Bilateral Health Agreements between the Federal and Provincial/Territorial Governments in Canada

- Au-delà du Transfert canadien en matière de santé, Ottawa entend consacrer 3 milliards de dollars sur les quatre prochaines années au financement de services cibles.

- Pour régir ce financement, Ottawa souhaite négocier des accords bilatéraux avec les provinces et territoires.

- S’ils sont bien conçus, ces accords pourraient favoriser l’innovation en matière d’élaboration de programme tout en respectant le principe fédéral.

It seems that the federal-provincial conflict over medicare and health care funding will never end. At a meeting in Toronto on October 18, 2016, Jane Philpott, the federal minister of health, clashed with her provincial and territorial (P/T) counterparts. P/T health ministers, consistent with their premiers and finance ministers, demanded that the federal government not allow the Canada Health Transfer (CHT) escalator to drop from 6 percent to 3 percent beginning in 2017-18 based on the timelines and formula established by the previous, Conservative government — at least until first ministers could first reach a long-term agreement on health system funding and sustainability.1

Before the meeting, Philpott reiterated her government’s election pledge to transfer $3 billion over the next four years above and beyond the CHT to improve home care, potentially through conditional bilateral agreements. P/T governments have responded negatively to the amount of money and the form in which it might come. This $3 billion is considerably less than the $60 billion provincial and territorial governments estimate they will lose over the next decade due to the decline in the CHT escalator. P/T governments are equally adamant in demanding that the level of funding of the CHT be adequate to relieve current pressures. Until this is resolved, they are not prepared to discuss boutique initiatives such as home care involving bilateral agreements.2

Both sides face pressures that have led to this impasse. From Ottawa’s perspective, more CHT money merely keeps the existing health system going without creating the kind of improvements it claims Canadians are demanding. At the same time, the Trudeau government — elected on an extensive policy platform of “real change” — wants to be seen as keeping its promise of $3 billion “to deliver more and better home care services for all Canadians” that “includes more access to high quality in-home caregivers, financial supports for family care, and, when necessary, palliative care.”3

Based on the constitutional division of powers, Ottawa must work with and through the provinces to deliver on this specific promise. 4 The problem here is that a $3-billion top-up to the CHT, which flows directly into the general revenue funds of P/T governments, would not provide the federal government with the policy accountability and visibility it desires to demonstrate that it is living up to its election platform.

The provinces and territories are already doing the heavy lifting — reforming their delivery systems, improving quality, increasing patient satisfaction, reducing waiting times and constraining costs, all the while burdened with deficits because of slowing or declining revenues.5 Health care remains their single largest program expenditure: in some cases, it represents more than 40 percent of total provincial expenditures. Most P/T governments are irritated at the thought that they should do something beyond what they are doing already in return for what they perceive as a minimal amount of additional federal funding.

Is the federal government’s tough position merely an early bargaining ploy, or does it mark the beginning of a shift in the way that Ottawa directs money for health care to the provinces? The purpose of this IRPP Insight is to examine bilateral health transfer agreements (HTAs) as a potential instrument. After reviewing the logic and history of bilateral HTAs, I discuss whether they are desirable from public policy and federalism standpoints. I then explore whether such a change is fiscally and politically feasible.

Why Bilateral Health Transfer Agreements?

If the federal government resorts to using bilateral agreements to expend the $3 billion it has promised, it will be a result of its frustration with the current state of affairs. Billions of dollars of tax revenues collected by the Government of Canada are transferred to provincial and territorial governments for health care, in return for which the P/T governments agree to uphold the five broad principles (formally known as “criteria”) in the Canada Health Act: public administration, comprehensiveness, universality, portability and accessibility for universal medicare.6

The CHT is the federal government’s single largest transfer — $34 billion compared to $17 billion for Equalization and $13 billion for the Canada Social Transfer (CST) in fiscal year 2015-16. Moreover, it has been the fastest growing of the three transfers since it was created in 2004. Only Old Age Security ($46 billion) — a transfer directly to Canadian citizens — exceeds the CHT. Moreover, in terms of dollars, the CHT exceeds the size of individual service programs delivered by the Government of Canada, including National Defence ($19 billion), the federal government’s single largest direct program expenditure in 2015-16.

The 2004 first ministers’ agreement, reached during Liberal Paul Martin’s brief term as prime minister, delivered the largest increases to health transfers. It came on the heels of federal health transfer increases in 1999, 2000 and 2003. It is true that these increases in aggregate could be seen as compensation for the constraints placed on health transfers since the 1980s, including the major cuts of 1995, when the Canada Health and Social Transfer was introduced. However, the agreement’s guarantee of a 6 percent annual escalator for the following decade provided considerable fiscal predictability and stability for provincial governments.

