Carbon Pricing and Intergovernmental Relations in Canada

- Le plan national de tarification du carbone annoncé en octobre 2016 témoigne du leadership d’Ottawa en matière de réduction des émissions de GES et de respect des engagements internationaux du pays.

- Ce plan est d’une flexibilité suffisante pour convenir aux provinces qui ont mis en place un marché du carbone ou une taxe sur le carbone, mais aussi à celles qui n’ont pas encore adopté une politique climatique.

- À l’instar d’autres domaines de politiques publiques, les processus intergouvernementaux permettent de coordonner la mise en œuvre du plan en tenant compte des différentes économies et situations des provinces.

In October 2016, Prime Minister Justin Trudeau announced a national carbon pricing plan for Canada and reaffirmed Canada’s commitment to reduce emissions by 30 percent below 2005 levels by 2030. Provincial and territorial governments have two years to implement either a cap-and-trade program or a carbon tax in line with the federal minimum price; otherwise, the federal government will impose a carbon tax in that jurisdiction, returning to the province all revenues collected within its borders. Other features include a carbon price floor that rises over time for carbon tax provinces and a requirement of declining annual caps in provinces that have adopted a cap-and-trade system.

The announcement was almost a year in the making. Trudeau campaigned in the 2015 federal election on promises to establish national greenhouse gas (GHG) emissions reduction targets in cooperation with the provinces and territories, and to institute a carbon pricing regime.1 He then committed Canada to aggressive action at the UN climate change meetings in Paris in December 2015. Riding on a wave of international acclaim, the federal government spent the ensuing months engaging with the provinces and territories to develop a national carbon pricing plan. Although other outcomes were possible, Ottawa’s decision to take unilateral action took many by surprise.

In this paper we first evaluate the federal government’s national carbon pricing plan in terms of its potential for balancing the economic efficiency gains from greater carbon price harmonization and its scope for providing flexibility for provinces’ diverse circumstances. Second, we look at intergovernmental coordination in other policy fields in Canada, specifically income taxes, goods and services taxes, and environmental standards. A comparative exercise of this kind should shed light on how to structure intergovernmental coordination and allow it to evolve over time to deliver more efficient and effective carbon pricing.

We conclude that a more “directive” approach by the federal government was needed both to jump-start the process of intergovernmental coordination on carbon pricing and to ensure effective coordination during implementation. As our case studies show, such an approach is particularly useful in circumstances where provincial policies are well established and there are significant economic and political differences across provinces — as is the case with carbon pricing. The federal government’s new carbon pricing plan affords provinces considerable flexibility in its implementation, in accordance with intergovernmental practice in other policy settings. This flexibility means that carbon prices will continue to diverge and emissions reductions will not be cost-effective within Canada. Fortunately, intergovernmental coordination and associated outcomes can and do change over time. Our case studies offer ways to identify viable paths for addressing the tension between flexibility and cost-effectiveness and for improving carbon pricing outcomes in Canada.

Carbon Pricing Systems: Objectives and Conditions for Success

Carbon pricing is an important tool in the policy-maker’s toolkit for reducing GHG emissions. A price on carbon can be implemented using either a carbon tax or a cap-and-trade system.2 A carbon tax imposes a fixed charge per tonne of GHG emitted; under a cap-and-trade or emissions trading system, the government sets a cap on annual GHG emissions and issues permits equal to that cap. Permits can be traded among those covered by the system, creating a market and a price for emissions permits.

Carbon pricing is appealing because it provides financial incentives to reduce emissions, but gives emitters the flexibility to choose the options that minimize the costs of doing so.3 Emitters can reduce emissions by lowering output, changing production technologies or switching fuels; alternatively, emitters can choose to pay the carbon tax or buy emissions permits to cover emissions, if that is the lowest-cost option.

We define a successful carbon pricing system for Canada as one that (1) ensures the federal government’s target of reducing emissions to 30 percent below 2005 levels by 2030 is reached; and (2) achieves emissions reductions in a cost-effective manner. Box 1 outlines four conditions necessary for success.

Carbon Pricing before the October 2016 Announcement

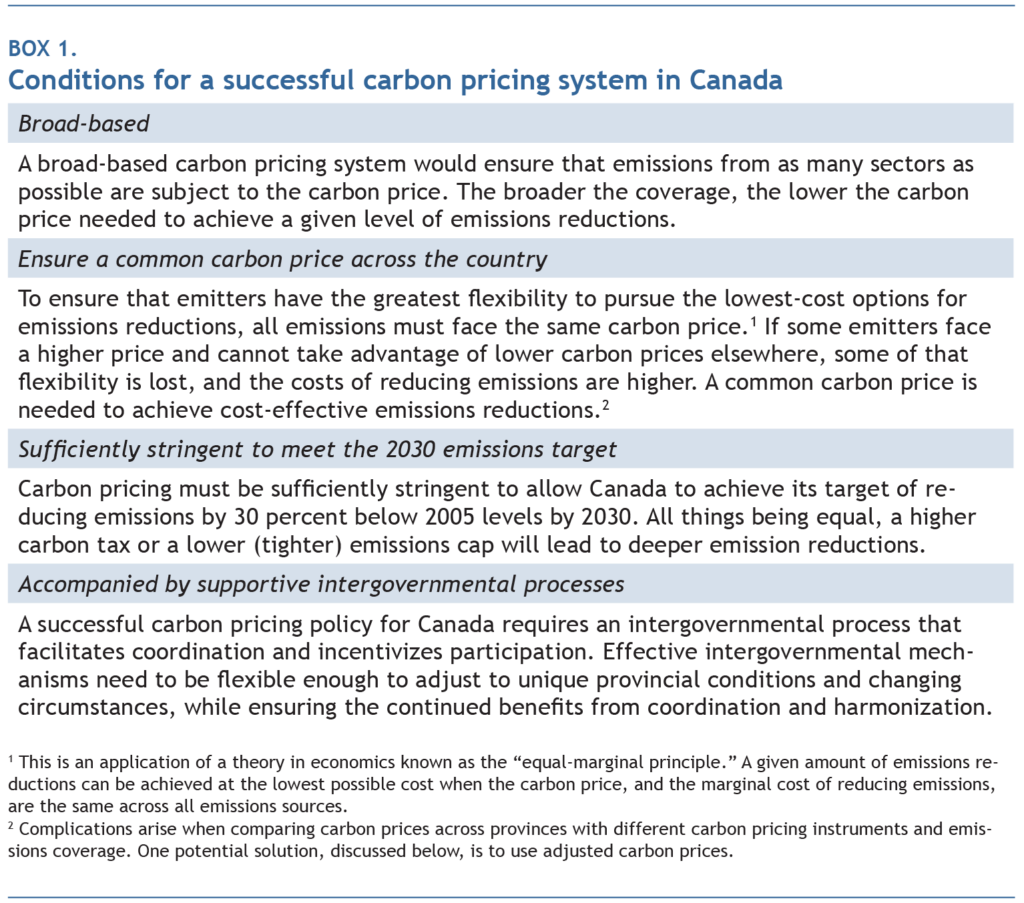

As of October 2016, three provinces — British Columbia, Alberta and Quebec — had implemented carbon pricing; a fourth, Ontario, was set to launch a pricing system in 2017 (table 1). Manitoba had intended to join the Western Climate -Initiative, along with Quebec and Ontario, and to implement a cap-and-trade program, but the defeat of the provincial New Democratic Party government earlier this year suspended these plans. Saskatchewan is focused on carbon-capture-and-storage technology development, and Nova Scotia is using a regulatory approach to reduce emissions from coal-fired electricity generation. The territories have argued against a carbon tax, and the Atlantic provinces have not announced any concrete carbon pricing plans. At the national level, prior to the recent announcement, no carbon pricing policy was in place. Table 1 summarizes Canada’s current carbon pricing landscape, highlighting emissions reduction targets, choice of carbon pricing instrument, carbon prices and revenue recycling options.

