Federal Equalisation System in the United States?” Journal of Public Policy 34, no. 2 (2014a): 303-29.

- Watts, “American Constitution,” 111.

- Commonwealth Grants Commission, The Commonwealth Grants Commission: The Last 25 Years (Canberra: Commonwealth Grants Commission, 2008), 27.

- T.O. Hueglin and A. Fenna, Comparative Federalism: A Systematic Inquiry, 2nd ed. (Toronto: University of Toronto Press, 2015), 191.

- Hueglin and Fenna, Comparative Federalism, 190.

- Lecours and Béland, “Federalism and Fiscal Policy.”

- D. Béland and A. Lecours, “The Ideational Dimension of Federalism: The ‘Australian Model’ and the Politics of Equalization in Canada,” Australian Journal of Political Science 46, no. 2 (2011): 199-212; W.D. Coleman and G. Skogstad, “Neo-liberalism, Policy Networks, and Policy Change: Agricultural Policy Reform in Australia and Canada,” Australian Journal of Political Science 30, no. 2 (1995): 242-63; ed. B.W. Hodgins, D. Wright and W. Heick, Federalism in Canada and Australia: Historical Perspectives 1920-1988 (Peterborough, ON: Broadview Press, 1989); ed. H. Obinger, S. Leibfried, and F.G. Castles, Federalism and the Welfare State: New World and European Experiences (Cambridge, MA: Cambridge University Press, 2005).

- Béland and Lecours, “Ideational Dimension.”

- D. Béland and A. Lecours, “Accommodation and the Politics of Fiscal Equalization in Multinational States: The Case of Canada,” Nations & Nationalism 20, no. 2 (2014b): 337-54; P.E. Bryden, “The Obligations of Federalism: Ontario and the Origins of Equalization,” in Framing Canadian Federalism: Historical Essays in Honour of John T. Saywell, ed. D. Anastakis and P.E. Bryden (Toronto: University of Toronto Press, 2009), 75-94.

- A. Fenna, “The Malaise of Federalism: Comparative Reflections on Commonwealth-State Relations,” Australian Journal of Public Administration 66 (2007): 298-306.

- P.M. Leslie, National Citizenship and Provincial Communities: A Review of Canadian Fiscal Federalism (Kingston, ON: Queen’s University, Institute of Intergovernmental Relations, 1988), 28; R.A. McLarty, “Econometric Analysis and Public Policy: The Case of Fiscal Need Assessment,” Canadian Public Policy 23, no. 2 (1997): 207.

- Béland and Lecours, “Ideational Dimension.”

- P. Gusen, “Expenditure Need: Equalization’s Other Half” (Toronto: University of Toronto, School of Public Policy & Governance, Mowat Centre for Policy Innovation, February 2012).

- B. Dahlby, “Eliminating the Ceiling on Equalization Payments,” National Post, September 9, 2014.

- Office of the Parliamentary Budget Officer, Fiscal Sustainability Report 2016 (Ottawa: Office of the Parliamentary Budget Officer, 2016).

- D. Béland and A. Lecours, “Equalization at Arm’s Length” (Toronto: University of Toronto, School of Public Policy & Governance, Mowat Centre for Policy Innovation, 2012).

- The CGC currently consists of a chair and 3 members, and has a staff of about 30.

About the authors

Daniel Béland holds the Canada Research Chair in Public Policy (tier 1) at the Johnson-Shoyama Graduate School of Public Policy at the University of Saskatchewan. A specialist in fiscal and social policy, he has published 14 books and more than 100 articles in peer-reviewed journals. His most recent book is Obamacare Wars: Federalism, State Politics, and the Affordable Care Act (with Philip Rocco and Alex Waddan; 2016).

André Lecours is professor in the School of Political Studies at the University of Ottawa. His main research interests are Canadian politics, European politics, nationalism (with a focus on Quebec, Scotland, Flanders, Catalonia and the Basque country) and federalism. He is the author of Basque Nationalism and the Spanish State (2007) and coauthor of Nationalism and Social Policy: The Politics of Territorial Solidarity (with Daniel Béland; 2008).

Une publication préconise la création d’un organisme indépendant qui déterminerait les paiements de péréquation

Montréal – Pour apaiser les tensions politiques entourant les transferts versés aux provinces dans le cadre de son programme de péréquation, Ottawa devrait s’inspirer de l’Australie et mettre sur pied un organisme indépendant chargé de recommander le niveau des paiements, préconise une nouvelle publication de l’Institut de recherche en politiques publiques.

Depuis 1957, ce programme clé du fédéralisme canadien consent aux provinces des paiements qui les aident à fournir des services de niveau comparable à des taux d’imposition comparables. La formule qui détermine les versements tient compte de la forte disparité des capacités fiscales des provinces. Les auteurs du texte, Daniel Béland et André Lecours, démontrent que cette disparité varie considérablement selon la situation économique des régions du pays, provoquant souvent des tensions intergouvernementales.