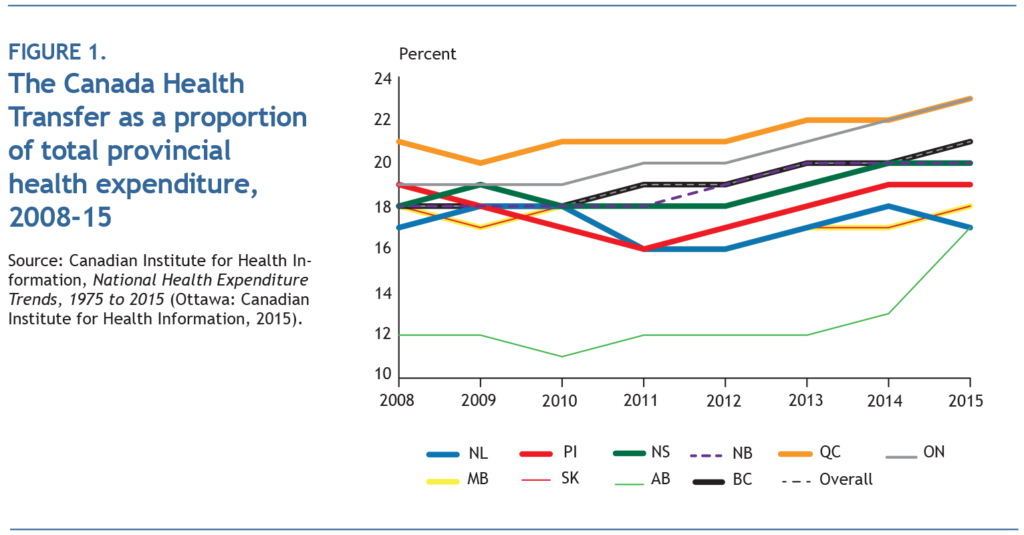

Toward the end of 2011, the Harper government decided that the escalator would be reduced to 3 percent beginning in 2017-18, and as that date approaches, P/T governments have made major efforts to get the Trudeau government to reconsider.7 They justify their position on the basis that the federal government’s relative contribution to provincial health spending is insufficient. However, the fact that the growth in provincial health expenditures has declined in recent years relative to the steady 6 percent growth in the CHT has resulted in a growing federal contribution to the provinces in aggregate since 2009, as illustrated in figure 1.

Although provincial premiers have argued that the CHT should actually be 25 percent of provincial health expenditures, this is based on an erroneous historical narrative. The historic bargain on cost-sharing during the 1950s and 1960s was based on federal sharing of provincial medicare spending. It was never intended to include all provincial health expenditures, an important point given that all provincial governments began to provide targeted subsidies and programs for home care, long-term care and prescription drugs by the 1970s and 1980s. If hospital and physician spending is used as a crude proxy for medicare, then the federal government is now contributing far more than its historic share of 25 percent when the 25 percent represented by the permanent tax transfer of 1977 is taken into account. At the same time, partly because of changes in health care needs and delivery, medicare represents a declining share of the current health care responsibilities of P/T governments.

The perception within the federal government, fortified by many external media, think tank and academic commentators, is that Ottawa has received precious little in terms of accountability and credit for CHT increases since the first ministers’ agreements on health in 2003 and 2004. More importantly, there is a strong belief that despite the “health system transformation” rhetoric of the Martin government at the time of the 10-Year Plan to Strengthen Health Care, the last decade of predictable, stable funding has produced meagre, even poor, results. This view is supported by the decline in Canadian health system performance as measured in the Commonwealth Fund’s international survey of high-income countries. Despite strident calls for major changes in the past two decades in various commissioned reports at the federal and provincial levels, the perception is that there has been little systemic health reform that would alter this downward trajectory.

Whether the dominant narrative in Ottawa is accurate or not, the point is that it has become the conventional wisdom among decision-makers in the federal government. There is a powerful desire to facilitate the improvement of health system performance so that this downward trend is reversed, to extract greater value for federal money, and to obtain a greater degree of accountability in order that both the federal government and the people of Canada know that public money is being used for positive change rather than to prop up a “failing” health system. It may turn out that 2016 is the year of discontent that finally pushes the federal government “back to the future” through the use of bilateral HTAs. Given this possibility, it may be useful to review the past experience with bilateral HTAs and then determine what policy lessons, if any, might be drawn from this history.

History of Transfers through Bilateral Agreements

From 1948 until 1961, the federal government administered the National Health Grants Program to fund 10 areas it deemed strategic for the future of Canada. This program’s bilateral HTAs funded hospital construction, public health, mental health, cancer control, public health services and research, professional training, and sexual disease control. As Prime Minister Mackenzie King stated at the inception of the program, these health grants represented “the first stages in the development of a comprehensive insurance plan for Canada.”8 In 1949, grants for provincial health surveys were added in order to: (1) ensure the effective use of the other health grants; (2) plan the extension of hospital utilization; and (3), most significantly, “plan the proper organization of hospital and medical care insurance.”9

In his major work on the origins of medicare in Canada,10 Malcolm Taylor concludes that it would not have been possible for provinces to implement universal hospital coverage under the framework of the Hospital Insurance and Diagnostic Services Act (HIDSA) from 1958 until 1961 without the groundwork provided by the national health grants. Taylor’s assertion was based largely on his personal experience as a health care advisor to provincial governments in Saskatchewan and Ontario during these years. The hospital construction grants encouraged the expansion and modernization of hospitals so that the increased demand triggered by universal access could be met. Without a doubt, the health survey grants allowed provincial governments to study the organization and management of their health systems in order to lay the groundwork for publicly financed hospital and medical care coverage. Regrettably, however, there has been no detailed historical examination of the program that would provide additional insight into the impact of the National Health Grants Program.