British Columbia

British Columbia implemented its carbon tax in 2008 at an initial rate of $10 a tonne of GHG emitted. The tax rate increased annually over the next five years to $30 a tonne, where it remains. On many occasions over the past five years, the province has reaffirmed its commitment to hold the carbon tax at the current rate, with a view to letting the other provinces catch up.4 The tax is broad-based, covering about 70 percent of emissions in the province. Of the share not covered, roughly 10 percent comes from non-energy-use agriculture and landfills, 10 percent from fugitive emissions, and the remainder from other sources.5

The province has also introduced emissions “intensity” — emissions per unit of output — targets for liquefied natural gas (LNG) facilities to encourage the development of a clean LNG industry. The targets are ambitious, in light of existing and emerging technology for powering the energy-intensive liquefaction process. In the likely case that the intensity targets are not met, new facilities will be required to purchase BC-based offsets or make contributions to a technology fund. However, the BC government has introduced an incentive program that would pay for 50 to 100 percent of those costs for facilities that are close to the benchmarks.6 LNG facilities are also liable for the $30 per tonne carbon tax, although there has been some speculation that the province might grant this sector an exemption. Following a lengthy environmental review process, the federal government in October 2016 approved the Pacific North West LNG project in British Columbia. The approval came with 190 conditions, including a hard cap on carbon emissions from the facility and a further reduction in emissions intensity if a third liquefaction unit is added. Given current market conditions for oil and gas, there is still considerable uncertainty about whether the project will actually go forward.

British Columbia’s carbon tax is revenue neutral: revenues generated by the tax must be offset by tax rate reductions elsewhere in the system.

Alberta

Alberta was one of the first provinces to implement carbon pricing, introducing its Specified Gas Emitters Regulation (SGER) system in 2007. Facilities with emissions equal to or above 100,000 tonnes were required to reduce their emissions intensity by 12 percent. Emitters were then assigned emissions rights equal to 88 percent of their baseline production. A facility with emissions in excess of its emissions rights could purchase Alberta-based offsets, make contributions to a technology fund at a rate of $15 per tonne or buy emissions rights from a facility that had a surplus — in other words, that had achieved more emissions reductions than required.7 The SGER system applies to about 50 percent of Alberta’s emissions, the bulk of which are associated with oil sands production and electricity generation.8

Certain initial design features, such as the offset provisions, limited the policy’s effectiveness. The option to make contributions to a technology fund essentially capped the carbon price at the specified contribution rate of $15, since facilities were unlikely to pursue compliance options that cost more than this. In 2015, the province announced a new climate plan featuring a broad-based carbon levy on transportation and heating fuels (diesel, gasoline and natural gas), an annual cap on oil sands emissions, and a phaseout of coal-fired electricity. Coverage under the new plan will expand to 78 to 90 percent of emissions. Large industrial emitters will continue to be covered by the SGER system until the end of 2017. The technology fund contribution rate has increased to $20 per tonne for 2016 and $30 for 2017. In the case of transportation and heating fuels, the carbon tax is paid on all emissions, as is the case with British Columbia’s carbon tax. In contrast, for emissions covered under the SGER, the carbon price — that is, the technology fund contribution rate — is paid only on emissions in excess of the facility’s emissions rights.

In 2018, the SGER is set to be replaced by a new system, under which facilities in trade-exposed sectors such as oil and gas, cement, and petrochemicals will face sector-specific performance benchmarks. Facilities with emissions in excess of the benchmarks will be able to meet their compliance obligations by paying the carbon levy, buying Alberta-based offsets or purchasing emissions performance credits from facilities with surplus credits (and emissions below the benchmark).

Finally, the Alberta government intends to use its carbon pricing revenues to help selected industries and households adjust, and to support infrastructure and clean technology investment.

Quebec

Quebec’s first carbon pricing initiative was a small carbon tax, the green duty, introduced in December 2007. The duty applied on fuel distributors, with the tax rate set annually so as to generate approximately $200 million for the province’s Green Fund. The duty was roughly equal to $3 a tonne and was phased out in 2014.

In 2013, Quebec became the first province to launch a broad-based cap-and-trade program. One year later, Quebec linked its system with California’s cap-and-trade program under the auspices of the Western Climate Initiative (WCI).9 About 85 percent of the province’s emissions are now covered by the cap-and-trade regime. Under the WCI, each jurisdiction has its own cap-and-trade legislation, but the Quebec and California systems cover the same greenhouse gases and sectors; as well, cost-containment measures, compliance periods and monitoring, reporting and verification systems are all harmonized. Quebec sets an annual emissions cap, provides permits equal to its cap, and agrees to recognize and accept permits from the California system. Emitters can purchase permits at the joint Quebec-California auctions that are held periodically throughout the year, and permits from either system can be traded among all covered entities.

Note that, in a carbon tax regime, the carbon price is fixed until the government legislates a rate change. In a cap-and-trade system, the carbon price (the price of a 1-tonne permit) is determined by the supply and demand for permits in the regional carbon market, and can change depending on market forces. Currently, the permit price (the carbon price) is $16.45 a tonne, equal to the reservation or floor price set for permits.10 As was the case with revenues from its green duty, Quebec allocates permit auction revenues to its green fund to help support green infrastructure and technology.

Ontario

In 2015, Ontario decided to pursue a cap-and-trade approach to carbon pricing. The province expects to launch its program in 2017 and to join the WCI regional carbon market, along with Quebec and California, in 2018.

The program includes facilities with annual emissions in excess of 25,000 tonnes, covering about 82 percent of the province’s emissions. Most large emitters will receive permits free of charge during the first compliance period from 2017 to 2020, although some permits will be auctioned. Once linked, Ontario plans to participate in the joint auctions with Quebec and California. As a full participant in the regional carbon market, Ontario will see its covered emitters (like those of Quebec and California) face the same carbon price, estimated to be around $18 in 2018.11 Ontario intends to use its carbon pricing revenues to fund green projects.

Evaluation of Existing Provincial Policies

Existing provincial policies are, unfortunately, insufficient to achieve either of our stated objectives — to reach 2030 emissions targets and to do so cost–effectively; notably, they also satisfy none of the four key conditions for success.

Existing systems are not broad-based

Existing provincial carbon pricing policies are designed to cover 70 to 85 percent of emissions in each province. When the Ontario and Alberta regimes are fully implemented in 2017, about 65 percent of Canada’s total emissions will be covered by some form of carbon pricing. Even so, more than a third of Canada’s emissions would not be covered by any form of carbon pricing through such policies alone.

There is no common carbon price

When emitters face the same carbon price, emissions reductions are encouraged where they are cheapest — that is, where the marginal costs of abatement are lowest. But different provinces have different carbon prices. British Columbia’s $30 carbon tax will encourage emissions reductions as emitters try to reduce their carbon tax bills. There is, however, no carbon price in Manitoba, so emitters there have no incentive to undertake emissions reductions. Suppose all low-cost emitters were located in Manitoba and all high-cost emitters were in British Columbia. Why would we encourage higher-cost emissions reductions in British Columbia when they could be undertaken more cheaply somewhere else? A common carbon price in Canada would ensure that the cheapest abatement cost opportunities are undertaken, regardless of where in Canada they occur. It is important to note that with each year that passes without achieving a common price, emissions reductions costs are higher than necessary.

A simple comparison of provincial carbon prices can be misleading unless it takes into account differences in emissions coverage or access to permits from outside Canada. One potential solution is to use “adjusted” carbon prices. -British -Columbia’s carbon price could be lowered to take into account that the province’s emissions coverage is lower than of Quebec. Quebec’s carbon price could be raised to reflect that its lower carbon price is due partly to its participation in a linked cap-and-trade-system with California. Fewer emissions reductions are taking place in Quebec because it is cheaper for some Quebec emitters to buy permits and for the emissions reductions to take place in California. Even with such adjustments, the difference in provincial carbon prices is sizable, ranging from a low of zero to a high of about $21 for 2016.12