À l’exemple de la Commonwealth Grants Commission australienne, ils proposent donc de créer une commission indépendante qui favoriserait la dépolitisation du processus en atténuant le rôle d’Ottawa comme seul arbitre des paiements. D’autant plus, ajoutent-ils, qu’« un nouveau gouvernement fédéral qui dit vouloir établir un nouveau type de relations avec les provinces pourrait offrir l’occasion de restructurer l’administration du programme de péréquation ».

Les auteurs examinent aussi l’intérêt de prendre en compte les besoins particuliers des provinces pour déterminer le niveau des paiements. Certaines subissent des pressions budgétaires considérables en matière de soins de santé étant donné le vieillissement plus rapide de leur population.

« Les Canadiens ont clairement besoin de mieux comprendre leur système de péréquation et nos choix politiques passés », concluent Béland et Lecours, pour qui la comparaison avec la situation d’autres pays serait une excellente façon d’améliorer la qualité du débat public.

On peut télécharger la publication Canada’s Equalization Policy in Comparative Perspective, de Daniel Béland et André Lecours, sur le site de l’Institut (irpp.org/fr).

-30-

L’Institut de recherche en politiques publiques est un organisme canadien indépendant, bilingue et sans but lucratif, basé à Montréal. Pour être tenu au courant de ses activités, veuillez vous abonner à son infolettre.

Renseignements : Alex Shadeed tél. : 514 815-3130 ashadeed@irpp.org

For all provinces, we must de-politicize equalization

Earlier this year, Saskatchewan Premier Brad Wall asked Ottawa to send back the money it contributed to equalization to help the struggling province through the downturn in energy prices. His remarks point to enduring political frustrations about the functioning of Canada’s current arrangement for territorial financial redistribution, which allocates more than $17-billion a year to provinces falling below the equalization standard.

Simultaneously, Alberta’s Wildrose Party formed a panel in February to examine the impact of equalization payments on the country. Its report, released last week, is highly critical of the program.

Although equalization is not up for a formal review until 2019, we argue in a recent study published by the Institute for Research on Public Policy that its governance structure should be re-examined to ensure it is administered in the fairest and most impartial way as possible.

To reduce the political heat, the federal government should consider the creation of an arm’s-length agency such as the Australian Commonwealth Grants Commission to make recommendations on equalization payments.

Since it was put in place in the early 1930s, the Australian model has contributed to the fairly low level of intergovernmental tensions around equalization in that country. While the strength of provincial governments and identities in Canada might mean a de-politicization of equalization similar to that of Australia will be difficult to reach, attenuating the federal government’s role as the sole arbiter on equalization can help us move in the right direction. In fact, such a reform would require Ottawa to loosen its reins on equalization and force the provinces to give up their federal whipping horse.

An arm’s-length agency administering equalization in Canada would receive its terms of reference from the federal government. After receiving input from the provincial governments, it would make a recommendation on equalization payments to the federal government, which would make the final decision. The arm’s-length agency would also make recommendations on adjustments to the formula and the program more generally. The agency could be headed by non-partisan, well-respected experts, preferably with links to different regions of the country, serving as commissioners. In Australia, the number of equalization commissioners is set at three and Canada could adopt this model or increase their number to five, with the aim of increasing the expertise level of the new arm’s-length agency. At the same time, like in Australia, commissioners would rely on the administrative and technical support of highly qualified staff hired directly by the agency using a merit system.

The creation of Canada’s equalization program in 1957 represented a milestone, not only because it established mechanisms to reduce disparities among the 10 provinces, but also because it would embed equalization in broader notions of solidarity and nationhood. The current governance arrangement may give citizens the impression that equalization is subject to the political vagaries of the federation and allows the program to be painted by some as a rigged welfare scheme, which is a complete distortion. Adopting governance structures that work to remove this impression of overt politicization of equalization could strengthen the program in the short and long term.

A new federal government that has signalled its willingness to develop a new type of relationship with the provinces might provide an opportunity to restructure how equalization is administered. Now that intergovernmental relations around equalization are quiet, this would be a good time to consider reform options that could help avoid the type of bickering that occurred during the Paul Martin and early Stephen Harper years.

Daniel Béland is the Canada Research Chair in Public Policy and a professor at the Johnson Shoyama Graduate School of Public Policy at University of Saskatchewan. André Lecours is a professor at the School of Political Studies at University of Ottawa.

Webinaire : Canada’s Equalization Policy In Comparative Perspective

Inscrite dans la Constitution, la péréquation est une question centrale dans la dynamique du fédéralisme canadien. Daniel Béland et André Lecours, auteurs d’une récente publication de l’IRPP sur le sujet, ont décrit les principes et les modalités de la péréquation et exposé les pressions budgétaires que subissent les provinces. À l’exemple de la Commonwealth Grants Commission australienne, ils ont proposé de créer une agence indépendante chargée de recommander le niveau des paiements.