Bilateral HTAs also accompanied the establishment and maintenance of universal hospital coverage. These bilateral HTAs, subject to the legislative template set out in the HIDSA of 1957, required 50 percent cost-sharing across the board by -provincial governments. Although in theory, bilateral HTAs could be tailored to fit the -circumstances of individual provinces, the reality was that the HIDSA bilateral HTAs were almost all identical. The federal government intended these bilateral HTAs to create a contractual relationship between the two orders of government, since the HIDSA and its detailed regulations could not be directly enforced at the provincial level.11

This combination of legislation, detailed regulation and accountability through a bilateral HTA allowed the federal government to introduce a high degree of control through regular monitoring and surveillance. These agreements required provinces to “establish a hospitals planning division” within their governments that could “license, inspect and supervise hospitals” and “approve hospital budgets” as well as collect “prescribed statistics” and submit “required reports.”12 This regime relied on a significant amount of federal government surveillance with a veritable “‘army’ of federal civil servants charged with auditing provincial bills and repaying half” as well as on-site inspection of hospital beds in each province to determine eligibility for cost-sharing.13

While there has been no detailed scholarly study of specific health care objectives and outcomes obtained from this approach, it was effective in helping to establish universal hospital coverage in Canada. Of course, the approach also triggered significant opposition in Quebec. After the Lesage government was elected in 1960, the reform-oriented government made it clear that, while it was sympathetic to expanding universal medicare, it would never enter a similar shared-cost regime with detailed federal oversight. This position forced the Pearson government to take a very different approach when it encouraged provincial governments to add medical care to existing universal hospital coverage in the mid-1960s.14

A.W. Johnson, a senior finance official in the Pearson government tasked with negotiating the fiscal structure for the initiative with the provinces, came up with a novel solution — one that broke with the Department of Health and Welfare’s recommendation in favour of the HIDSA arrangement with accompanying bilateral agreements. To meet the demands of the Quebec government, Johnson suggested that provincial governments need not sign a bilateral agreement with Ottawa; “instead they would simply have to enact legislation which established a plan in conformity with the principles established by the Federal Government [through the Medical Care Act] after…consultation with the provinces.”15

As a consequence, the health transfer regime created for universal medical care coverage in the late 1960s differed in some important respects from the HIDSA regime established in the late 1950s. In particular, the requirement for bilateral agreements, which provided a legal basis for the detailed hospital inspections by federal civil servants, was removed.16 At the same time, federal auditors continued to check if -individual provinces spent their share of the federal contribution on eligible medical care and held back a portion of bilateral transfers to ensure provincial government compliance.

The two regimes — bilateral HTAs under the HIDSA and a multilateral approach under the Medical Care Act — operated side by side until they were replaced by a block transfer regime in 1977 that provided the provinces with greater flexibility through looser conditionality. By 1975, it was clear that the federal government no longer wanted the fiscal risk associated with cost-sharing health spending by the provinces. That year, federal finance minister John Turner introduced a budget that included cuts to medicare transfers and gave notice of Ottawa’s intention to terminate both the HIDSA and the Medical Care Act.

Facing a chorus of criticism from provincial governments and policy commentators, federal health minister Marc Lalonde stressed the importance of encouraging illness prevention and health promotion services — just a year before he had released his landmark report on the determinants of health — and the need to invest in health system change to reduce expensive and sometimes inappropriate hospital and physician care.17

This turned out to be the opening salvo in the federal-provincial negotiations that would produce block funding through Established Programs Financing (EPF). For their part, provincial governments were willing to give up some of the fiscal security associated with cost-sharing in return for less conditionality and greater flexibility in their health spending. Block funding for health care would continue after EPF morphed into the Canada Health and Social Transfer (1995) and the current Canada Health Transfer.

Bilateral HTAs were reintroduced decades later in a very different form. In 2000, as part of a first ministers’ agreement on health renewal and early childhood development, the federal government transferred approximately $560 million over six years on a per capita basis to P/T governments to support primary care innovation and reform. There were 13 bilateral agreements, one for each province and territory, as part of the Primary Health Care Transition Fund (PHCTF). Although there were multijurisdictional agreements with provincial and territorial governments as well as national-level agreements with nongovernmental organizations, the bilateral HTAs constituted the core of the fund. Each agreement was tailored to fit the primary care reform priorities, timelines and goals, as well as administrative capacities, of the individual jurisdiction. Although the bilateral HTAs under the PHCTF had a degree of conditionality concerning documentation and evaluation requirements, they did not include the federal surveillance (e.g. inspections) and enforceability mechanisms (e.g. cash holdbacks) under the HIDSA legal and regulatory regime.18 The first ministers’ health accords of 2003 and 2004 also involved earmarked health transfers beyond the block transfer, the most notable of which were the 5-year, $16-billion Health Reform Fund established in 2003 and the 10-year, $5.5-billion Wait Times Reduction Fund and Wait Times Reduction Transfer in 2004.19

These federal-P/T health accords also involved separate contribution agreements on health human resources, internationally educated health professionals and medical residencies involving considerably smaller amounts of money but adopting a similar approach to the PHCTF. Finally, the Patient Wait Times Guarantee Trust (PWTGT), introduced by the federal government in 2007, used bilateral agreements to flow $612 million to the provinces for up to three years. The purpose of the PWTGT was to encourage provincial governments to establish wait time guarantees for specific surgical procedures.20

Extracting Policy Lessons

So what policy lessons can be derived from this historical experience? Without a doubt, the introduction of a conditionalized health transfer regime can have a major impact on the direction of the health system. It is almost impossible to imagine the current Canadian medicare system — 13 provincial and territorial single-payer and single-tier universal coverage programs for hospital, diagnostic and medical care services operating under the five principles of the Canada Health Act — without the introduction of federal shared-cost financing.21 The question is whether subsequent changes to shared-cost financing triggered desirable changes to the Canadian health system and its performance.