Existing policies cannot achieve the 2030 emissions reduction target

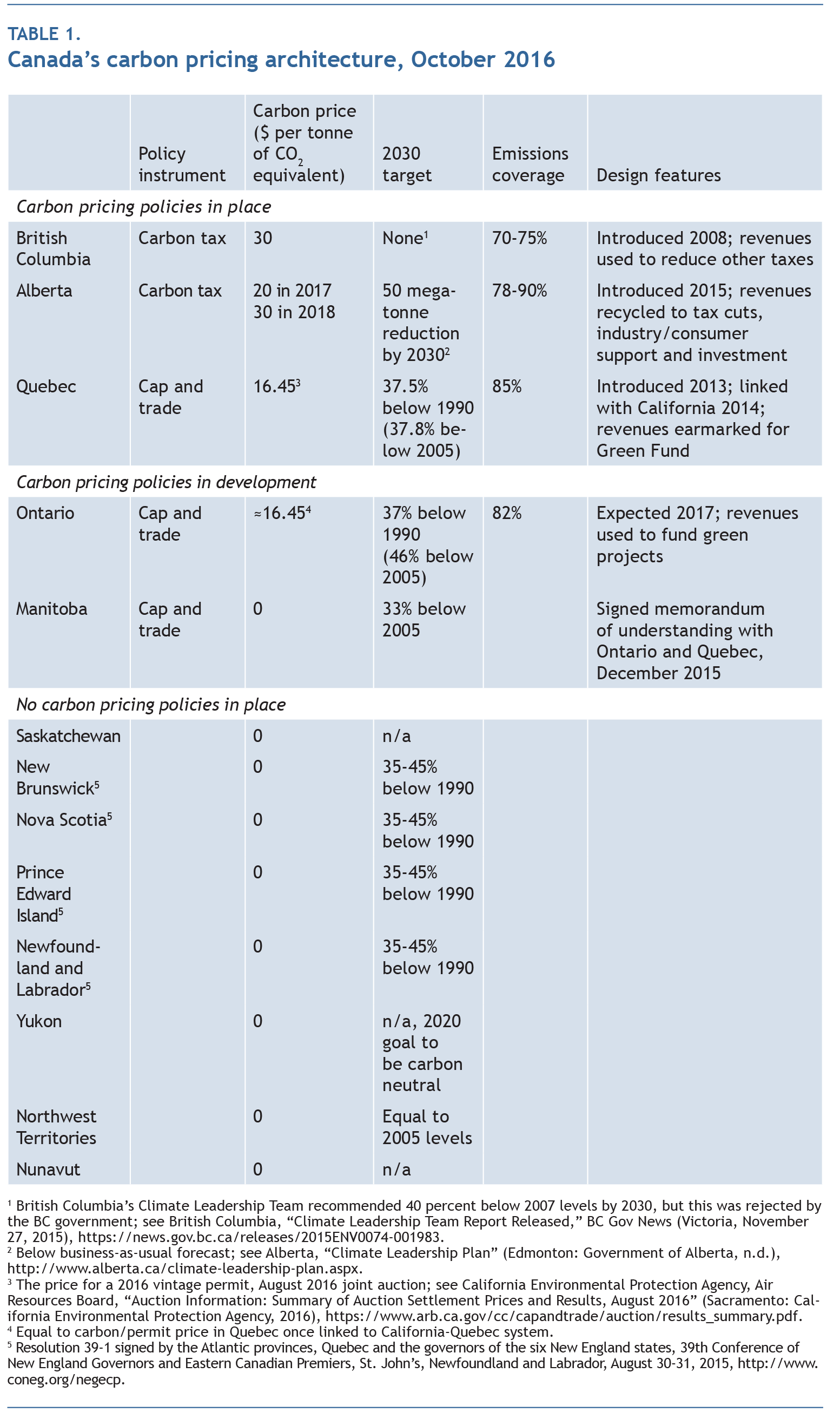

Carbon pricing should be sufficiently stringent that Canada can achieve its 2030 emissions reduction target. To achieve this goal, Canada’s emissions must fall from current levels to about 523 megatonnes by 2030 (see figure 1). Even if all provinces achieved reductions equal to their stated targets (by whatever means), Canada would fall short of its national target by more than 50 megatonnes.13

Existing intergovernmental processes have not worked

Intergovernmental — that is to say, interprovincial — processes under the auspices of the Council of the Federation (COF) have stimulated discussion on carbon pricing, but these have been undertaken on a voluntary basis. In this purely provincial body, there are no mechanisms to encourage provinces to adopt carbon pricing, impose a particular carbon price or achieve a specific emissions reduction target. Indeed, the COF has been unable to overcome the deep divisions among provinces that are rooted in their distinct economic and political contexts to bring about any meaningful coordination of climate policy.14 More recently, there have been discussions among groupings of provinces, including between Quebec and Ontario (since the election of the Wynne Liberals) on cap and trade and, more informally, between British Columbia and Alberta on coordinating or linking carbon prices, but this approach has not delivered a broad-based or harmonized pricing system across the country.15

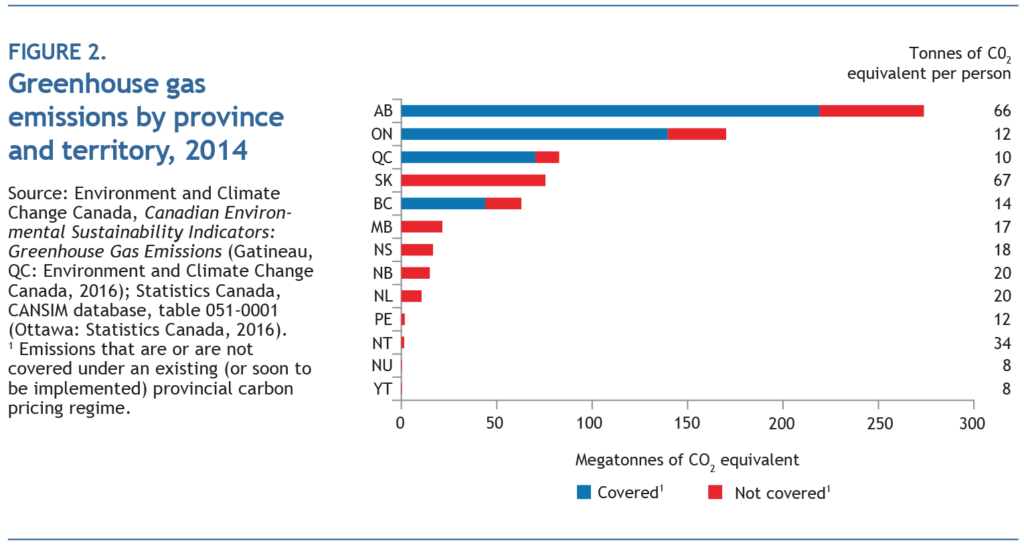

There are sizable differences in the provinces’ emissions profiles, both in absolute and per capita terms (see figure 2).16 Although four of the five largest emissions–producing provinces have implemented (or are developing) carbon pricing systems, these systems do not cover all provincial emissions — the blue shading in figure 2 indicates the fraction of emissions covered by carbon pricing in each province.17 Existing coordination mechanisms have failed so far to reconcile provincial differences or to produce a carbon pricing system capable of achieving our two preferred objectives.

The Federal Government’s Pan-Canadian Carbon Pricing Plan

Following his election, Prime Minister Trudeau engaged the provinces in a collaborative process to establish a pan-Canadian carbon pricing framework. He met with First Ministers in November 2015 to discuss climate change, brought provincial and territorial representatives with him to the Paris climate meetings one month later, and held a First Ministers’ Meeting in March 2016. The outcome of the latter meeting — the Vancouver Declaration — committed First Ministers to “work together to develop a pan-Canadian framework on clean growth and climate change and implement it by 2017,” as well as to “transition to the low carbon economy by adopting a broad range of measures, including carbon pricing mechanisms.” The declaration set in motion a working group process (co-chaired by the federal and provincial governments) aimed at identifying opportunities for coordinated action in several areas, including carbon pricing mechanisms. A collaborative, intergovernmental process led by the federal government was well underway.

There was a great deal of speculation about the potential outcome of this process and what the pan-Canadian framework would eventually look like. Trudeau’s announcement of a national carbon pricing plan put an end to some of this speculation, and surprised some. A few provinces, particularly Saskatchewan, Nova Scotia, and Newfoundland and Labrador, reacted quite negatively to the federal plan.

The federal government’s national carbon pricing plan18 includes the following key features:

- a two-year time frame for implementation;

- for provinces, a choice between cap and trade or a carbon tax;

- increasing stringency: for carbon tax provinces, the carbon price must satisfy the federal price floor of $10 per tonne for 2018 and should rise by $10 each year until 2022; cap-and-trade provinces must set an emissions reduction target equal to (or greater than) 30 percent below 2005 levels by 2030 and declining caps at least to 2022, so as to produce emissions reductions that correspond with those in carbon tax provinces;

- common scope for emissions coverage; provincial carbon pricing systems should cover at a minimum the same emission sources as covered by British Columbia’s carbon tax; and

- the imposition by the federal government of a carbon tax at the floor price in provinces that have not adopted either a carbon tax or cap-and-trade system by 2018; all revenues collected in the jurisdiction will be returned to it.