Going back to 1975, when provinces were put on notice that the health transfer regime would be fundamentally altered, the federal government had two main objectives. In addition to reducing the fiscal risk inherent in a shared-cost -regime — one order of government spends and the other automatically picks up 50 percent of the tab — the federal minister of health wanted to see a rebalancing of resources from hospitals and doctors to home- and community-based care, prevention, and population health. The common perception, not only within the federal government but also among many health experts at the time, was that shared-cost financing had pushed provincial governments into concentrating fiscal and human resources on hospitals and doctors.

This would certainly have been the case for hospital services deemed eligible for funding under the HIDSA and the accompanying federal-provincial -bilateral agreements as the number of hospital beds in each province was carefully -monitored through provincial government data collection and federal government inspection. Indeed, the introduction of this shared-cost regime gave provinces considerable incentive to shut down beds in provincial mental hospitals (deemed ineligible for federal cost-sharing) and transfer patients to psychiatric wings of hospitals, which were deemed eligible hospital expenditures.22

However, did the introduction of a block transfer regime trigger a rebalancing of provincial resources from hospital care and physician care to less expensive and potentially more appropriate health care or more upstream illness-preventing interventions? The short answer is we do not know. There was certainly a correlation between the decline in the proportion of core medicare spending relative to nonmedicare spending in Canada after EPF was introduced — a trend that has continued to the present. However, it is impossible to know whether block transfer funding caused this trend or whether the trend would have occurred, and to the same extent, even in the absence of a switch to block funding. The fact that other health services have grown in importance relative to hospital and physician care may be more due to changes in technology, lifestyles, demographic structure and provincial policies that eased -access to home care, community care and prescription drug therapies. Of course, these provincial policies may have been encouraged by the flexibility offered through block funding but, again, there is a paucity of evidence on the linkage between the two.

In summary, it is difficult to draw definitive policy conclusions concerning the effectiveness of one health transfer regime as opposed to another in terms of health outcomes or health system performance. In no case was ongoing rigorous and independent evaluation built into the transfer instrument. The creation of the Health Council of Canada in 2003 was an effort to evaluate health outcomes accompanying the federal government’s investment in the first ministers’ health accords and the return on the investment in federal transfers in 2003 and 2004. However, the Health Council’s post facto and largely negative assessment of the return on investment in federal transfers was (through no fault of its own) based on limited analysis and information.23 In any case, since bilateral HTAs were not part of the transfers established in 2003 and 2004, little can be deduced about the health policy effectiveness of bilateral HTAs based on the Health Council’s study.

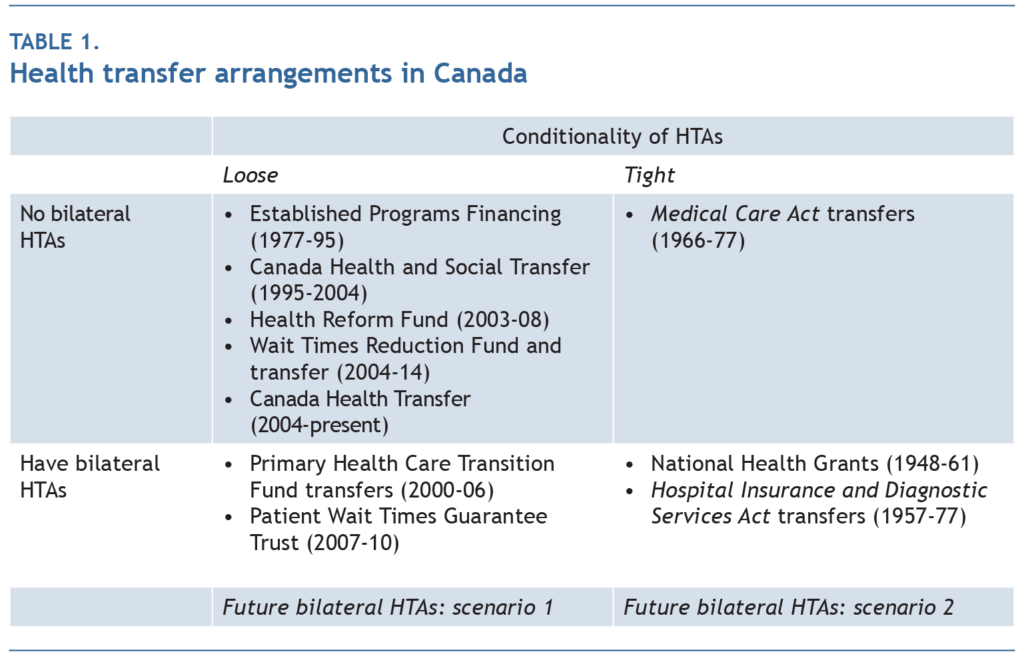

While there is limited evidence of the impact of a particular health transfer regime on health system performance, from the federal government’s perspective, each regime can be evaluated in terms of what we might call process criteria. The first is accountability: the way in which the P/T government is held accountable to the federal government for achieving a given set of objectives. In particular, will the P/T government be held directly accountable through a bilateral HTA, or will there be a looser form of accountability through public promises or first minister communiqués, both of which are non-enforceable? Table 1 identifies four categories of health transfers in Canada based on the existence (or not) of bilateral HTAs and the degree of conditionality accompanying a given health transfer instrument.

The second process criterion is conditionality: the extent to which a transfer is accompanied by conditions that reflect pan-Canadian objectives, whether determined by the federal government unilaterally or determined by an intergovernmental bargaining process such as a First Ministers’ Conference.

Most of the recent health transfer arrangements lie in the upper-left-hand quadrant of table 1 — a combination of no bilateral HTAs and loose conditionality. The exception to this is in the bilateral agreements under the Primary Health Care Transition Fund and the Patient Wait Times Guarantee Trust, in the lower left-hand quandrant of table 1. Unless the cash is considered small relative to the main block transfer, a bilateral HTA is likely to incur active opposition to federal intervention in a provincial jurisdiction. In the case of the PHCTF and the PWTGT, there was little or no active opposition because the cash amount was marginal relative to the main block transfer. A more speculative reason is the acceptable nature of the conditionality that accompanied the bilateral HTAs signed as part of the PHCTF and the PWTGT.

Desirability of Bilateral Health Transfer Agreements

The context in which the PHCTF was created in 2000 bears some resemblance to the situation today. The federal government has indicated it wants any money -additional to the CHT to be used in a way that will facilitate reform and innovation. The CHT (like the Canada Health and Social Transfer in 2000) will continue to be the main transfer instrument, and only a marginal amount of money beyond what is required under the current CHT formula will potentially be funnelled through a different transfer mechanism. If it is made clear that under no circumstances will further money be available except through a bilateral HTA, then provincial governments may grudgingly but quietly accept the arrangement, especially if there is limited conditionality attached to the HTAs. In table 1, this is scenario 1.

However, if the federal government wants clear objectives written into the bilateral HTAs — either as agreed to at a first ministers’ meeting or as unilaterally established by Ottawa — then this becomes scenario 2. The advantage of this scenario is that it can provide more clarity on objectives and greater transparency on the flow of funds, particular if it involves cost-sharing. This instrument allows the federal government to monitor the flow of funds into the targeted health reform. While this may be its greatest advantage from the perspective of the federal government, it may also be its greatest disadvantage from a provincial perspective, in that it is likely to “distort” what would otherwise be the spending priorities of a government that is closer than the federal government to the population it serves.

When dealing with such unavoidable trade-offs, it may be best to speak in terms of finding an appropriate balance between competing objectives. Although block transfers such as the CHT might not distort provincial spending decisions, they provide poor accountability between orders of government and little to no incentive for hard, but nonetheless joint (federal-provincial), targeting of priorities. In contrast, special purpose transfers — when they are limited in size and combined with bilateral agreements — offer a number of advantages.

For example, bilateral HTAs create a venue for accountability between orders of government. However, the extent and practical utility of this accountability is determined by a number of factors, including:

- the nature and degree of oversight;

- the enforceable sanctions set out in the agreement;

- the clarity and effectiveness of dispute resolution mechanisms in the event of perceived noncompliance by either party; and

- the amount of information sharing and transparency afforded to the parties through the agreement.

In keeping with basic federalist principles, bilateral HTAs should be voluntary for both parties. In the case where priorities are set by the federal government, bilateral agreements allow provincial governments not to opt in if they disagree — an option with far fewer fiscal consequences for a special purpose transfer that is substantially smaller than the general purpose CHT transfer. In the case where priorities are jointly set through some federal-P/T consensus, it still allows a provincial government to stand aside if it disagrees with any aspect of the majority decision.

A further advantage is that bilateral HTAs permit a degree of provincial flexibility. An agreement can be tailored to a given provincial government’s needs and policy priorities. Although this was not how the bilateral agreements under the HIDSA were constructed in the late 1950s and early 1960s, this was the approach used in the PHCTF transfers of the early 2000s. This flexibility comes at a cost to the federal government in terms of negotiating time since each agreement is unique and therefore can take considerable effort to finalize. In addition, this approach contains the risk that the unique features of one agreement — assuming the content were made public — could become a precedent and insisted-upon in subsequently negotiated bilateral agreements.

However, there are clear advantages to provincial governments in being able to tailor the agreements to their own unique circumstances and to fit their policy ambitions. In this way, bilateral HTAs allow for the possibility of a series of natural experiments in health policy and programs. One of the lauded advantages of a federation is the latitude to experiment at a level below the central government so that the cost of policy failure is minimized for the country as a whole, and progress is made through the imitation of a successful jurisdiction. It is interesting in this respect to see how Saskatchewan used the National Health Grants to assist its experiment in universal hospital coverage and lay the groundwork for universal medical care coverage.24 At the same time, Alberta had established a rival multipayer, multitier system of public hospital insurance, which all other governments were able to observe. Ultimately, the Saskatchewan model was deemed the successful innovation and, with the help of federal cost-sharing and standard setting, replicated in the rest of the country.25

These are the conceptual and historical advantages and disadvantages of an approach using bilateral HTAs. However, they must be put into the context of current reality to determine the actual fiscal and political feasibility of such an instrument, the subject of the next section.

Fiscal and Political Feasibility

Theoretically, the short-term fiscal impact of transferring any health money to the P/T governments (above and beyond the current CHT formula) is the same whether it is done through a temporary CHT top-up or a separate set of bilateral HTAs. In practice, however, not every provincial government and territorial government will necessarily sign a bilateral agreement. This would leave at least some money on the table that could potentially be returned to the federal treasury.

Of course, some premiers will argue for the right to opt out of the bilateral HTAs — with financial compensation. However, agreeing to this would set a precedent and effectively remove any incentive for provincial governments to invest the time and resources to negotiate a bilateral HTA and accept any degree of conditionality that would be part of such an agreement. Of course, the key to the legitimacy of any opting-in arrangement is for the federal government to be able to effectively reject any claims, based on intergovernmental history, that this is money to which provinces are otherwise entitled.