How does this plan stack up against our conditions for success?

Is it broad-based?

Carbon pricing under the federal plan is broad-based, a substantial improvement over the status quo (as of October 2016). Under the federal plan, emissions in all provinces will be subject to some form of carbon pricing starting in 2018. The plan calls for the scope of emissions coverage to be the same across provinces, roughly in line with coverage under British Columbia’s carbon tax.

Is there a common carbon price across Canada?

The federal government plan will reduce carbon price differentials between provinces with and without an existing carbon price, but differentials will remain between cap-and-trade provinces and carbon tax provinces. This means that emissions reductions will not be cost-effective. The federal price floor applies only to carbon tax provinces. In cap-and-trade provinces, the carbon price is determined by the supply and demand for permits. The permit price is expected to be about $18 to 20 in 2020, well below the expected carbon price floor of $30 for carbon tax provinces.19

Is it sufficiently stringent?

The federal plan likely will achieve greater emissions reductions than would the status quo, but it still might not be stringent enough to achieve the 2030 target. Estimates indicate that the carbon price will have to rise to about $160 by 2030 to achieve the emissions reductions needed to hit the target.20 Under the federal plan, the carbon price floor, which applies only to carbon tax provinces, will rise by $10 annually until it reaches $50 in 2022, but there is no indication of what happens after that.

Cap-and-trade provinces will be required to have a reduction target for 2030 equal to (or greater than) the national target, and to have declining annual caps up to 2022 sufficient to match reductions in carbon tax provinces. But it is not yet clear how the federal government intends to establish equivalency for cap-and-trade provinces in terms of matching the requirement for declining caps with the rising carbon price floor. Beyond 2022, the situation is even murkier.

Is the plan supported by intergovernmental processes?

The federal government’s plan does require carbon pricing in all provinces but also offers provinces flexibility, as they can decide how carbon pricing will be implemented in their jurisdiction. They can choose to adopt a carbon tax or a cap-and-trade system or they can let the federal government impose and collect a carbon tax and return the resulting revenues to the province. In addition, although the details have yet to be revealed, the federal plan allows existing provincial carbon pricing policies to continue, provided they meet the federal government’s stipulations in terms of increasing stringency over time. Provinces without a carbon pricing policy in place also have two years to decide which option will work best for them. Finally, a five-year review is planned and will take into account progress on emissions reductions, the actions of other countries and the extent of permits and credits imported from other countries.

In sum, the federal government’s plan improves on the status quo by expanding emissions coverage across the country and by providing provinces flexibility in the choice of carbon pricing instrument. But the plan does not anticipate a single, economy-wide carbon price or promise cost-effective emissions reductions. Moreover, although the plan’s stringency will increase over time, the measures are probably not enough to achieve the 2030 target.

Why did the federal government decide on this particular balance of flexibility and efficiency? To help answer this question, it is useful to turn to selected fields where, through intergovernmental coordination, federal policy reach was extended over time.

Intergovernmental Coordination: Tax and Environmental Cases

Understanding how and why federal and provincial governments have coordinated in related policy areas can help explain Ottawa’s decision to proceed with its particular approach to national carbon pricing. This history can also provide valuable insights for federal-provincial coordination on carbon pricing as Canada moves forward. Here, we consider approaches to intergovernmental coordination that have been used in the tax (income tax and goods and services tax/harmonized sales tax, or GST/HST) and environmental policy (Canada-wide standards) fields. For each case, we describe the intergovernmental process used and the outcomes achieved.

Why is intergovernmental coordination needed?

Intergovernmental coordination is often pursued when factors of production, goods and services, and environmental pollutants flow freely across provincial borders, and when federal and provincial governments occupy the same policy space. Uncoordinated policies in these areas might adversely affect economic efficiency, lead to higher administrative and compliance burdens, and hinder the achievement of national goals.21

In the case of taxes, federal and provincial governments co-occupy most major fields. Governments rely on taxes, particularly income and sales taxes, to generate revenue, but also to achieve distributional and social objectives. Independent tax setting by the federal government and the provinces, however, can generate economic inefficiencies. Provinces can use their tax systems to compete for mobile capital and labour, distorting the allocation of resources across the country. Tax competition can also lead to inefficiently low tax rates, suboptimal levels of government-provided goods and services, and higher tax collection and administrative costs.

In the case of environmental policy, pollutants that spill over provincial borders might be dealt with inadequately if governments make decisions based solely on their own economic and political imperatives. Provincial policies can induce the production activities that generate emissions to move elsewhere, a problem known as emissions leakage. A province that imposes stricter emissions controls can put its emissions-intensity and trade-exposed sectors at a competitive disadvantage. Both problems can deter provinces from undertaking otherwise desirable policies to control harmful emissions. The coordination challenge is compounded by the dominant provincial role in natural resources development and management and by the shared jurisdiction of the federal government and the provinces over most areas associated with pollution abatement. The breadth and diversity of the environmental policy field makes it difficult to unravel the respective roles of the two levels of government and deal effectively with spillovers.

In all cases, there is a significant challenge to coordination; governments wish to reap the economic efficiency and administrative gains that come with greater harmonization, but they also wish to preserve the flexibility that comes with independent decision-making.

Intergovernmental Processes and Outcomes

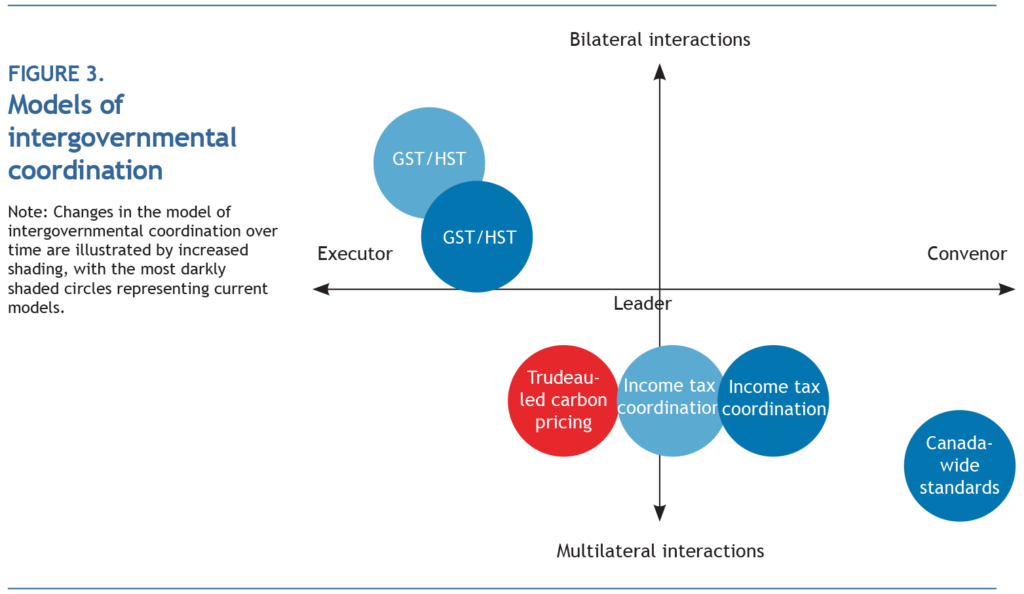

Our case study analysis focuses on two important dimensions of intergovernmental relations, as portrayed in figure 3. The first dimension is the federal government’s use of “directive” authority vis-à-vis provinces — namely, the ability to ensure that actions necessary for the effective execution of its policies are taken, making full use of the constitutional/legal and political levers available to it.22 Along the horizontal axis, we differentiate among the roles as executor (imposing a course of action on provinces), leader (setting a goal and encouraging provinces to take a course of action but not actually imposing) and convenor (seeking merely to assemble provinces and encourage action). The second dimension, measured along the vertical axis in figure 3, is the nature of federal engagement with the provinces, ranging from multilateral (with all provinces) to purely bilateral (the federal government and individual provinces). By locating particular models of intergovernmental coordination across the two dimensions, we can compare the different approaches used and their evolution over time in particular case studies of policy coordination. We also discuss for each case the outcomes of each intergovernmental process in terms of the potential for achieving the economic efficiency and administrative gains from greater harmonization and the scope for providing flexible and independent provincial government decision-making.