Provincial governments may argue that they were forced into the bilateral agreements in order to get health funding required for ongoing (status quo) operation rather than innovation or reform. However, the reality is that the main funding for medicare, which also enables the enforcement of the Canada Health Act, is provided through the CHT, and a 3 percent annual escalator is more than sufficient to keep up with the recent growth rate in P/T health expenditures.

Although short-term fiscal feasibility is simple to address, the question of the medium- and long-term fiscal feasibility of bilateral HTAs depends on a number of factors. The first is the time span. This will depend on the time required to establish the changes stipulated in the agreement and the health reform ambitions of the federal government. To reduce its fiscal risk and some of the time and uncertainty involved in negotiating up to 13 separate bilateral agreements, the federal government may want to insist on a common period for all agreements, a set maximum for the federal financial contribution and a common expected level of provincial cost-sharing.

For example, if all agreements had to conform to a 50-50 cost share within a fixed federal program envelope over five years, this would limit risk for the federal government. While such framework conditions would reduce provincial flexibility, some general guidelines will be essential to ensure that bilateral negotiations focus on the substance of the health innovations or reforms targeted rather than timelines or money in terms of respective contribution rates. In any event, the budgeting process would require the federal government to set aside sufficient funds to meet its potential fiscal commitments, and these would have to be known in advance — something that a defined fiscal maximum and a defined cost-sharing formula would provide.

As for timelines, the federal government would want as short a period as possible to implement the health reform. Provincial governments would want as long a period as possible and would perhaps want to see the federal contribution become permanent in order to help meet ongoing operating expenses. The federal government could argue that it will consider permanent funding only in cases where a provincial reform shows such promise that the federal government is willing to set up a new national cost-share transfer to encourage other provinces to adopt the reform.

The political feasibility of this approach is difficult to determine. While all P/T governments would no doubt prefer any new federal money to be provided as a top-up to the CHT, because that would give each jurisdiction maximum flexibility with minimal accountability, if this option were taken off the table, then some, perhaps a majority of, P/T governments would probably be willing to negotiate bilateral HTAs. This would occur even if the premiers initially committed themselves, as they have recently, to a position in which they refuse to consider bilateral transfer agreements until the federal government agrees to a top-up to the CHT or the temporary extension of the 6 percent CHT escalator, or at least some bridging escalator above 3 percent.

This might not be true of at least one jurisdiction. Governments in Quebec have long opposed federal government “intrusion” into areas of social policy and programs, including health programs such as medicare. Historically, Quebec has exercised its right not to opt in to pan-Canadian programs, even where it has come at some cost to the province. In other cases, it has demanded the right to opt out with financial compensation, including the receipt of tax transfer points instead of cash from the federal treasury. In the case of pensions, a more innovative solution was found in which the Quebec Pension Plan was established side by side with the Canada Pension Plan. These examples of asymmetric federalism, the result of a nation-building enterprise within Quebec,26 have had a profound impact on the political and intergovernmental culture of Canada.27

Despite its opposition to federal involvement in health care, Quebec did ultimately accept cost-sharing under the HIDSA and a bilateral agreement with Ottawa on universal hospital coverage. However, as discussed above, this approach was rejected after 1960 and the Quiet Revolution. In the formative evolution of medicare, however, developments were more symmetric. Quebec grudgingly accepted the federal medicare bargain on the same terms and conditions as other provinces. More recently, the Quebec government did agree to bilateral HTAs under the PHCTF. Beyond the fact that the money involved was small compared to the health block transfer, the PHCTF offered the Quebec government the opportunity to shape the purpose of the transfer to comply with its existing reform initiatives, in particular the establishment and support of family medicine groups. A similar approach, even if accompanied by greater conditionality in terms of reporting indicator data based on a commonly agreed-upon performance measurement framework, may be grudgingly acceded to even if initially opposed.

Conclusion: What Is the Likelihood of Bilateral Health Transfer Agreements?

Whether the federal government will actually pursue bilateral HTAs depends on its willingness to accept some degree of provincial opposition to increased accountability and conditionality. Since we are only talking about a marginal amount of money, at least relative to the enormous amount of money already committed to the provinces through the CHT, this can serve to reduce provincial opposition.

The outcome also depends on the health policy ambitions of the current federal government. If the Trudeau government is convinced that it can play a leading role in reversing sagging health system performance throughout Canada, as suggested recently by the Advisory Panel on Healthcare Innovation, then properly designed bilateral HTAs could potentially encourage the kind of difficult innovation that might change currently negative trends.28 Similarly, if the federal government wants to focus on one area of health reform, it could use bilateral HTAs and 50-50 cost-sharing to get provincial governments to invest money that would otherwise be used for other purposes, while still allowing considerable experimentation in terms of design, and see what emerges as a better approach.

Bilateral HTAs could work in carefully defined areas where reform can be levered at relatively low cost. These areas might include, for example, “medically necessary” home care services as narrowly delineated in the Romanow report in 2002.29 Or bilateral HTAs could lever reform in distinct areas of light and intermediate home care or even possibly for aspects of complex long-term care, two areas for federal intervention identified by Harvey Lazar.30 This is not likely to be an -approach that would work for more expensive and time-consuming reforms such as national pharmacare.

So given all this, what is the likelihood that the federal government will actually direct all of the $3 billion in additional health funding through bilateral HTAs? I think there are three key factors that will determine the answer to this question: the desire of the Trudeau government to see bold health policy experimentation at the provincial level; the extent to which the Trudeau government is truly concerned about accountability and insists this be reflected in each HTA; and the amount of political capital it is willing to expend to see this through.