Case 1: Income tax coordination

Income taxation has been a matter of intergovernmental discussion and negotiation since Confederation. Dominion-provincial conferences were initiated as early as the 1930s to coordinate corporate and personal income taxes, with mixed success. The federal government was the major player early on: when it entered the field in 1917, only British Columbia and Prince Edward Island levied a personal income tax, and the federal government’s role was firmly established before most provinces became active in this tax field. The several following decades brought about a high degree of centralization in an “Ottawa-led cooperative federal system,”23 but the introduction of formal tax collection agreements beginning in the 1960s began to allow for more flexibility in provincial tax regimes and increasing tax room for the provinces.24

Process

Frequent intergovernmental meetings on these issues have regularly included all provinces and have tended to result in compromise deals proposed by the federal government or by particular provinces. To implement the outcomes, the federal government then signs a bilateral Federal-Provincial Tax Collection Agreement with each “agreeing” province. For personal income taxes, all provinces except Quebec have entered into bilateral agreements with the federal government; for corporate income taxes, all provinces except Alberta and Quebec have done so. The federal government also collects provincial income taxes on behalf of the “agreement” provinces, free of charge.

Arrangements are reviewed periodically. In response to provincial demands for greater independence and flexibility, the federal government often has sought to encourage (and sometimes preserve) coordination by presenting provinces with a “menu of options.” For example, in 1941, provinces could choose to receive an annual payment equal to the actual provincial personal income tax revenues collected in 1940, or a payment equal to the cost of servicing their net debt in 1940, in exchange for vacating the personal and corporate income tax fields for the duration of the war.25 During negotiations early in the postwar period, provinces were offered the choice of receiving tax payments based on federal income tax collected in the province or a “tax abatement” — a reduction in the federal tax rate to make room for a province to levy its own personal income tax.

Although the federal government’s engagement with the provinces has been, and continues to be, multilateral, its use of directive authority is considerably weaker than in the past. With the expansion of the welfare state and the greater need for tax revenues in the 1960s and beyond, the provinces successfully lobbied for more flexibility and a greater share of income tax revenue. Differences in income tax systems grew as provinces exercised the flexibility they won in intergovernmental forums. In figure 3, we illustrate this evolution, and the change in the federal government’s role, by shifting the current model of intergovernmental income tax coordination further into the bottom right-hand quadrant.

Outcomes

The tax base for income taxes (corporate and personal) has been largely harmonized between levels of government and across provinces. Rules for allocating taxable income across provinces have been agreed to, even in provinces that administer and collect their own income taxes (corporate income tax in Alberta and both corporate and personal income taxes in Quebec). Over time, however, the system has become less harmonized: provinces for a long time were restricted to applying a single tax rate on federal tax owing, but they eventually were able to determine their own tax rates, tax brackets and credits.26 The gain in flexibility has been accompanied by greater divergence in provincial personal income tax systems.

Case 2: GST/HST coordination

Intergovernmental coordination with respect to sales taxes paints a somewhat different picture from the income tax case. There were a number of serious issues with the federal government’s manufacturers’ sales tax (MST), in place since 1924, including the problem of cascading taxation, whereby the tax was applied and reapplied at various points on manufacturing inputs.27 Eventually persuaded that the tax had to go, the federal government announced in 1981 that it intended to replace it with some form of value-added tax. Ten years later, it introduced the goods and services tax (GST).

Most provinces have chosen to harmonize their retail sales tax systems with the GST and have signed a comprehensive integrated tax collection coordination with the federal government to replace their sales tax with a harmonized sales tax (HST). Quebec and the federal government signed in 1991; New Brunswick, Newfoundland and Labrador, and Nova Scotia in 1996; Ontario and British Columbia in 2010 (British Columbia later repealed it, for electoral reasons); and Prince Edward Island in 2013. A tax policy review committee, originally established by the federal government and the Atlantic provinces, administers and reviews issues arising from the tax collection agreements. As additional provinces have joined the HST system, they have been added to this intergovernmental committee.

Process

Before introducing the GST, federal officials undertook “broad-based consultations with the provinces.”28 Provinces opposed the federal move to enter the retail sales tax field, of which they had been sole occupant for several decades. These consultations thus met with little success. Rather than continue with the highly inefficient and costly MST, the federal government decided to proceed unilaterally with the GST. It then initiated negotiations with individual provinces willing to harmonize their retail sales taxes with the GST, offering to assume the collection and administrative burden of an HST and lump-sum “transition” payments.

Interestingly, the GST/HST agreements were arrived at without the extensive intergovernmental discussion that accompanied income tax coordination. In contrast to the income tax case, we see a model of intergovernmental coordination whereby provinces have entered the system sequentially, and options for adjustment support and implementation have been negotiated bilaterally. This approach, not surprisingly, has resulted in some variability in the deals made with provinces. Some have negotiated “unique provisions” for their jurisdiction. Ontario’s agreement, for example, allows for more deviations from the GST tax base than is permitted in the HST agreements with the three Atlantic provinces. In Quebec, the provincial government administers and collects the GST on behalf of the federal government in return for a fee. In the other HST provinces, the federal government administers and collects, free of charge, the federal and provincial components of the GST/HST.

The current model of intergovernmental coordination for GST/HST, located in the top-left-hand corner of figure 3, now reflects more provincial engagement and a more leader-like role for the federal government, as compared with the executor-driven model in operation when the GST was first introduced, in 1991.

Outcomes

The GST applies across the country, but HST systems are not in place in all provinces. Over time, the efficiency gains from sales tax harmonization have improved as more provinces have signed agreements with the federal government, although this has not been a speedy process: it has taken more than 25 years, since the GST was introduced in 1991, to convince six of the nine provinces with retail sales taxes to adopt the HST.

Provinces have complete flexibility in deciding if and when they harmonize with the GST. Harmonizing provinces can also set the tax rate for the provincial component, with notice. Provinces have limited flexibility to influence the design of the tax or to deviate from the tax base, except for the deviations in coverage resulting from the “unique provisions” negotiated with some provinces.29 These deviations do lead to differences among the harmonized provinces, but they are arguably smaller than those between HST and non-HST provinces. The retail sales tax systems in British Columbia, Saskatchewan and Manitoba operate quite distinctly from the GST/HST. Importantly, general sales taxes paid on business inputs are credited back to businesses in HST provinces, but not in retail sales tax provinces.30 These differences in tax treatment distort the efficient allocation of economic activity and investment across provinces.

Case 3: Canada-wide environmental standards

The primary forum for intergovernmental coordination on environmental issues since 1987 has been the Canadian Council of Ministers of the Environment (CCME). Comprising the environment ministers from the federal, provincial and territorial governments, the CCME operates on a consensus basis, which the organization defines as a “process that attempts to recognize and account for the differing, legitimate interests of its 14 member governments.”31

In 1998, the Canada-Wide Accord on Environmental Harmonization was signed by all jurisdictions but Quebec. The Accord sets out a comprehensive framework outlining “specific roles and responsibilities” that will “generally be undertaken by one order of government only,” thus eliminating duplication of effort.32 Governments can develop qualitative or quantitative Canada-wide standards, guidelines, objectives and criteria for protecting the environment and reducing risks to human health.33 Generally, each standard includes a target and a time frame for achieving the target, a list of governments’ initial actions toward achieving the standard and a protocol for reporting to the public on progress achieved. Canada-wide standards have since been adopted for a number of chemicals. Although Quebec did not sign the accord or the Canada-Wide Environmental Standards Sub-agreement, in most areas it has taken complementary actions and has also developed working interjurisdictional arrangements on issues such as monitoring and reporting.34

Process

The CCME does not use overt bargaining and voting/majority rule in its multilateral forum; rather, it places emphasis on “maximizing opportunities to resolve differences and to reach agreement on workable solutions.”35 The federal government sits firmly in the role of convenor in this forum and acts for the most part as one of 14 governments seeking consensus decisions. Of course, it can decline to convene meetings of the CCME, as Prime Minister Stephen Harper did for many years.36

Under the Canada-Wide Accord, the CCME provides organizational support for ministers to “set priorities and establish workplans for addressing issues of Canada-wide significance pursuant to this Accord.” The CCME also coordinates the standards setting, scientific support, implementation and reporting on Canada-wide standards, and it is the intended forum for any additional issues a jurisdiction wishes to bring forward. Given its well-established presence on the national scene and its regularized role under the Accord, one can conclude that the CCME is a more formalized mechanism for intergovernmental oversight and coordination than one generally finds in other areas of shared policy jurisdiction.

Of the models of intergovernmental coordination we consider here, the CCME process has the highest level of multilateral/provincial engagement (13 of 14 governments, excepting Quebec) and the purest convenor-like role for the federal government. It is therefore located in the bottom-right-hand corner of figure 3.

Outcomes

One could argue that the introduction of Canada-wide standards has brought about a higher level of consistency across the country. However, there are several rather significant caveats. First, the standards are not actually binding, provinces are not required to enforce them and nothing in the Canada-Wide Accord prevents a jurisdiction from imposing its own standards.37 Second, Quebec is not a signatory, but abides by its own standards. Third, critics of Canada-wide standards are concerned that, rather than ratcheting up the pressure on laggards to set more stringent policies, the emphasis on multilateral consensus building is pulling the collective effort “down” to meet the lowest common denominator. There has thus been considerable criticism of the standards’ lack of stringency.38

Of our three cases, this process has yielded provinces the most scope for flexible and independent decision-making.

Coordination on Carbon Pricing: Moving Forward with an Eye on the Past

Given that the broad outlines of a national carbon pricing system have now been set, attention must focus on how to understand the federal decision to move unilaterally in light of the need to coordinate provincial and federal activities to meet the 2030 target in a cost-effective manner. Key lessons from our tax and environmental cases can serve as signposts for the road ahead.

The federal government’s directive authority is needed to jump-start harmonization

The federal government is highly unlikely to overcome provincial differences and craft a pan-Canadian carbon pricing approach that is both cost-effective and stringent enough to achieve the 2030 emissions reduction target if it merely plays a convenor role. Much of the effort under the Canada-Wide Accord was aimed at cementing a consensus-driven process in which the federal government would not play a directive role — indeed, this is the role some provinces seemed to favour for Ottawa with respect to carbon pricing — with the result that, as noted, the Canada-wide standards have been criticized as too lax. Similarly, the absence of any federal leadership on the climate file prior to 2015 has led to the current fragmented system.

By contrast, the income and retail sales tax coordination cases highlight the ways in which the federal government can apply its directive authority early on in the coordination process to achieve greater harmonization. In the income tax case, this was accomplished in a multilateral context through a series of decision-making processes that pushed the harmonization agenda forward. In the GST/HST case, provinces had the first-mover advantage, and existing provincial retail sales taxes were well established. Opposition on the part of several provinces was so entrenched that achieving the efficiency gains of a more harmonized retail sales tax system seemed unlikely to be realized through a multilateral process.39 After the failure of its attempt to consult with the provinces, and given the deeply rooted opposition of many provinces to any federal role in retail sales taxation, the federal government acted unilaterally to put in place the GST. In both cases, harmonization would not have been achieved without decisive federal action.

For most of the year following his election Prime Minister Trudeau adopted the role of convenor, using a multilateral approach to try to obtain agreement on a national carbon pricing system. Again, however, similar to the GST/HST case, provinces had the first-mover advantage, and some provincial carbon pricing policies were already in place. Opposition on the part of several provinces posed the risk of delaying common action indefinitely.40 The federal government then chose to use its directive authority to implement a national pricing plan and impose a carbon tax in provinces that have not implemented carbon pricing on their own. Such unilateral action was needed to move the process forward, although existing provincial carbon pricing policies pose longer-term coordination problems.

Six months ago, the model of intergovernmental coordination for carbon pricing was in the lower-right-hand quadrant of figure 3, with the federal government’s role more akin to that of convenor. We would now locate the current Trudeau-led model in the lower-left-hand quadrant, given the federal government’s executor role and the application of the federal plan to all provinces.

Some flexibility is needed

Provinces jointly occupy most major tax fields and have shared responsibility for the environment. Understandably, they are reluctant to accept measures that constrain their ability to set policy independently. Our case studies demonstrate that, once the key components of a coordinated system are in place, some level of flexibility can be accommodated. Provinces clearly have the most flexibility in the CCME case, although, with the federal government in the role of convenor, there is no mechanism to “ratchet up” standards. With respect to the tax cases, provinces that have signed tax agreements with the federal government have more flexibility with respect to income taxes and less with respect to the GST/HST. All provinces, however, have the choice of whether or not to sign an agreement in the first place.

Determining the right amount of flexibility is tricky: more flexibility means giving up some of the efficiency gains that come from greater harmonization. Arguably, provincial governments use personal income tax, more than sales and corporate income tax, to achieve distributional and social objectives — hence their need for relatively more flexibility in personal income tax coordination. Provinces use corporate income tax to achieve economic development objectives, so some flexibility is called for here as well. Broad-based sales taxes are primarily for revenue generation. Not surprisingly, personal income tax coordination affords provinces the most flexibility, the GST/HST the least.

On carbon pricing, the federal government has balanced the use of its directive authority and unilateral action by giving provinces choice on how to implement carbon pricing in their jurisdiction: a provincial carbon tax, a provincial cap-and-trade program or the imposition of a carbon tax by the federal government. Provinces will also keep all carbon pricing revenues raised within their borders. Both the GST/HST and CCME cases demonstrate that more flexibility is needed when provinces are first movers and have well-established policies in place. This is clearly the case with carbon pricing.

We must note an important distinction, however, between the GST/HST case and carbon pricing. The federal government implemented the GST primarily for revenue generation. The unilateral imposition of the GST put provinces under pressure to harmonize in order to address the added administrative and compliance costs for business. Yet it was up to each province to decide whether or not to eliminate its retail sales tax and harmonize. Eventually, greater -harmonization was achieved, but the sequential (and delayed) nature of provincial buy-in meant that the efficiency gains from greater harmonization have taken decades to achieve. In contrast, the federal government is not implementing carbon pricing for the purpose of revenue generation. Instead, it has made the imposition of a federal carbon tax conditional on provinces not acting to implement their own carbon price or meet the conditions for increasing environmental stringency. The Trudeau government’s carbon tax initiative will close the gaps in carbon pricing across the country. In contrast to the GST/HST, then, cost-effectiveness improvements (from a reduction in carbon price differentials) need not be delayed.

Coordination, and flexibility, can change over time

Our cases also reveal that intergovernmental coordination processes can change over time. In the income tax case, for example, the federal government’s role moved from leader to convenor. In the GST/HST case, its position has shifted downward (toward multilateralism) and slightly right (leading out of the executor quadrant) as more provinces have harmonized and the system matures.

As intergovernmental processes change over time, so too do the outcomes — reflecting a different balance between the scope for flexible decision-making and the gains from harmonization. We observe that flexibility can come in different forms. Sometimes it is made available when a province decides to harmonize. For example, in both tax cases, incentives were offered to encourage provincial participation, although the two cases differed in how these supports were formulated. In the income tax case, the same menu of options typically was offered to all provinces, leaving each province to choose the one that suited it best. In the case of the GST, options were negotiated individually with each province before it agreed to harmonize. Flexibility can also be exercised on an ongoing basis — in the case of income tax, for example, provinces can choose tax credits and tax rates; in the case of the CCME, they can take measures regarded as equivalent to CCME-recommended approaches.

Importantly, building a periodic review into coordination agreements — the federal national carbon pricing plan has one scheduled in 2022 — would provide an opportunity to make adjustments to various features, including those that affect the scope for flexible and independent decision-making.

Concluding Remarks: Keeping Our Eyes on the Target

The Trudeau-led model of intergovernmental coordination culminated in the federal government’s national carbon pricing plan. Ottawa is using its directive authority to implement a flexible plan that encompasses all provinces. Two challenges, however, are associated with the federal plan. First, the carbon price under the current plan is scheduled to reach $50 in 2022, but the price will need to continue rising — and perhaps at a faster pace, depending on complementary measures undertaken — to achieve the 2030 emissions reductions target. Second, carbon price differentials between cap-and-trade provinces and carbon tax provinces are likely to persist.

In the initial plan, flexibility clearly was needed both to recognize those provinces that had already implemented a carbon pricing policy and to reduce political opposition in those provinces that have done little or have adopted other means of mitigation. But this approach means that emissions reductions will be more costly for business. It will delay the realization of a common carbon price across the country, which, in turn, would facilitate further lower-cost emissions reductions — a point we made earlier but is worth repeating here. Addressing this tension needs to be at the forefront of coordination efforts moving forward. As well, the federal government must maintain its ability to exercise directive authority in this respect, while being mindful of provinces’ differing economic and other circumstances.