Of course, money can sometimes buy change. If the federal government were willing to reduce the pain of the CHT escalator drop by bridging the difference — let’s say by setting the escalator to 4.5 percent for 2017-18 — then this transitional funding might encourage most provinces to agree to bilateral HTAs. However, this would be a difficult decision for a federal government facing a very large deficit and a plethora of expensive election promises it is still expected to implement during its first term of office.

- “Finance and Health Ministers Seek Funding Partnership with the Federal Government,” communiqué from Conference of Provincial-Territorial Ministers of Health, Toronto, October 17, 2016.

- G. Galloway and K. Grant, “Philpott, Provinces Hit Impasse over Health Funding,” Globe and Mail, October 18, 2016. https://www.theglobeandmail.com/news/politics/philpott-provinces-hit-impasse-over-health-funding/article32434450/.

- Liberal Party of Canada, Real Change: A New Plan for a Strong Middle Class (Ottawa: Liberal Party of Canada, 2015), 9.

- Although this paper is not focused on the issue of the federal-provincial division of powers in health care and the constitutional legitimacy of the federal spending power, note that provincial governments hold the primary responsibility for health care (the list of provincial responsibilities in the Constitution Act, 1867 includes hospitals) but do not have exclusive jurisdiction. Moreover, the ability of the federal government to use its spending power in areas of provincial jurisdiction has been upheld by the Supreme Court of Canada.

- For example, the Atlantic provinces are under pressure because of an aging population. A new study concludes that without a significant boost in funding, the region’s health care system could collapse under the strain within a decade; see R. Saillant, A Tale of Two Countries (Halifax: Nimbus, 2016).

- G.P. Marchildon, “The Three Dimensions of Universal Medicare in Canada,” Canadian Public Administration 57, no. 3 (2006): 362-82.

- G.P. Marchildon and H. Mou, “The Conservative 10-Year Canada Health Transfer Plan: Another Fix for a Generation?” in How Ottawa Spends: The Harper Government: Mid-Term Blues and Long-Term Plans, ed. C. Stoney and G.B. Doern (Montreal: McGill-Queen’s University Press, 2013), 47-63.

- M.G. Taylor, Health Insurance and Canadian Public Policy: The Seven Decisions That Created the Canadian Health Insurance System (Montreal: McGill-Queen’s University Press, 1978), 164.

- Taylor, Health Insurance and Canadian Public Policy, 163-4.

- Taylor, Health Insurance and Canadian Public Policy.

- This dimension is barely referred to by Taylor in his discussion of the implementation of the HIDSA in Health Insurance and Canadian Public Policy.

- I found a template agreement, dated December 4, 1957, “respecting contributions under The Hospital Insurance and Diagnostic Services Act” in the British Columbia Archives, GR 68, Box 14, File 20 (Federal-Provincial Health Program); and a draft agreement, dated June 30, 1958, between the Government of Canada and the Government of Saskatchewan in the Saskatchewan Archives Board (Regina), R33.1, 562 (National Hospitalization).

- M. Bégin, Medicare: Canada’s Right to Health (Montreal: Optimum, 1988), 66.

- T. Kent, A Public Purpose (Montreal: McGill-Queen’s University Press, 1988), 366-9.

- A.W. Johnson, quoted in P.E. Bryden, “The Liberal Party and the Achievement of National Medicare,” in Making Medicare: New Perspectives on the History of Medicare in Canada, ed. G.P. Marchildon (Toronto: University of Toronto Press, 2012), 81.

- The shared-cost formula was changed so that each province’s share was now calculated on the provincial per capita share of pan-Canadian provincial government health spending.

- Canadian Museum of History, Making Medicare: The History of Health Care in Canada, 1914-2007 (Ottawa: Canadian Museum of History, 2010), https://www.historymuseum.ca/cmc/exhibitions/hist/medicare/medic-6h07e.shtml

- This is a personal judgment based on what appears to have been limited contract oversight, very general assessment of outcomes and limited information on contract performance in the final report: Health Canada, Primary Health Care Transition Fund: Evaluation and Evidence (Ottawa: Health Canada, 2007).

- The transfer amounts are based on Finance Canada information accessed October 30, 2016, https://www.fin.gc.ca/fedprov/fihc-ifass-eng.asp.

- S. Norris, The Wait Times Issue and the Patient Wait Times Guarantee (Ottawa: Parliamentary Information and Research Service, Library of Parliament, 2009). Based on the text of one such bilateral agreement between the Government of Canada and the Government of Saskatchewan dated March 28, 2007, for a wait time guarantee on coronary artery bypass graft, the Saskatchewan government was entitled to receive its provincial share ($27 million) of the $612 million federal trust fund in return for setting a wait time guarantee of 2 weeks for Level I patients, 6 weeks for Level II patients and 26 weeks for Level III patients by 2010.

- Marchildon, “The Three Dimensions of Universal Medicare in Canada.”

- G.P. Marchildon, “A House Divided: Deinstitutionalization, Medicare and the Canadian Mental Health Association in Saskatchewan, 1944-1964,” Histoire Sociale/Social History 44, no. 88 (2011): 305-29. However, it should be kept in mind that the potential incentive effect of a pure cost-sharing formula was dulled somewhat by the precise HIDSA formula in which only 25 percent of the federal contribution was based on the individual province’s eligible hospital and diagnostic services expenditures and 25 percent based on its per capita share of total provincial spending.