Certainly, the federal government will need to be prepared to actively manage this issue over the medium and longer terms. Dealing with the carbon price gap between cap-and-trade and carbon tax provinces will be particularly challenging, given the flexibility the plan currently affords provinces. The federal government could take the lead and encourage the development of a common offset market or linkages between cap-and-trade provinces and carbon tax provinces. Linking — and two-way trade in emissions permits and tax credits — could lead to a common carbon price and improved cost-effectiveness. However, provinces have thus far been resistant to establishing these types of links.

Alternatively, the federal government could rein in flexibility. It could extend the federal minimum carbon price to the cap-and-trade provinces, or work to transition provinces to a single carbon pricing approach nationally, offering targeted inducements in the form of adjustment grants or a greater share of the GST/HST tax field. By manoeuvring along the axis between the executor and leader roles, the federal government can adjust the carbon pricing system to reap the benefits of greater harmonization. And it can do this manoeuvring knowing that public opinion is supportive — a key consideration as intergovernmental negotiations on system design continue.41

A significant complicating factor, particularly in terms of how quickly the carbon price rises, is external. Much will depend on what unfolds in the United States. Future state-level actions will be critically important, since Quebec and Ontario have focused their efforts on cross-border carbon trading with California. -California has over the decades shown considerable political stamina in taking climate actions, even in the face of federal resistance. The Trump administration will not be able to undo the actions taken or planned by the Sunshine State or other states, but national-level action on climate seems unlikely.

All of this means that the task of developing a cost-effective national carbon pricing system that meets Canada’s emissions reduction target for 2030 has only just begun. Over the next five years and beyond, the federal government must manage the system to achieve a balance between carbon price coordination and flexibility. The December First Ministers’ Meeting will provide considerable insight into how Ottawa plans to approach this management role.

The authors would like to thank Leslie Seidle, France St.-Hilaire and Kathryn Harrison for their helpful comments. The views expressed here and any errors are our responsibility.

- Liberal Party of Canada, “Platform: Climate Change” (Ottawa: Liberal Party of Canada, 2015), https://www.liberal.ca/realchange/.

- Here we focus exclusively on explicit carbon pricing options.

- Canada’s Ecofiscal Commission, The Way Forward: A Practical Approach to Reducing Canada’s Greenhouse Gas Emissions (Montreal: Canada’s Ecofiscal Commission, 2015).

- See British Columbia, Climate Leadership Plan (Victoria: Government of British Columbia, August 2016), https://climate.gov.bc.ca/wp-content/uploads/sites/13/2016/10/4030_CLP_Booklet_web.pdf.

- See British Columbia, Ministry of Finance, “Myths and Facts about the Carbon Tax” (Victoria: Ministry of Finance, n.d.), https://www.fin.gov.bc.ca/tbs/tp/climate/A6.htm.

- Offsets are credits for emissions reductions generated outside the carbon pricing regime. For example, landfill operators could receive offsets for emissions reductions achieved by implementing new waste-disposal practices. These offsets can be sold to emitters covered by the carbon pricing regime. For a comprehensive discussion of the treatment of British Columbia’s LNG facilities, see W. Antweiler, “Liquefied Natural Gas: Technology Choices and Emissions,” Werner’s Blog: Opinion, Analysis, Commentary, November 11, 2014, https://wernerantweiler.ca/blog.php?item=2014-11-11.

- A. Leach, “Policy Forum: Alberta’s Specified Gas Emitters Regulation,” Canadian Tax Journal 60, no. 4 (2012): 881-98.

- A. Read, “Climate Change Policy in Alberta,” Backgrounder (Calgary: Pembina Institute, July 2014), https://www.pembina.org/pub/climate-change-policy-in-alberta.

- The WCI was formed in 2007 as a collaborative endeavour to develop a western regional cap-and-trade architecture. Several US states joined, along with four Canadian provinces in 2008. By 2011, there were only five remaining partners: California, British Columbia, Quebec, Ontario and Manitoba. The Western Climate Initiative, Inc., a nonprofit organization created in 2011, now provides technical expertise, manages auctions and administers the compliance tracking system for the Quebec-California linked system.

- See California Environmental Protection Agency, Air Resources Board, “Auction Information: Summary of Auction Settlement Prices and Results, August 2016” (Sacramento: California Environmental Protection Agency, 2016), https://www.arb.ca.gov/cc/capandtrade/auction/results_summary.pdf.

- See D. Sawyer, J. Peters, and S. Stiebert, “Impact Modelling and Analysis of Ontario Cap-and-Trade Program” ([Toronto]: EnviroEconomics, Navius Research, and Dillon Consulting, 2016), https://drive.google.com/file/d/0B9FT5KrVwYmwa2VETHVha2dSTEk/view.

- See D. Beugin, J. Dion, S. Elgie, N. Olewiler, and C. Ragan, “Comparing Stringency of Carbon Pricing Policies” (Montreal: Canada’s Ecofiscal Commission, July 2016), https://ecofiscal.ca/wp-content/uploads/2016/07/Ecofiscal-Commission-Comparing-Stringency-Carbon-Pricing-Report-July-2016.pdf.

- P. Boothe and F.-A. Boudreault, “By the Numbers: Canada’s GHG Emissions” (London, ON: Western University, Ivey School of Business, Lawrence National Centre for Policy and Management, 2016), https://www.ivey.uwo.ca/cmsmedia/2112500/4462-ghg-emissions-report-v03f.pdf.

- E. Collins, “Coming into Its Own? The Council of the Federation, 2003-16,” IRPP Insight (Montreal: Institute for Research on Public Policy, forthcoming).

- See T. Snoddon, “Carbon Copies: The Prospects for an Economy-Wide Carbon Price in Canada,” e-Brief (Toronto: C.D. Howe Institute, September 15, 2016).

- Large regional disparities are also apparent when other metrics, such as emissions per capita or emissions per GDP, are used.

- The fraction of covered emissions in each province is approximated by multiplying 2014 provincial emissions by the percentage of emissions covered by existing and proposed carbon pricing regimes: 70 percent coverage in British Columbia, 85 percent in Quebec, 82 percent in Ontario and 80 percent in Alberta.

- Canada, “Pan-Canadian Approach to Carbon Pollution,” Backgrounder (Ottawa: Government of Canada, October 3, 2016), https://news.gc.ca/web/article-en.do?nid=1132169.

- Sawyer, Peters, and Stiebert, “Impact Modelling.”

- M. Jaccard, “Want an Effective Climate Policy? Heed the Evidence,” Policy Options (Montreal: Institute for Research on Public Policy), February 2, 2016, https://policyoptions.irpp.org/magazines/february-2016/want-an-effective-climatepolicy-heed-the-evidence/.

- For a discussion, see R. Boadway and H. Kitchen, Canadian Tax Policy, 3rd ed. (Toronto: Canadian Tax Foundation, 1999).

- For an analysis of the federal government’s constitutional authority with regard to carbon pricing, see N.J. Chalifour, “Climate Federalism: Parliament’s Ample Constitutional Authority to Regulate GHG Emissions,” Working Paper 2016-18 (Ottawa: University of Ottawa, Faculty of Law, 2016), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2775370.

- R. Simeon, “Plus ça change…Intergovernmental Relations Then and Now,” Policy Options (Montreal: Institute for Research on Public Policy), March 1, 2005, https://policyoptions.irpp.org/magazines/policy-optionsat-25/plus-ca-changeintergovernmental-relations-then-and-now/.

- T. Snoddon, “Prospects for Integrated Carbon Taxes in Canada: Lessons from Federal-Provincial Tax Coordination,” CERPA Working Paper No 2015-9 (Waterloo, ON: Wilfrid Laurier University, Department of Economics, Laurier Centre for Economic Research and Policy Analysis, 2015).

- E.H. Smith, Federal-Provincial Tax Sharing and Centralized Tax Collection in Canada, Special Studies in Taxation and Public Finance 1 (Toronto: Canadian Tax Foundation, 1998), 30.

- See R. Boadway, “Taxes and Transfers in Canada: The Federal Dimension,” in Tax Is Not a Four-Letter Word: A Different Take on Taxes in Canada, ed. A. Himelfarb and J. Himelfarb (Waterloo, ON: Wilfrid Laurier University Press, 2013); and T. Courchene and A. Stewart, “Provincial Personal Income Taxation and the Future of the Tax Collection Agreements,” in Provincial Public Finances: Plaudits, Problems and Prospects, vol. 2, ed. M. McMillan (Toronto: Canadian Tax Foundation, 1991).

- R.M. Bird, “The GST/HST: Creating an Integrated Sales Tax in a Federal Country,” Working Paper 12-21 (Atlanta: Georgia State University, Andrew Young School of Policy Studies, International Centre for Public Policy, April 2012), https://scholarworks.gsu.edu/cgi/viewcontent.cgi?article=1070&context=icepp.

- J.-H. Chabot and M.A. McMahon, “The Evolution of Indirect Taxes,” Canadian Tax Journal 61, suppl. (2013): 21-3.

- J. Makarenko, “Harmonized Sales Tax: Overview, History and Debates,” Mapleleafweb, January 19, 2010, https://mapleleafweb.com/features/harmonized-sales-tax-overview-history-and-debates.

- British Columbia, Manitoba and Saskatchewan (the provinces that still collect their own retail sales tax) were estimated to have the highest marginal effective tax rates (METRs) on capital investment in Canada in 2014, in part because of the embedded taxes on business inputs in their sales taxes; see D. Chen and J. Mintz, “The 2014 Global Tax Competitiveness Report: A Proposed Business Tax Reform Agenda,” SPP Research Papers 8, no. 4 (Calgary: University of Calgary, School of Public Policy, 2015). Ontario’s decision to adopt the HST, for example, is estimated to have reduced its METR by more than 12 percentage points; see D. Chen and J. Mintz, “Federal-Provincial Business Tax Reforms: A Growth Agenda with Competitive Rates and a Neutral Treatment of Business Activities,” SPP Research Papers 4, no. 1 (Calgary, University of Calgary, School of Public Policy, 2011).

- Canadian Council of Ministers of the Environment, “About: Consensus” (Winnipeg: CCME, 2014), https://www.ccme.ca/en/about/consensus.html.

- Canadian Council of Ministers of the Environment, “A Canada-Wide Accord on Environmental Harmonization” (n.p.: CCME, 1998), https://www.ccme.ca/files/Resources/harmonization/accord_harmonization_e.pdf.

- Environment and Climate Change Canada, “Canada-wide Standards” (Gatineau, QC: Environment and Climate Change Canada, 2014), https://www.ec.gc.ca/lcpe-cepa/default.asp?lang=En&n=A092D16B-1.

- Environment and Climate Change Canada, “Part II: Canada’s Draft National Action Plan on Unintentionally Produced Persistent Organic Pollutants” (Gatineau, QC: Environment and Climate Change Canada, 2013), https://www.ec.gc.ca/lcpe-cepa/default.asp?lang=En&n=CAE9F571-1&wsdoc=A973BC66-4BB6-A23A-B7E0-C31301D2814C.

- Environment and Climate Change Canada, “Part II.”

- J. Simmons, “Federalism, Intergovernmental Relations and the Environment,” in Canadian Environmental Politics and Policy: Austerity and Ambivalence, 4th ed., ed. D.L. VanNijnatten (Don Mills, ON: Oxford University Press, 2016), 130-45.

- I. Weibust, Green Leviathan: The Case for a Federal Role in Environmental Policy (London: Ashgate, 2009), 167.

- Weibust, Green Leviathan; K. Harrison, “Federal-Provincial Relations and the Environment,” in Canadian Environmental Policy: Context and Cases, 2nd ed., ed. D.L. VanNijnatten and R. Boardman (Don Mills: Oxford University Press, 2001); C. Hancey, “Particulate Matter, Ground-Level Ozone, and the Canada-Wide Standards Regulatory Process” (Ottawa: Sierra Club Canada Foundation, 1999), https://www.sierraclub.ca/national/programs/atmosphere-energy/climate-change/ground-level-ozone.html; Canadian Institute for Environmental Law and Policy, “Why the Proposed Canada-Wide Standards Fail to Protect Health and Environment” (n.p.: CIELAP, 2002), https://cielap.org/pdf/shw_whytheproposed.pdf.

- See R. Domingue and J. Soucy, “The Goods and Services Tax: Ten Years Later,” PRB 00-03E (Ottawa: Library of Parliament, Parliamentary Research Bureau, June 15, 2000, https://publications.gc.ca/Collection-R/LoPBdP/BP/prb0003-e.htm#D.%C2%A0Provinces%E2%80%99%20Reasons%20for%20Opposing%20Harmonization(txt).

- J. Wingrove, “Trudeau Commits to Carbon Price Amid Provincial Opposition,” Globe and Mail, July 20, 2016, https://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/trudeau-commits-to-carbon-price-amid-provincial-opposition/article31024076/.

- Nanos, “Views on Climate Change Initiatives: Clean Energy Survey Summary, Part 1 of 2,” Submission 2016-906 (Toronto: Nanos Research, 2016), https://nanosresearch.com/sites/default/files/POLNAT-S15-T701_1.pdf. Nanos survey data indicate that a majority of Canadians supports a national plan for meeting the climate change target, an independent federal role in pursuing action and the establishment of a national carbon pricing system.

About the authors

Tracy Snoddon, an associate professor of economics at Wilfrid Laurier University, is an economist who specializes in federal public policy. Her current research focuses on the implementation of climate change policies in uncertain and dynamic settings, insurance and climate change, and the impact of environmental problems on environmental awareness and government policy. Her work has been published in journals such as Canadian Public Policy and Economics of Governance and she is coauthor of the public economics textbook Public Finance in Canada (2016).

Debora L. VanNijnatten is associate professor of political science and North American studies at Wilfrid Laurier University and the Balsillie School of International Affairs. She is also a research partner with the Great Lakes Policy Research Network. Her research and publications have focused on transboundary environmental governance in North America at the cross-border regional (states and provinces), bilateral (Canada-US and US-Mexico) and continental levels. She is the author/editor of five books, including Environmental Policy in North America: Approaches, Capacity and the Management of Transboundary Issues (2013) and Climate Change Policy in North America: Designing Integration in a Regional System (2014).

Les processus intergouvernementaux sont essentiels à l’application coordonnée du plan canadien de tarification du carbone

Montréal – Les processus intergouvernementaux peuvent jouer un rôle clé pour ce qui est de coordonner l’application du plan canadien de tarification du carbone, et ils permettraient de tenir compte des différentes économies et situations des provinces, fait valoir une nouvelle publication de l’Institut de recherche en politiques publiques.

Selon ce plan annoncé en octobre par le premier ministre Justin Trudeau, les gouvernements provinciaux et territoriaux disposent de deux ans pour mettre en œuvre un marché du carbone ou une taxe sur le carbone reposant sur le prix minimal fixé par Ottawa. Ceux qui manquent à cette exigence se verront imposer une taxe par le gouvernement fédéral.

Mais le véritable défi consistera à coordonner la mise en œuvre globale du plan, observent Tracy Snoddon et Debora VanNijnatten (de l’Université Wilfrid-Laurier) : « Quatre provinces (le Québec, l’Ontario, l’Alberta et la Colombie-Britannique) totalisant 80 p. 100 de la population appliquent déjà différents mécanismes de tarification du carbone qu’il faudra harmoniser entre eux, mais aussi avec les nouvelles politiques qu’adopteront les autres provinces. »

L’annonce unilatérale du gouvernement fédéral de cette taxe sur le carbone a surpris beaucoup de personnes, reconnaissent les auteures, d’autant plus qu’il avait entretenu tout au long de l’année une collaboration avec les provinces et territoires au sujet de la tarification. Mais dans les circonstances, estiment-elles, il était justifié d’adopter une approche plus « directive ».

À l’examen d’autres politiques, par exemple l’harmonisation des taxes de vente, les auteures jugent en effet que le leadership fédéral s’est révélé particulièrement utile dans les secteurs de compétence partagée où les provinces avaient déjà pris les devants. Dans ces cas, concluent-elles, « la coordination intergouvernementale a permis d’accroître progressivement l’harmonisation des politiques mises en place ».

On peut télécharger l’étude Carbon Pricing and Intergovernmental Relations in Canada, de Tracy Snoddon et Debora VanNijnatten, sur le site de l’Institut (irpp.org/fr).

-30-

L’Institut de recherche en politiques publiques est un organisme canadien indépendant, bilingue et sans but lucratif, basé à Montréal. Pour être tenu au courant de ses activités, veuillez vous abonner à son infolettre.

Renseignements : Shirley Cardenas tél. : 514 594-6877 scardenas@irpp.org