- Health Council of Canada, Better Health, Better Care, Better Value for All: Refocusing Health Care Reforms in Canada (Toronto: Health Council of Canada, 2013).

- A.W. Johnson, Dream No Little Dreams: A Biography of the Douglas Government of Saskatchewan, 1944-1961 (Toronto: University of Toronto Press, 2004), 311-35.

- G.P. Marchildon, “Canadian Medicare: Why History Matters,” in Making Medicare: New Perspectives on the History of Medicare, ed. G.P. Marchildon (Toronto: University of Toronto Press, 2012), 3-18.

- D. Béland and A. Lecours, “Sub-state Nationalism and the Welfare State: Quebec and Canadian Federalism,” Nations and Nationalism 12, no. 1 (2006): 77-96.

- F. Rocher and P. Fafard, “Is There a Political Culture of Federalism in Canada? Charting an Unexplored Territory,” in The Global Promise of Federalism, ed. G. Skogstad, M. Papillon, D. Cameron, and K. Banting (Toronto: University of Toronto Press, 2013), 87-122; J. Smith. The Case for Asymmetry in Canadian Federalism (Kingston, ON: Institute for Intergovernmental Relations, Queen’s University, 2005).

- Advisory Panel on Healthcare Innovation, Unleashing Innovation: Excellent Healthcare for Canada — Report of the Advisory Panel on Healthcare Innovation (Ottawa: Health Canada, 2015).

- R. Romanow, Building on Values: The Future of Health Care in Canada (Ottawa: Commission on the Future of Health Care in Canada, 2002), 177-88, 325-30.

- H. Lazar, Many Degrees of Policy Freedom: The Federal Government’s Role for Seniors, IRPP Study 24 (Montreal: Institute for Research in Public Policy, 2011).

About the author

Gregory Marchildon holds the Ontario Research Chair in Health Policy and System Design at the Institute of Health Policy, Management and Evaluation at the University of Toronto. He is a professor in the School of Public Policy and Governance, University of Toronto, and the author of many books and peer-reviewed journal articles. He was a deputy minister in the Saskatchewan government in the 1990s and executive director of the Royal Commission on the Future of Health Care in Canada in 2001-02.

Soins de santé : des accords bilatéraux pourraient stimuler l’innovation et améliorer la performance du système canadien

Montréal – Des accords de transfert bien conçus entre Ottawa et les provinces pourraient stimuler l’innovation et améliorer la performance d’ensemble du système de santé canadien, selon une nouvelle publication de l’Institut de recherche en politiques publiques.

Outre le Transfert canadien en matière de santé (la subvention globale qu’Ottawa verse chaque année aux provinces), le gouvernement fédéral entend accorder 3 milliards de dollars au cours des quatre prochaines années pour le financement de services cibles, notamment les soins à domicile, par l’entremise d’accords bilatéraux.

« Si le gouvernement Trudeau conclut à la nécessité de jouer un rôle central pour améliorer la maigre performance du système de santé, observe Gregory Marchildon (Université de Toronto), des accords bilatéraux judicieusement conçus pourraient favoriser l’adoption des mesures innovantes qui permettraient d’inverser la tendance actuelle. »

Parmi leurs avantages, l’auteur note que ces accords pourraient être élaborés en fonction des besoins particuliers des provinces. Ainsi, certaines d’entre elles ont l’intention de privilégier les soins aux personnes atteintes de démence, un trouble lié au vieillissement de la population.

Ces accords offriraient aussi une plus grande liberté d’expérimentation : « La Saskatchewan, par exemple, avait jeté les bases de l’assurance maladie universelle en utilisant les subventions nationales à la santé pour mener son projet d’assurance hospitalisation. » Créées en 1948 et administrées par Ottawa, ces subventions avaient pour but d’aider les provinces à financer des services de santé publique et la construction d’hôpitaux.

Pour l’instant, le débat sur d’éventuels accords bilatéraux se heurte au mécontentement des provinces opposées à la diminution de la progression des transferts fédéraux, qui passeront de 6 à 3 p. 100 en avril prochain, comme l’avait décidé le gouvernement Harper. « Pourtant, estime Marchildon, une hausse annuelle de 3 p. 100 suffit amplement à faire face au taux de croissance des dépenses de santé provinciales et territoriales. »

On peut télécharger sans frais la publication Bilateral Health Agreements between the Federal and Provincial/Territorial Governments in Canada, de Gregory Marchildon, sur le site de l’IRPP (irpp.org/fr).

-30-

L’Institut de recherche en politiques publiques est un organisme canadien indépendant, bilingue et sans but lucratif, basé à Montréal. Pour être tenu au courant de ses activités, veuillez vous abonner à son infolettre.

Renseignements : Shirley Cardenas tél. : 514 594-6877 scardenas@irpp.org

Webinaire : Bilateral Health Agreements between the Federal and Provincial/Territorial Governments in Canada

Outre le financement accordé aux provinces et territoires dans le cadre du Transfert canadien en matière de santé, Ottawa a annoncé qu’il leur verserait 3 milliards de dollars sur une période de quatre ans pour répondre à certains besoins précis, notamment en soins à domicile et en santé mentale. Ces fonds supplémentaires seront régis par des accords à négocier avec chaque gouvernement provincial et territorial. Gregory Marchildon, qui a publié un texte IRPP Insight sur la question, analyse les avantages et inconvénients de tels accords bilatéraux, mais aussi leur faisabilité politique et budgétaire.